Question: please answer wuestion one part 1 and 2 Quad Enterprises is considering a new three-year expansion project that requires an Initial fixed asset Investment of

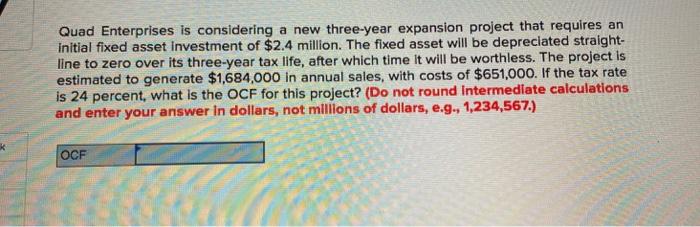

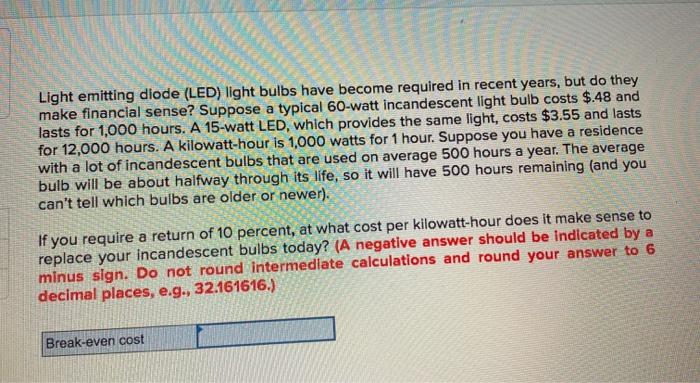

Quad Enterprises is considering a new three-year expansion project that requires an Initial fixed asset Investment of $2.4 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1,684,000 in annual sales, with costs of $651,000. If the tax rate is 24 percent, what is the OCF for this project? (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) * OCF Light emitting diode (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.48 and lasts for 1,000 hours. A 15-watt LED, which provides the same light, costs $3.55 and lasts for 12,000 hours. A kilowatt-hour is 1,000 watts for 1 hour. Suppose you have a residence with a lot of incandescent bulbs that are used on average 500 hours a year. The average bulb will be about halfway through its life, so it will have 500 hours remaining (and you can't tell which bulbs are older or newer). If you require a return of 10 percent, at what cost per kilowatt-hour does it make sense to replace your incandescent bulbs today? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 6 decimal places, e.g., 32.161616.) Break-even cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts