Question: Please answer with the same format Only those accounts are available Additional information: 1. Selling general, and adiministrative expenses included a charge of 27.000 for

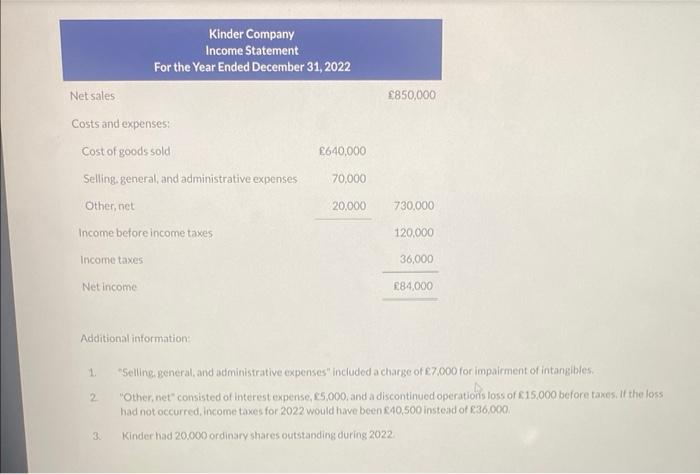

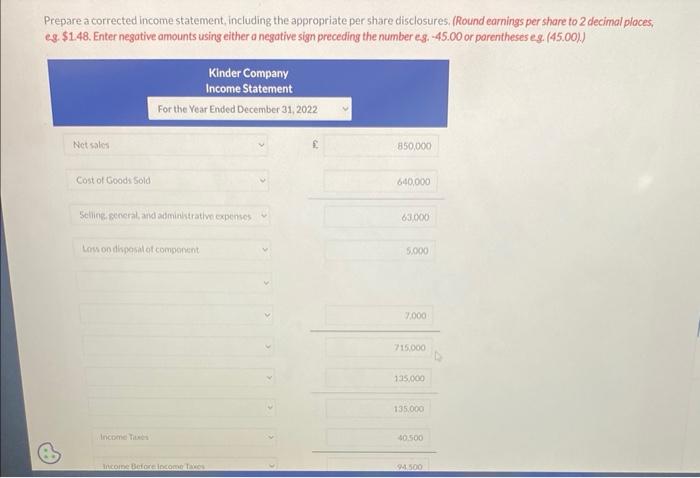

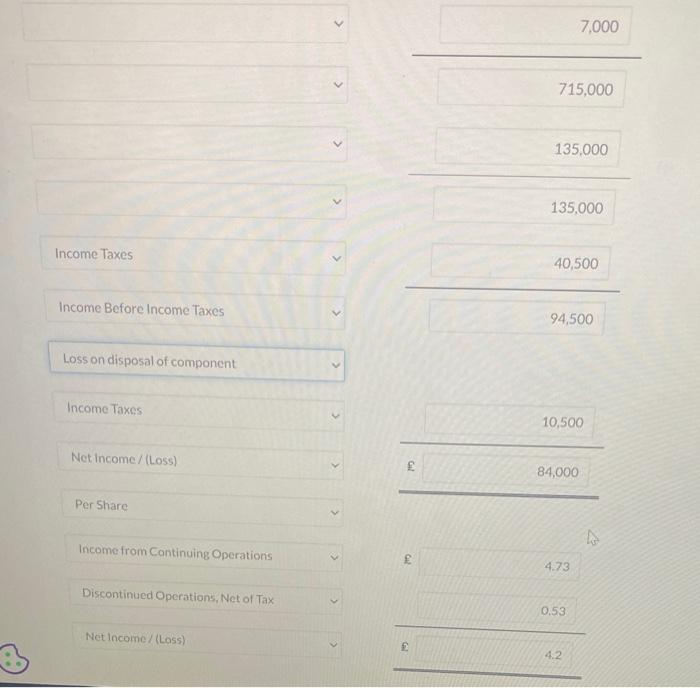

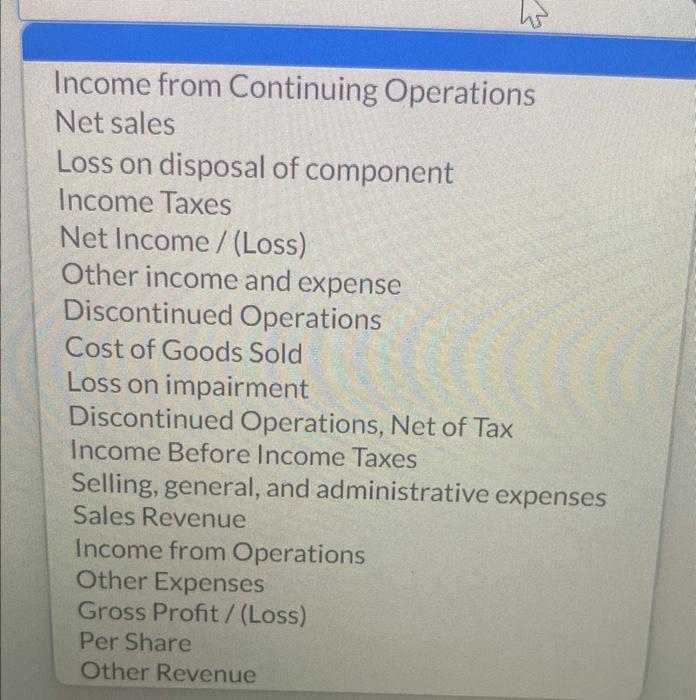

Additional information: 1. "Selling general, and adiministrative expenses" included a charge of 27.000 for impairment of intangibles. 2. "Other, net" consisted of interest expense, 5,000, and a discontinued operations loss of ,15,000 before takes, If the loss had not occurred, income taxes for 2022 would have been 40,500 insteid of 136,000 . 3. Kinder had 20.000 ordinary shares outstanding during 2022 Prepare a corrected income statement, including the appropriate per share disclosures, (Round earnings per share to 2 decimal ploces, eg. \$1.48. Enter negative amounts using either a negative sign preceding the number eg. 45.00 or porentheses eg. (45.00).) Income from Continuing Operations Net sales Loss on disposal of component Income Taxes Net Income / (Loss) Other income and expense Discontinued Operations Cost of Goods Sold Loss on impairment Discontinued Operations, Net of Tax Income Before Income Taxes Selling, general, and administrative expenses Sales Revenue Income from Operations Other Expenses Gross Profit / (Loss) Per Share Other Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts