Question: Please answer within 1 hour please help i really need it. will give you good rating QUESTION 1 _(50 marks) A firm is considering the

Please answer within 1 hour please help i really need it. will give you good rating

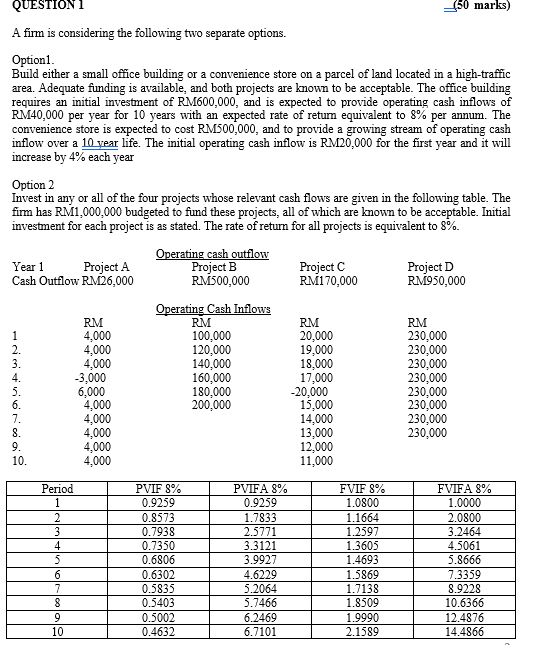

QUESTION 1 _(50 marks) A firm is considering the following two separate options. Option1. Build either a small office building or a convenience store on a parcel of land located in a high-traffic area. Adequate funding is available, and both projects are known to be acceptable. The office building requires an initial investment of RM600,000, and is expected to provide operating cash inflows of RM40,000 per year for 10 years with an expected rate of retum equivalent to 8% per annum. The convenience store is expected to cost RM500,000, and to provide a growing stream of operating cash inflow over a 10 year life. The initial operating cash inflow is RM20.000 for the first year and it will increase by 4% each year Option 2 Invest in any or all of the four projects whose relevant cash flows are given in the following table. The firm has RM1,000,000 budgeted to find these projects, all of which are known to be acceptable. Initial investment for each project is as stated. The rate of return for all projects is equivalent to 8%. Operating cash outflow Year 1 Project A Project B Project C Project D Cash Outflow RM26,000 RM500,000 RM170,000 RM950,000 Operating Cash Inflows RM RM RM RM 1 4,000 100,000 20,000 230,000 2. 4,000 120,000 19,000 230,000 3. 4,000 140,000 18,000 230,000 -3,000 160,000 17,000 230,000 5. 6,000 180,000 -20,000 230,000 6. 4,000 200.000 15,000 230,000 7. 4,000 14,000 230,000 8. 4,000 13,000 230,000 9. 4,000 12,000 10. 4,000 11,000 4. Period 1 2 3 4 5 6 7 8 9 10 PVIF 8% 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 PVIFA 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 FVIF 8% 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 FVIFA 8% 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 Compute the following for each option. 1. The NPV for each option 2. The ANPV for each investment option 3. Payback period for all options 4. Profitability index for all options 5. Draw up a matrix based on the results of these computation separated by Option 1 and Option 2 6. Recommend which alternative is more favorable in terms of accept-reject or ranking decisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts