Question: Please answer without taking a photo from your copybook. Practice Quiz - Capital Investment Analysis You are evaluating Projects 1 and 2. The projects have

Please answer without taking a photo from your copybook.

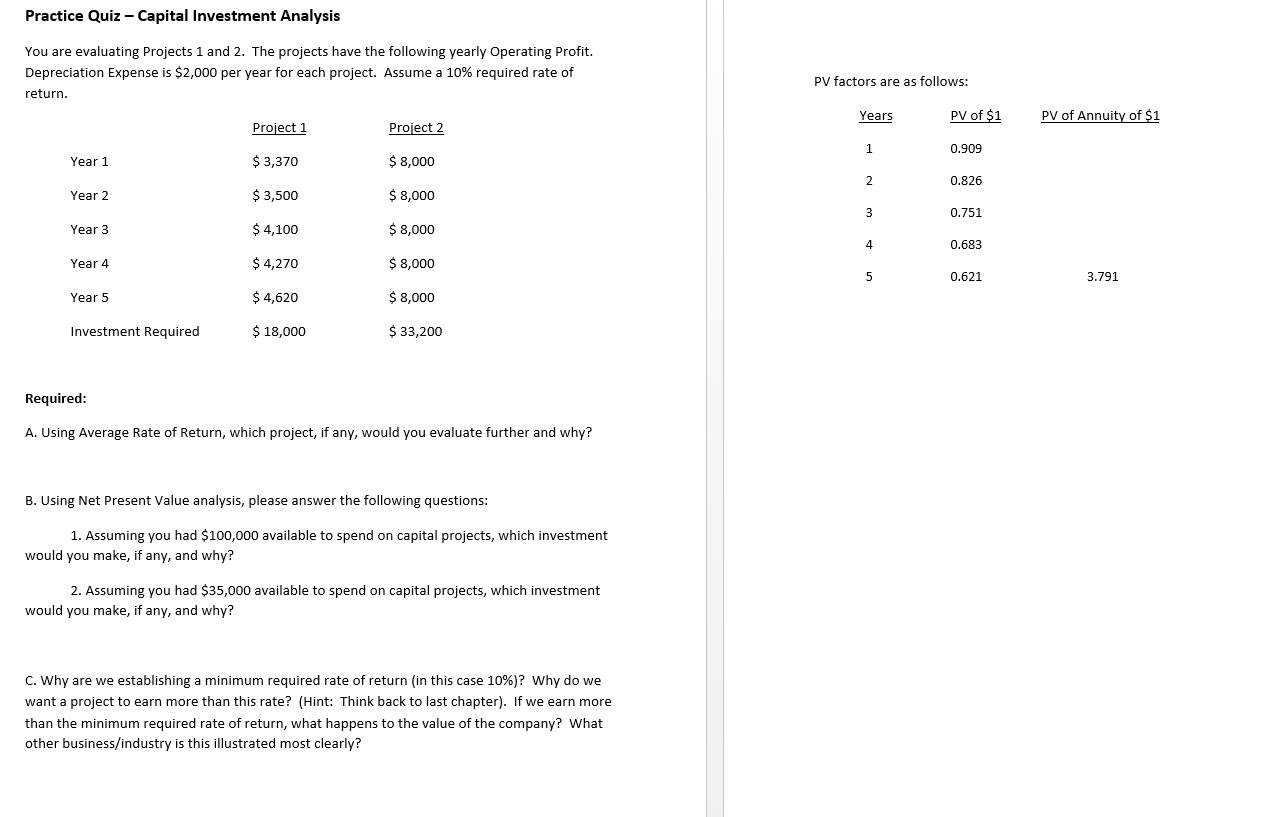

Practice Quiz - Capital Investment Analysis You are evaluating Projects 1 and 2. The projects have the following yearly Operating Profit. Depreciation Expense is $2,000 per year for each project. Assume a 10\% required rate of return. Required: A. Using Average Rate of Return, which project, if any, would you evaluate further and why? B. Using Net Present Value analysis, please answer the following questions: 1. Assuming you had $100,000 available to spend on capital projects, which investment would you make, if any, and why? 2. Assuming you had $35,000 available to spend on capital projects, which investment would you make, if any, and why? C. Why are we establishing a minimum required rate of return (in this case 10% )? Why do we want a project to earn more than this rate? (Hint: Think back to last chapter). If we earn more than the minimum required rate of return, what happens to the value of the company? What other business/industry is this illustrated most clearly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts