Question: Please Answers all Question. Question.2 Using NPV, should you invest in a project where the initial cash outflow is $25,000 and the cash inflow in

Please Answers all Question.

Please Answers all Question.

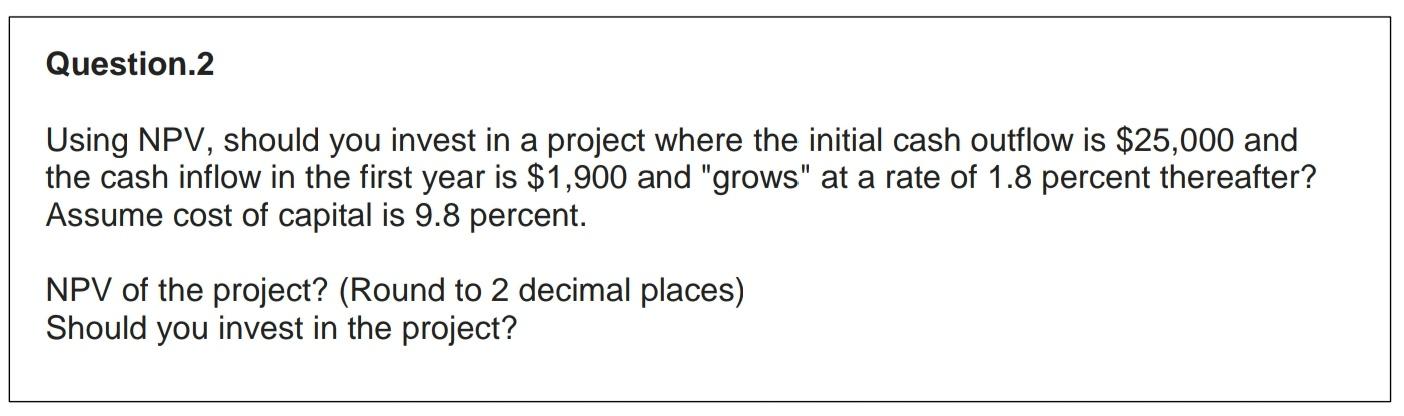

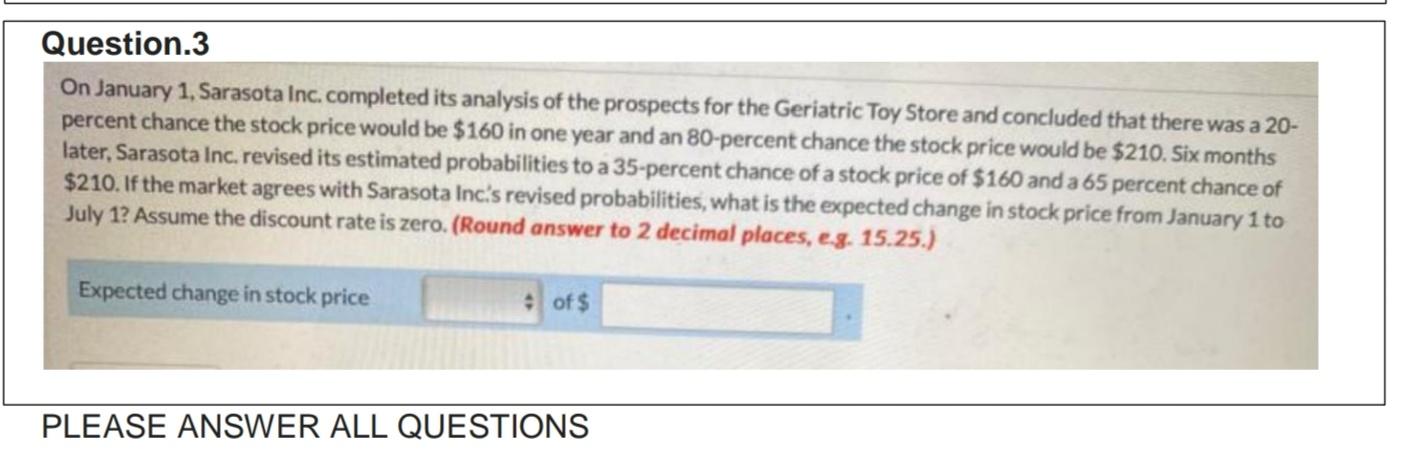

Question.2 Using NPV, should you invest in a project where the initial cash outflow is $25,000 and the cash inflow in the first year is $1,900 and "grows" at a rate of 1.8 percent thereafter? Assume cost of capital is 9.8 percent. NPV of the project? (Round to 2 decimal places) Should you invest in the project? Question.3 On January 1, Sarasota Inc. completed its analysis of the prospects for the Geriatric Toy Store and concluded that there was a 20- percent chance the stock price would be $160 in one year and an 80-percent chance the stock price would be $210. Six months later, Sarasota Inc. revised its estimated probabilities to a 35-percent chance of a stock price of $160 and a 65 percent chance of $210. If the market agrees with Sarasota Inc's revised probabilities, what is the expected change in stock price from January 1 to July 1? Assume the discount rate is zero. (Round answer to 2 decimal places, e.g. 15.25.) Expected change in stock price of $ PLEASE ANSWER ALL QUESTIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts