Question: Please answer with reason for all why the option is correct and why the other options are incorrect Please answer correct otherwise skip it Francom

Please answer with reason for all why the option is correct and why the other options are incorrect Please answer correct otherwise skip it

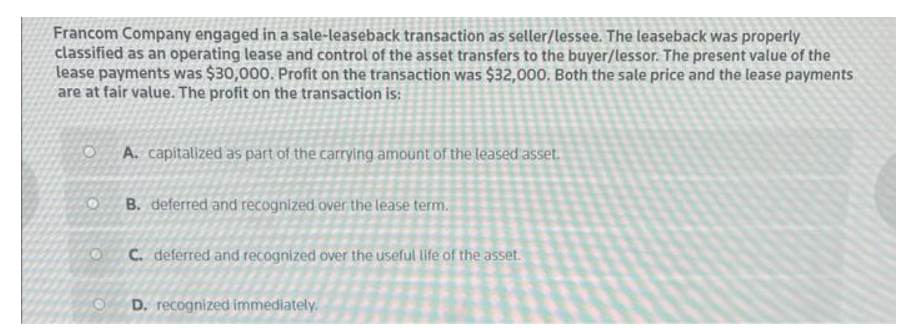

Francom Company engaged in a sale-leaseback transaction as seller/lessee. The leaseback was properly classified as an operating lease and control of the asset transfers to the buyer/lessor. The present value of the lease payments was $30,000. Profit on the transaction was $32,000. Both the sale price and the lease payments are at fair value. The profit on the transaction is: OfA. capitalized as part of the carrying amount of the leased asset. B. deferred and recognized over the lease term. C. deferred and recognized over the useful life of the asset. D. recognized immediately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts