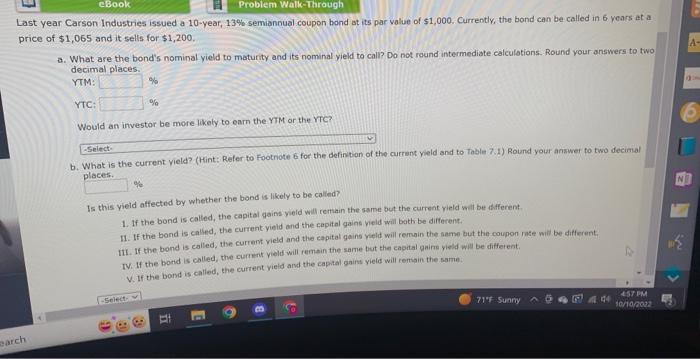

Question: please answer year Carson Industries issued a 10 -year, 13% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called

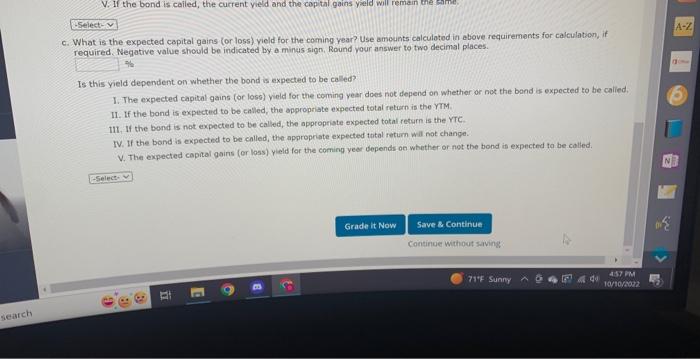

year Carson Industries issued a 10 -year, 13% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called in 6 years at a te of $1,065 and it sells for $1,200. a. What are the bond's nominal yield to maturity and its nominal yield to call? Do not round intermediate calculotions. Round your answers to two decimal places. rTM: Whuld an investor be more likely to earn the YTM or the YTC? b. What is the current vield? (Hint: Refer to Footnote 6 for the defintion of tne current yeld and to table 7.1) Round your aniwer to two decimal Is this yield affected by whether the bond is likely to be called? 1. If the bond is called, the capital gaims veld will remain the same but the current yield will be wafferent 11. If the bond is called, the current yieid and the capital gains veld will bath be different. III. If the bond is called, the current vield and the capital gains yelld will remain the same but the coupon rate will be different. IV. If the bond is colled, the cument yiold will remain the same but the capital gaime yield will be different. V. If the bond is called, the current vield and the capial gains yield will remain the same: c. What is the expected capital gains (or loss) yield for the coming year? Use amounts calculated in above requirements for calculation, if required. Negative value should be indicated by a minus sign, Round your answer to two decimal places. 7b Is this yield dependent on whether the bond is expected to be called? 1. The expected capital gains (or loso) yield for the coming year does not depend on whether or not the band is expected to be calied. 11. If the bond is expected to be called, the appropriate expected total return is the YIM. III. If the bond is not expected to be called, the appropriste expected total return is the YTC. IV. If the bond is expected to be called, the appropriate expected total return will not change. V. The expected copital gains (or loss) yield for the coming yeer depends on whether or not the bond is expected to be colled

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts