Question: please answer with showing all work and avoiding shortcuts of any sort. Try to avoid using a financial calculator Q5) Goldstream Enterprises has bonds on

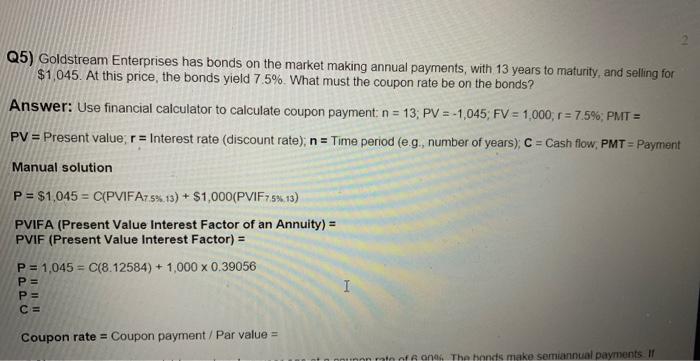

Q5) Goldstream Enterprises has bonds on the market making annual payments, with 13 years to maturity, and selling for $1,045. At this price, the bonds yield 7.5%. What must the coupon rate be on the bonds? Answer: Use financial calculator to calculate coupon payment: n=13;PV=1,045;FV=1,000,r=7.5%;PMT= PV= Present value; r= Interest rate (discount rate); n= Time period (e.g., number of years); C= Cash flow, PMT=Payment Manual solution P=$1,045=C( PVIFA7.5\%.13) +$1,000( PVIF7.5\%:13) PVIFA (Present Value Interest Factor of an Annuity) = PVIF (Present Value Interest Factor) = P=1,045=C(8.12584)+1,0000.39056P=P=C= Coupon rate = Coupon payment / Par value =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts