Question: PLEASE ANSWER WITH WORK!!! You have been hired to evaluate a project for the ABC company, a large publicly traded firm that is a market

PLEASE ANSWER WITH WORK!!!

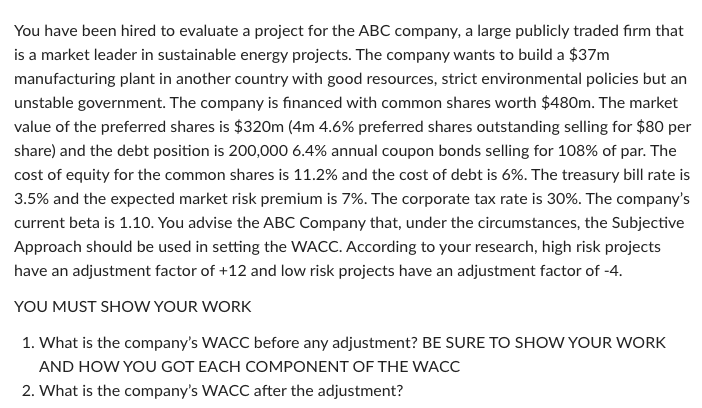

You have been hired to evaluate a project for the ABC company, a large publicly traded firm that is a market leader in sustainable energy projects. The company wants to build a $37m manufacturing plant in another country with good resources, strict environmental policies but an unstable government. The company is financed with common shares worth $480m. The market value of the preferred shares is $320m (4m 4.6% preferred shares outstanding selling for $80 per share) and the debt position is 200,000 6.4% annual coupon bonds selling for 108% of par. The cost of equity for the common shares is 11.2% and the cost of debt is 6%. The treasury bill rate is 3.5% and the expected market risk premium is 7%. The corporate tax rate is 30%. The company's current beta is 1.10. You advise the ABC Company that, under the circumstances, the Subjective Approach should be used in setting the WACC. According to your research, high risk projects have an adjustment factor of +12 and low risk projects have an adjustment factor of -4. YOU MUST SHOW YOUR WORK 1. What is the company's WACC before any adjustment? BE SURE TO SHOW YOUR WORK AND HOW YOU GOT EACH COMPONENT OF THE WACC 2. What is the company's WACC after the adjustment? You have been hired to evaluate a project for the ABC company, a large publicly traded firm that is a market leader in sustainable energy projects. The company wants to build a $37m manufacturing plant in another country with good resources, strict environmental policies but an unstable government. The company is financed with common shares worth $480m. The market value of the preferred shares is $320m (4m 4.6% preferred shares outstanding selling for $80 per share) and the debt position is 200,000 6.4% annual coupon bonds selling for 108% of par. The cost of equity for the common shares is 11.2% and the cost of debt is 6%. The treasury bill rate is 3.5% and the expected market risk premium is 7%. The corporate tax rate is 30%. The company's current beta is 1.10. You advise the ABC Company that, under the circumstances, the Subjective Approach should be used in setting the WACC. According to your research, high risk projects have an adjustment factor of +12 and low risk projects have an adjustment factor of -4. YOU MUST SHOW YOUR WORK 1. What is the company's WACC before any adjustment? BE SURE TO SHOW YOUR WORK AND HOW YOU GOT EACH COMPONENT OF THE WACC 2. What is the company's WACC after the adjustment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts