Question: PLEASE ANSWER WITH SOLUTION AND EXPLANATIONS: Microsoft Word - Assignment 1 I + v -O X -> C @ File | C:/Users/PC/Desktop/Assignment-1-Income-Taxation-Part-1.pdf 8 Guest E

PLEASE ANSWER WITH SOLUTION AND EXPLANATIONS:

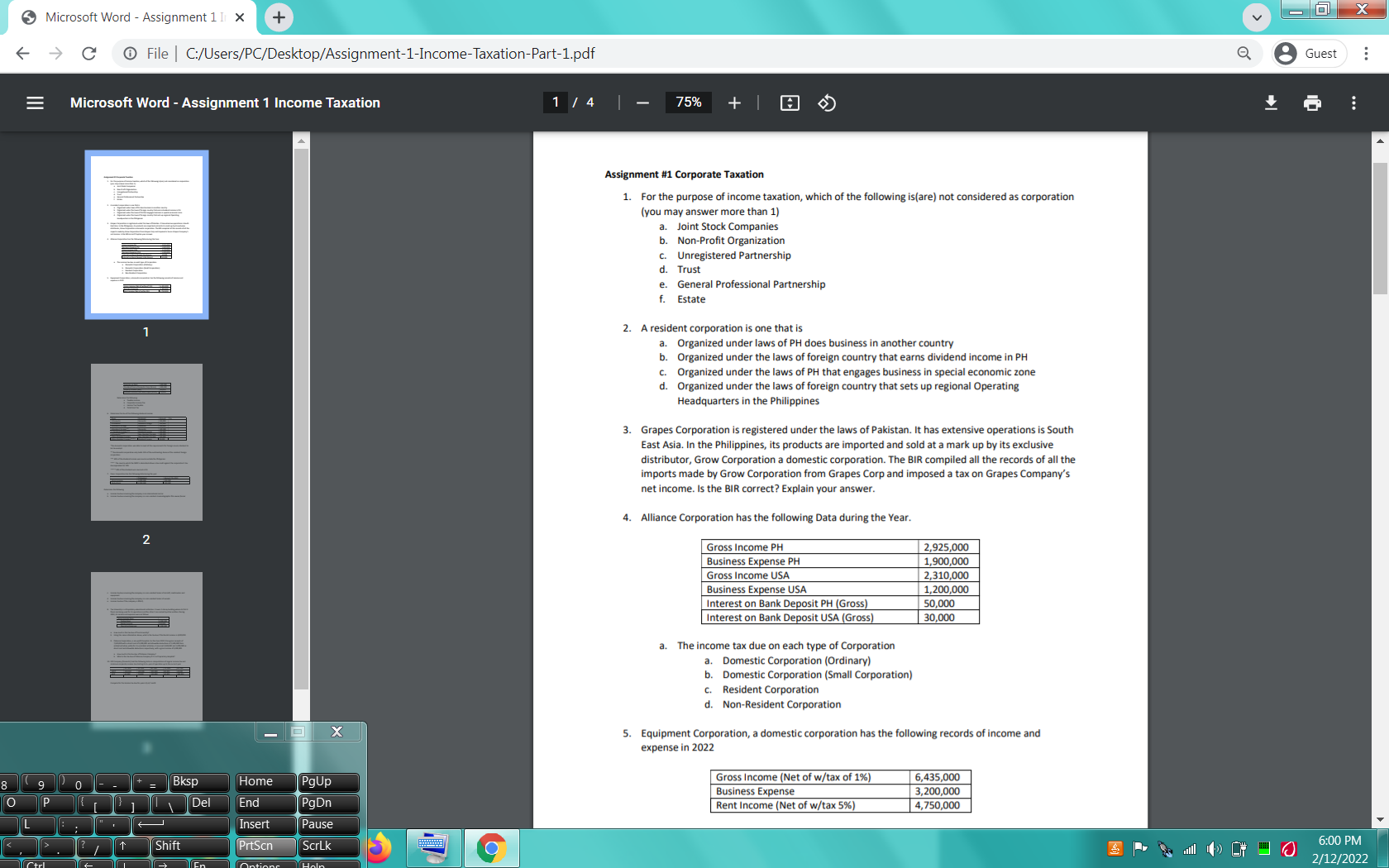

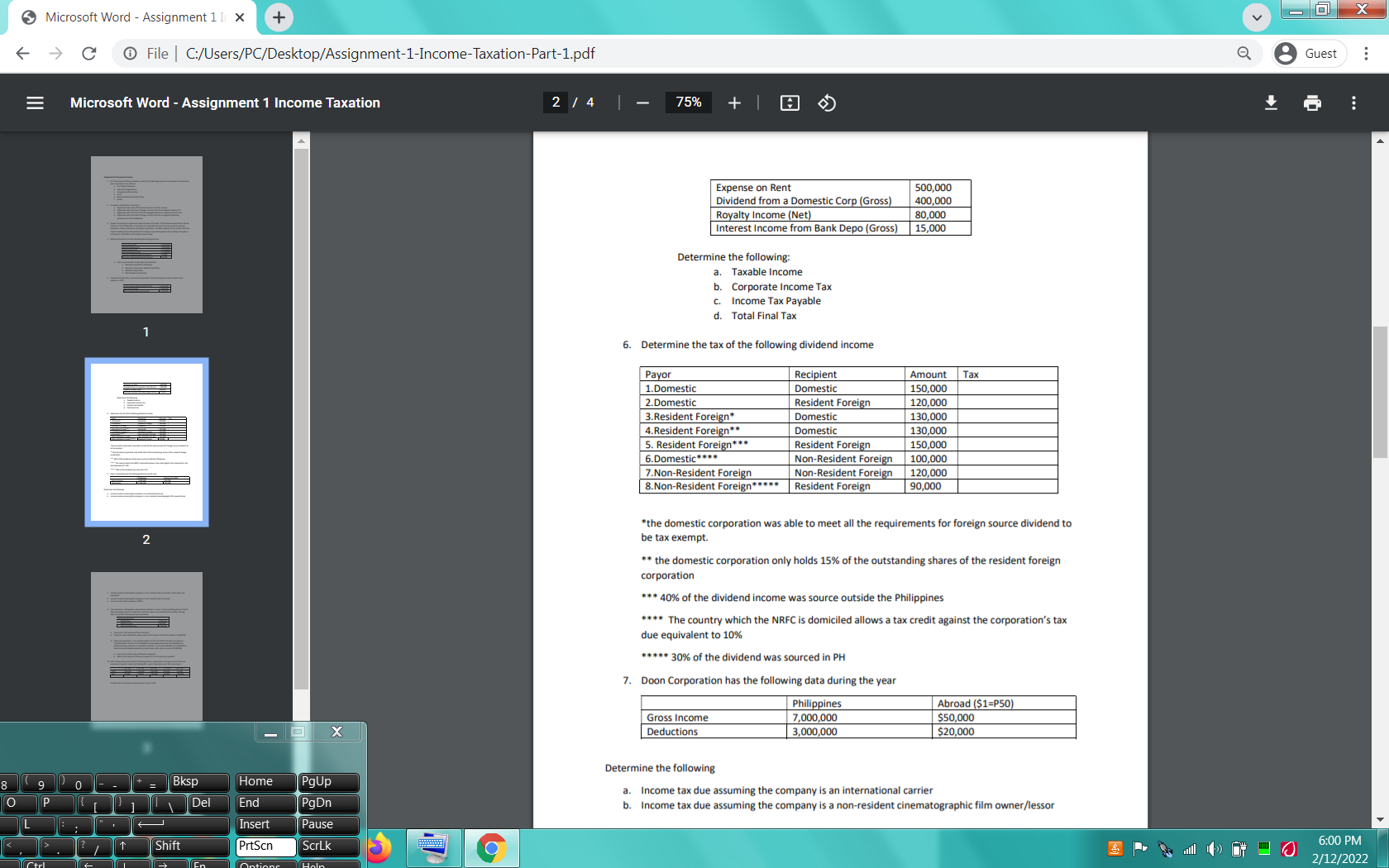

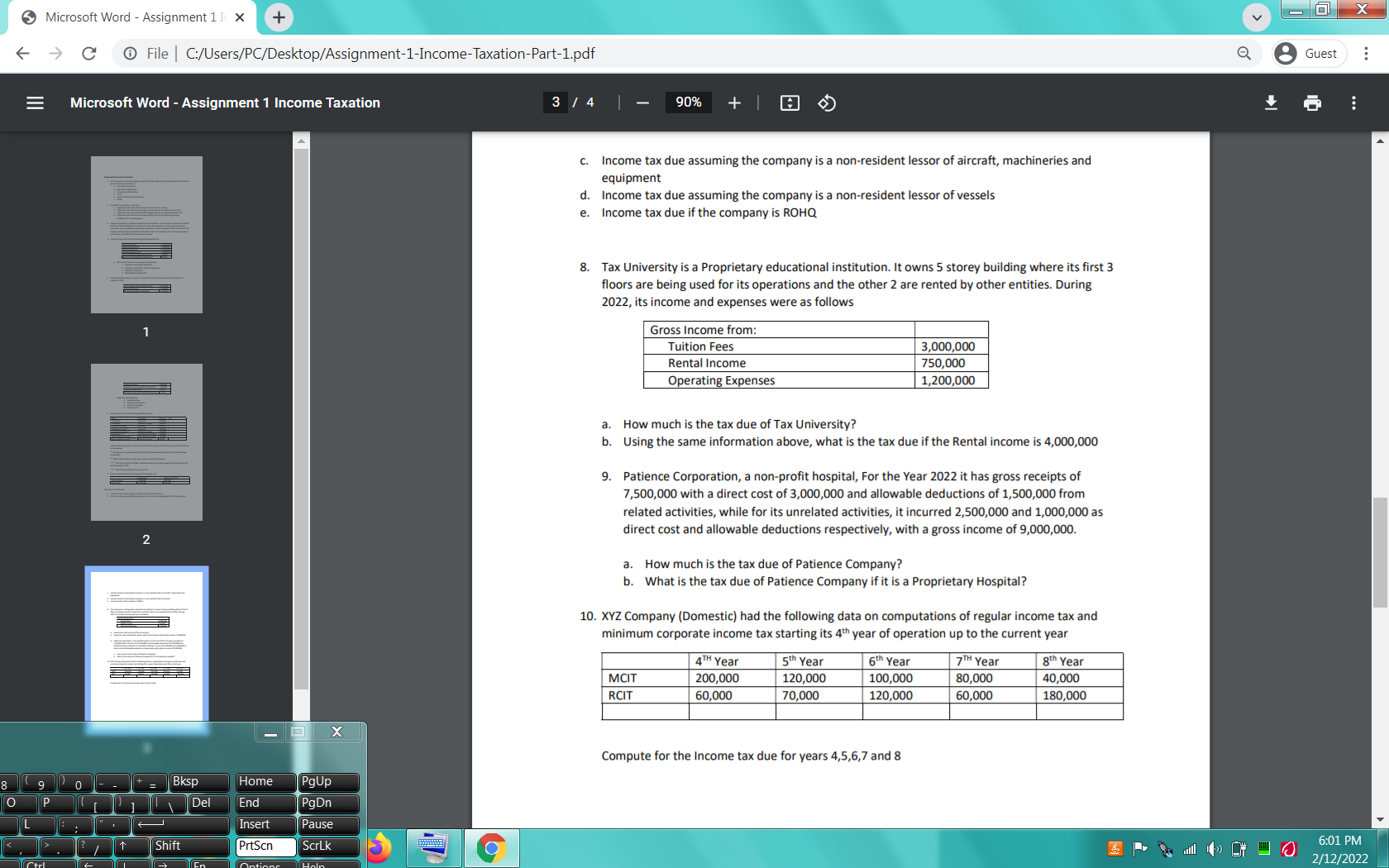

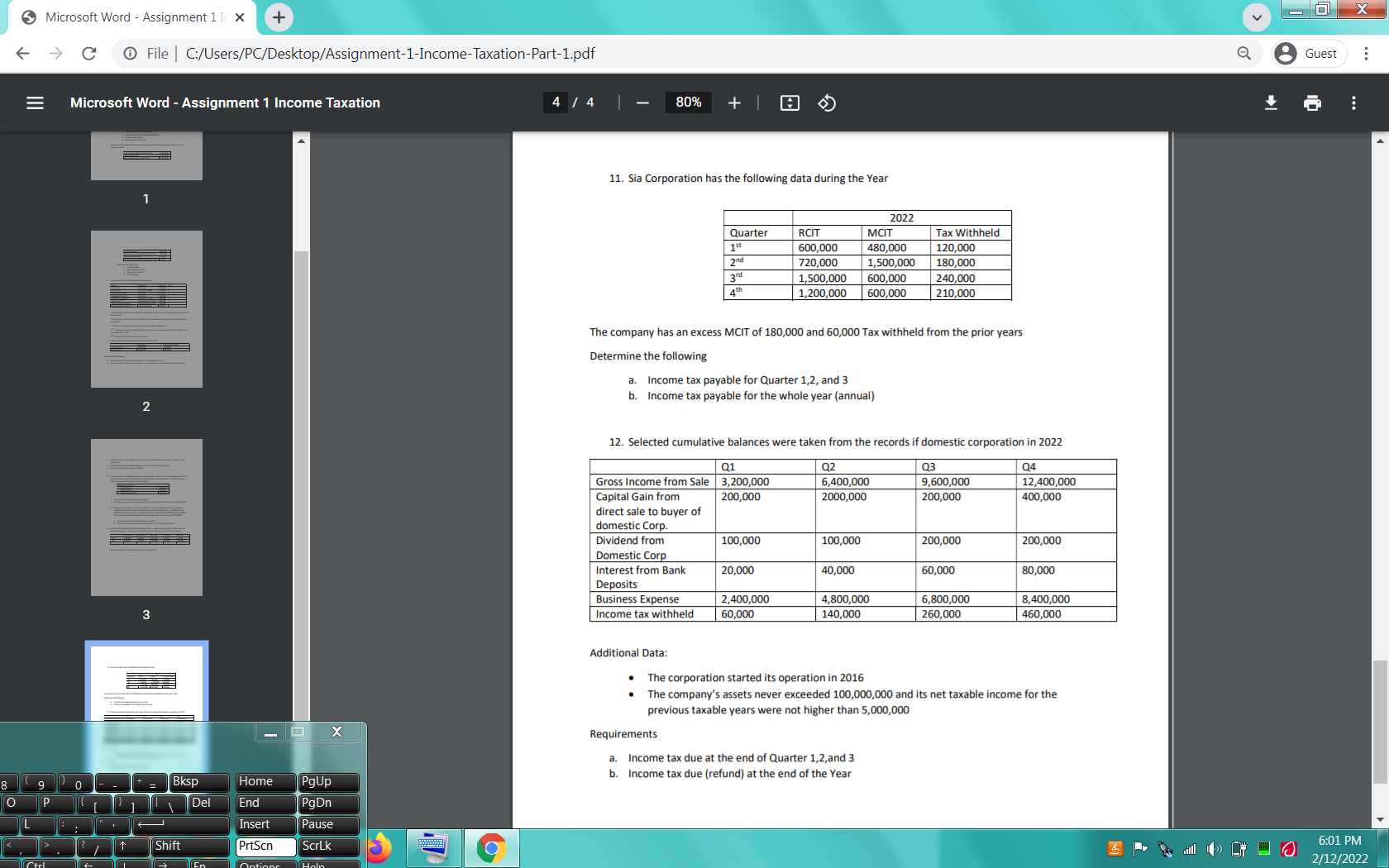

Microsoft Word - Assignment 1 I + v -O X -> C @ File | C:/Users/PC/Desktop/Assignment-1-Income-Taxation-Part-1.pdf 8 Guest E Microsoft Word - Assignment 1 Income Taxation 1 /4 75% + ... Assignment #1 Corporate Taxation 1. For the purpose of income taxation, which of the following is(are) not considered as corporation (you may answer more than 1) a. Joint Stock Companies b. Non-Profit Organization c. Unregistered Partnership d. Trust e. General Professional Partnership f. Estate 2. A resident corporation is one that is a. Organized under laws of PH does business in another country b. Organized under the laws of foreign country that earns dividend income in PH c. Organized under the laws of PH that engages business in special economic zone d. Organized under the laws of foreign country that sets up regional Operating Headquarters in the Philippines 3. Grapes Corporation is registered under the laws of Pakistan. It has extensive operations is South East Asia. In the Philippines, its products are imported and sold at a mark up by its exclusive distributor, Grow Corporation a domestic corporation. The BIR compiled all the records of all the imports made by Grow Corporation from Grapes Corp and imposed a tax on Grapes Company's net income. Is the BIR correct? Explain your answer. 4. Alliance Corporation has the following Data during the Year. Gross Income PH 2,925,000 Business Expense PH 1,900,000 Gross Income USA 2,310,000 Business Expense USA 1,200,000 Interest on Bank Deposit PH (Gross) 50,000 Interest on Bank Deposit USA (Gross) 30,000 a. The income tax due on each type of Corporation a. Domestic Corporation (Ordinary) b. Domestic Corporation (Small Corporation) . Resident Corporation d. Non-Resident Corporation X 5. Equipment Corporation, a domestic corporation has the following records of income and expense in 2022 8 9 0 - - + = Bksp Home PgUp Gross Income (Net of w/tax of 1%) 6,435,000 Business Expense 3,200,000 0 P Del End PgDn Rent Income (Net of w/tax 5%) 4,750,000 Insert Pause Shift PrtSon ScrLk 6:00 PM 2/12/2022Microsoft Word - Assignment 1 I + v -O X -> C O File | C:/Users/PC/Desktop/Assignment-1-Income-Taxation-Part-1.pdf 8 Guest E Microsoft Word - Assignment 1 Income Taxation 2/4 75% + ... Expense on Rent 500,000 Dividend from a Domestic Corp (Gross) 400,000 Royalty Income (Net) 80,000 Interest Income from Bank Depo (Gross) 15,000 Determine the following: a. Taxable Income b. Corporate Income Tax C. Income Tax Payable d. Total Final Tax 6. Determine the tax of the following dividend income Payor Recipient Amount Tax 1.Domestic Domestic 150,000 2. Domestic Resident Foreign 120,000 3.Resident Foreign* Domestic 130,000 4.Resident Foreign* * Domestic 130,000 5. Resident Foreign* * Resident Foreign 150,000 6.Domestic* * ** Non-Resident Foreign 100,000 7.Non-Resident Foreign Non-Resident Foreign 120,000 8.Non-Resident Foreign* * *** Resident Foreign 90,000 *the domestic corporation was able to meet all the requirements for foreign source dividend to 2 be tax exempt. ** the domestic corporation only holds 15% of the outstanding shares of the resident foreign corporation ***40% of the dividend income was source outside the Philippines *** The country which the NRFC is domiciled allows a tax credit against the corporation's tax due equivalent to 10% ***#* 30% of the dividend was sourced in PH 7. Doon Corporation has the following data during the year Philippines Abroad ($1=P50) Gross Income 7,000,000 $50,000 X Deductions 3,000,000 $20,000 Determine the following 8 9 0 - - + = Bksp Home PgUp a. Income tax due assuming the company is an international carrier 0 P Del End PgDn b. Income tax due assuming the company is a non-resident cinematographic film owner/lessor Insert Pause Shift PrtScr ScrLk 6:00 PM 2/12/2022(- 9 C (D Filel C:/UsersfPC,/DesktopfAssignmentililncomeiTaxationiPartipdf Q 8 Guest 5 Microsoft Word - Assignment 1 Income Taxation Income tax due assuming the company is a non-resident lessor ofairciaft, machineries and equipment Income tax due assuming the company is a non-resident lessor ofitessels Income tax due ifthe company is ROHQ Tax University is a Proprietary educational institution. It owns 5 storey building where its rst 3 floors are being used for its operations and the other 2 are rented by other entities. During 2022, its inoome and expenses were as follows Gross Income from: | Tuition Fees I 3,000,000 Rental income | 750,000 Operating Expenses | 1100.000 How much is the tax due oi Tax University? using the same information above, what is the (a! due if the Rental income is 4,000,000 Patience Corporation, a non-prot hospital. For the Year 2022 it has gross receipts of 7,500,000 with a direct cost of 3,000,000 and allowable deductions of 1,500,000 from related activities, while for its unrelated activities, it incurred 2,500,000 and 1.000.000 as direct cost and allowable deductions respectively, with a gross income of 9,000,000. a. How much Is the taii due of Patience Company? be What is the tax due oi Patience Company iflt is a Proprietary Hospital? . )(Yz Company (Domestic) had the following data on computations oi regular income tax and minimum corporate income taii starting its 4'\" year of operation up to the current year MCIT 200,000 120,000 100,000 80,000 40,000 "\"' Compute [or the Income tax due for years 4.5.6.7 and B 6'01 PM 2/12/2022 .lO Microsoft Word - Assignment 1 I + v -O X -> C @ File | C:/Users/PC/Desktop/Assignment-1-Income-Taxation-Part-1.pdf 8 Guest E Microsoft Word - Assignment 1 Income Taxation 4 1 80% + ... 11. Sia Corporation has the following data during the Year 2022 Quarter RCIT MCIT Tax Withheld 1 st 600,000 480,000 120,000 720,00 1,500,000 180,000 1,500,000 600,000 240,000 1,200,000 600,000 210,000 The company has an excess MCIT of 180,000 and 60,000 Tax withheld from the prior years Determine the following a. Income tax payable for Quarter 1,2, and 3 b. Income tax payable for the whole year (annual) 2 12. Selected cumulative balances were taken from the records if domestic corporation in 2022 Q1 Q2 Q3 Q4 Gross Income from Sale | 3,200,000 6,400,000 9,600,000 12,400,000 Capital Gain from 200,000 2000,000 200,000 400,000 direct sale to buyer of domestic Corp Dividend from 100,000 100,000 200,000 200,000 Domestic Corp Interest from Bank 20,000 40,000 60,000 80,000 Deposits Business Expense 2,400,000 4,800,000 6,800,000 8,400,000 3 Income tax withheld 60,000 140,000 260,000 460,000 Additional Data: The corporation started its operation in 2016 The company's assets never exceeded 100,000,000 and its net taxable income for the previous taxable years were not higher than 5,000,000 X Requirements a. Income tax due at the end of Quarter 1,2, and 3 8 9 0 - - + = Bksp Home PgUp b. Income tax due (refund) at the end of the Year 0 P Del End PgDn Insert Pause Shift PrtScr ScrLk O 6:01 PM 2/12/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts