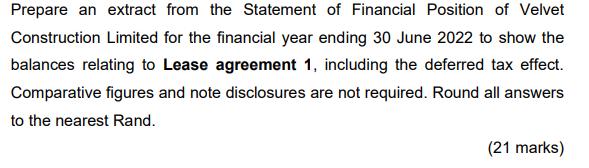

Question: Velvet Construction Limited is a company with a 30 June year-end and is involved in the construction industry. The company has the following lease

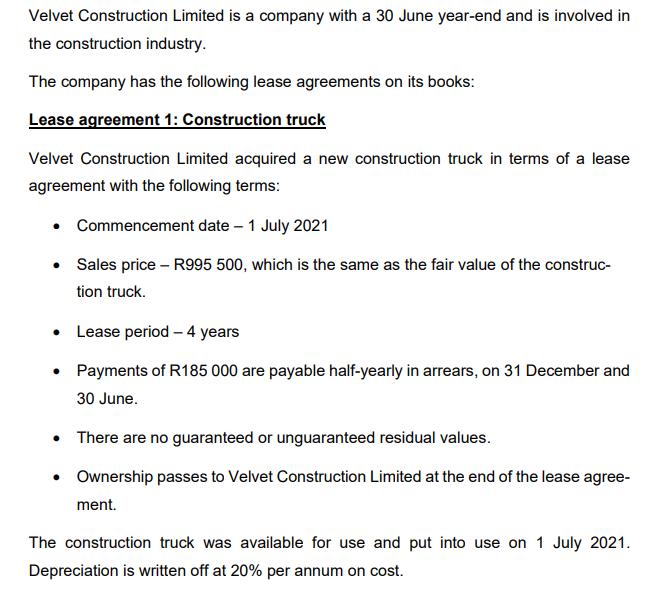

Velvet Construction Limited is a company with a 30 June year-end and is involved in the construction industry. The company has the following lease agreements on its books: Lease agreement 1: Construction truck Velvet Construction Limited acquired a new construction truck in terms of a lease agreement with the following terms: Commencement date - 1 July 2021 Sales price - R995 500, which is the same as the fair value of the construc- tion truck. Lease period - 4 years Payments of R185 000 are payable half-yearly in arrears, on 31 December and 30 June. There are no guaranteed or unguaranteed residual values. Ownership passes to Velvet Construction Limited at the end of the lease agree- ment. The construction truck was available for use and put into use on 1 July 2021. Depreciation is written off at 20% per annum on cost.

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Lease agreement 1 Construction truck Asset Construction truck Cost R995 500 Depreciation ... View full answer

Get step-by-step solutions from verified subject matter experts