Question: Please answer Year 0~ Year 3 all questions, Thank you. Your company has been doing well, reaching $1.05 million in earnings, and is considering launching

Please answer Year 0~ Year 3 all questions, Thank you.

Please answer Year 0~ Year 3 all questions, Thank you.

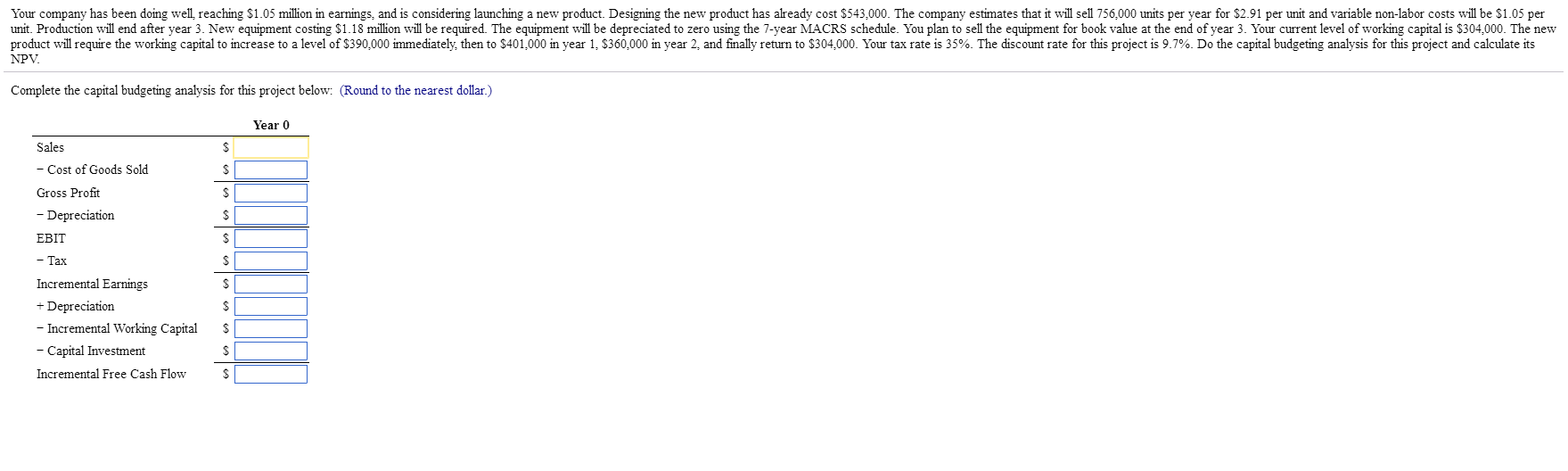

Your company has been doing well, reaching $1.05 million in earnings, and is considering launching a new product. Designing the new product has already cost $543, 000. The company estimates that it will sell 756:000 units per year for $2.91 per unit and variable non-labor costs will be $1.05 per unit. Production will end after year 3. New equipment costing $1.18 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule You plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $304, 000. The new product will require the working capital to increase to a level of $390, 000 immediately, then to $401, 000 in year 1, $360, 000 in year 2, and finally return to $304, 000. Your tax rate is 35%. The discount rate for this project is 9.7%. Do the capital budgeting analysis for this project and calculate its NPV. Complete the capital budgeting analysis for this project below: (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts