Question: Please answer within proper format with all supporting calculation seperately Note : Every entry should have narration please Please do not copy the answer from

Please answer within proper format with all supporting calculation seperately

Note : Every entry should have narration please

Please do not copy the answer from any other site

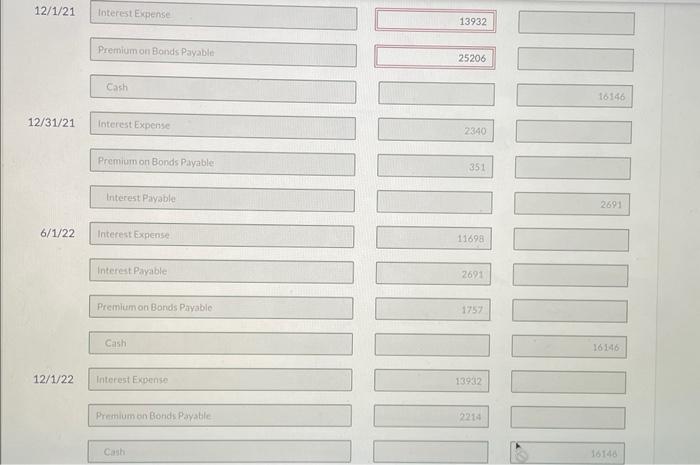

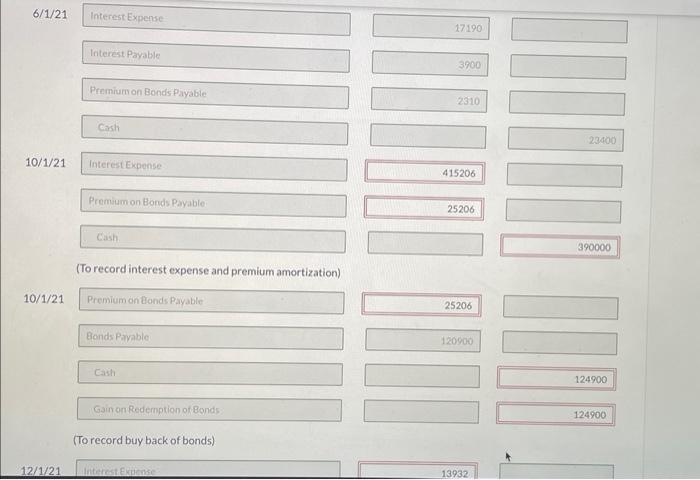

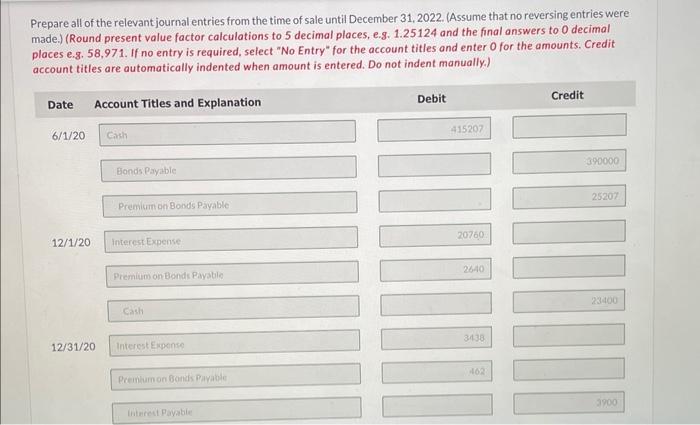

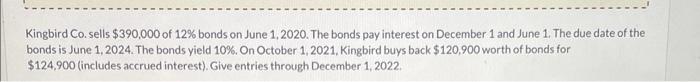

12/1/21 Interest Expense 13932 Premium on Bonds Payable 25206 Cash 16146 12/31/21 Interest Expense 2340 Premium on Bonds Payable: 351 Interest Payable 2691 6/1/22 Interest Expense 11698 Interest Payable 2691 Premium on Bonds Payable 1757 Cash 16 146 12/1/22 Interest Expense 139:32 Prathlum on Bonds Payable 9214 16148 Cash6/1/21 Interest Expense 17190 Interest Payable 3900 Premiumon Bonds Payable 2310 Cash 23400 10/1/21 Interest Expense 415206 Premium on Bonds Payable 25206 Cash 390000 (To record interest expense and premium amortization) 10/1/21 Premium on Bonds Payable 25206 Bonds Payable 120900 Cash 124900 Gain on Redemption of Bonds 124900 (To record buy back of bonds) 12/1/21 LInterest Eltense 13932Prepare all of the relevant journal entries from the time of sale until December 31, 2022. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 6/1/20 Cash 415207 Bonds Payable 390000 Premium on Bonds Payable 25207 12/1/20 Interest Expense 20760 Premium on Bonds Payable 2440 Cash 23400 12/31/20 Interest Expense 3438 Preinlumon Bonds Payable Interest Payable 3900Kingbird Co. sells $390,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1, The due date of the bonds is June 1, 2024. The bonds yield 10%. On October 1, 2021, Kingbird buys back $120,900 worth of bonds for $124,900 (includes accrued interest). Give entries through December 1, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts