Question: Please answer with working Ouestion 13 25 marks On January 1 , 2023, Fortress Investment Fund (FIF) purchased 7% bonds, having a maturity value of

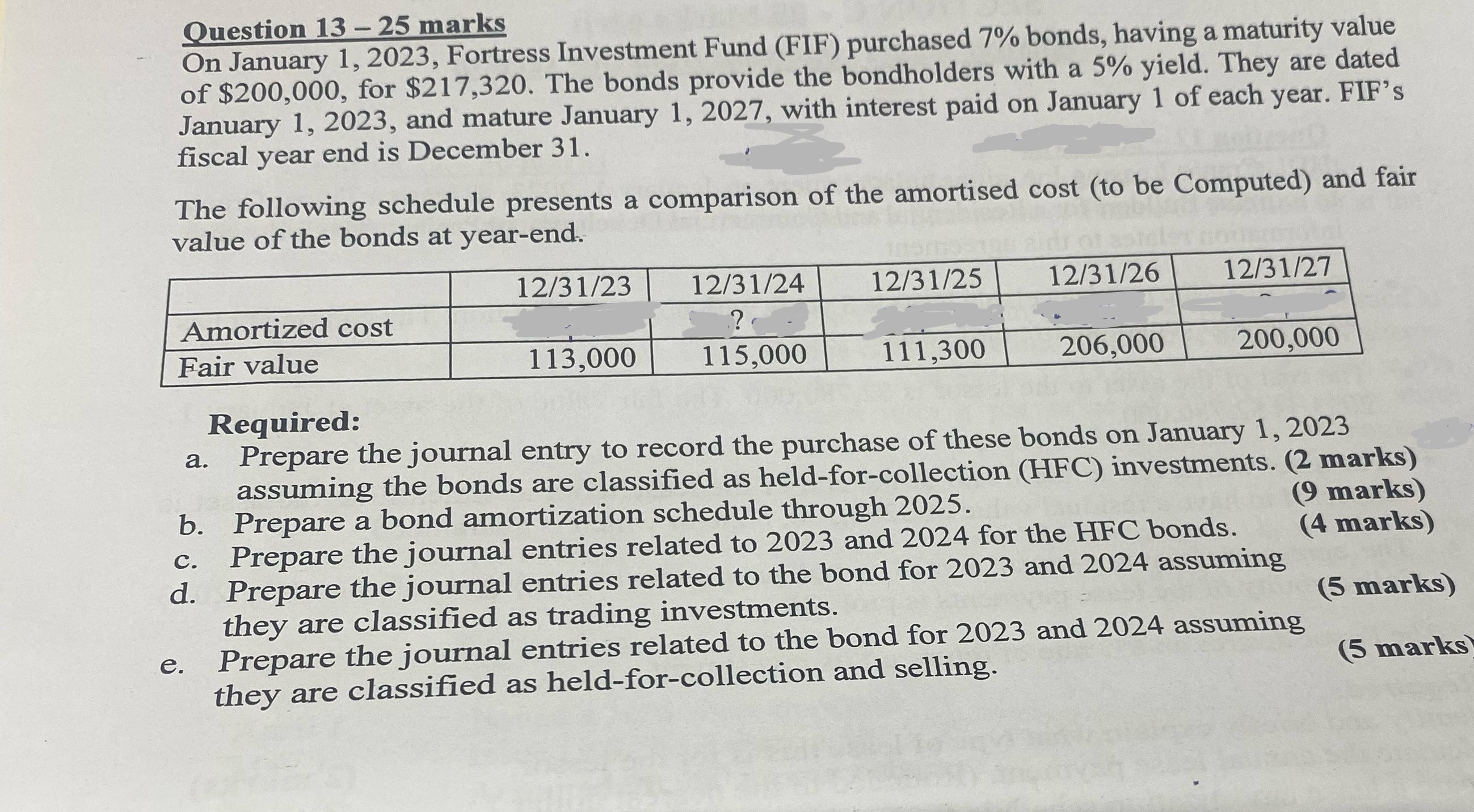

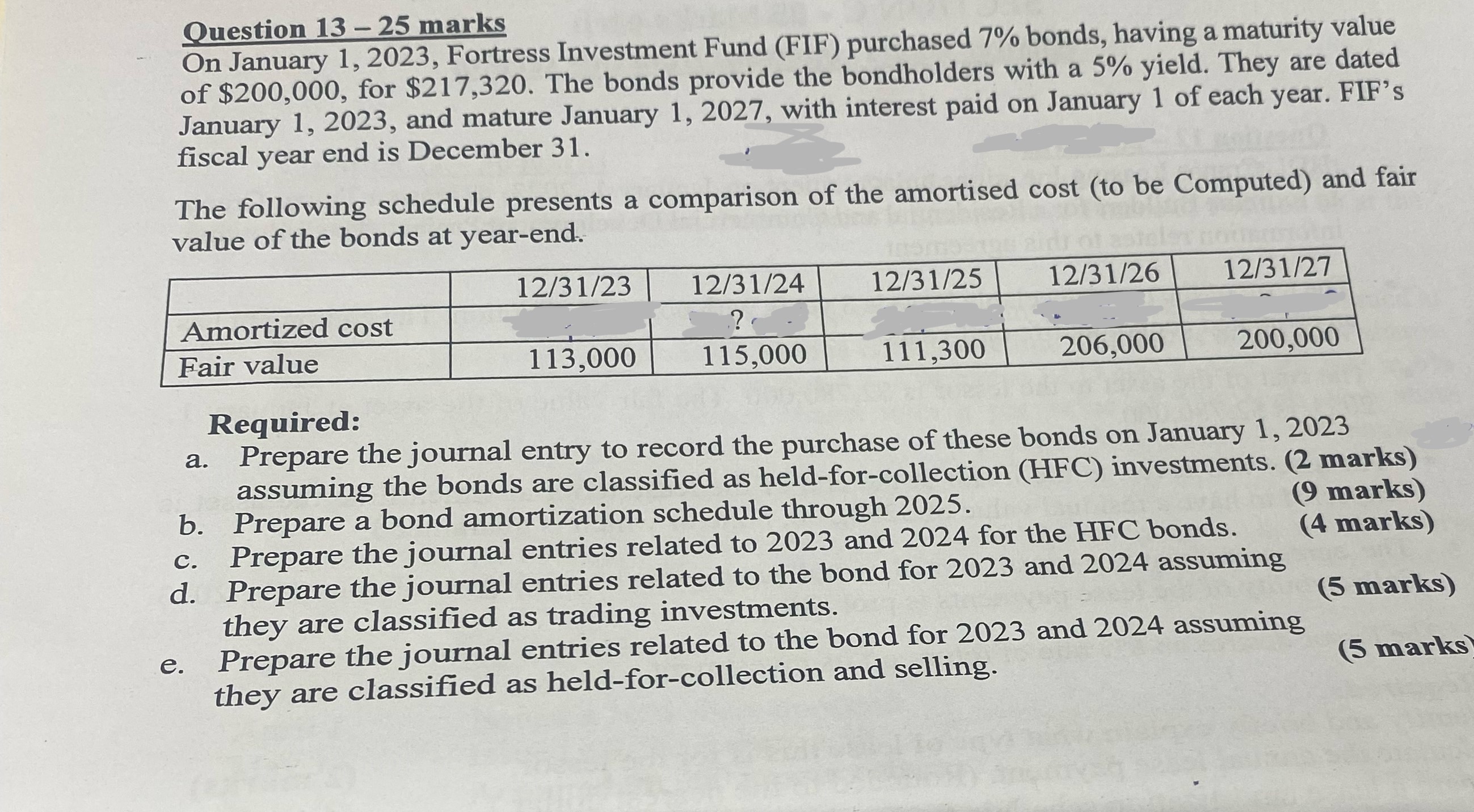

Ouestion 13 25 marks On January 1 , 2023, Fortress Investment Fund (FIF) purchased 7% bonds, having a maturity value of $200,000, for $217,320. The bonds provide the bondholders with a 5% yield. They are dated January 1, 2023, and mature January 1, 2027, with interest paid on January 1 of each year. FIF's fiscal year end is December 3 1 . The following schedule presents a comparison of the amortised cost (to be Computed) and fair value of the bonds at year-end. Amortized cost Fair value Required: 12/31/23 113,000 12/31/24 115,000 12/31/25 111,300 12/31/26 206,000 12/31/27 200,000 a. Prepare the journal entry to record the purchase of these bonds on January 1, 2023 assuming the bonds are classified as held-for-collection (HFC) investments. (2 marks) b. Prepare a bond amortization schedule through 2025. (9 marks) c. Prepare the journal entries related to 2023 and 2024 for the HFC bonds. (4 marks) d. Prepare the journal entries related to the bond for 2023 and 2024 assuming (S marks) they are classified as trading investments. e. Prepare the journal entries related to the bond for 2023 and 2024 assurning (S marks they are classified as held-for-collection and selling.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts