Question: Please anwer the question as detaied as possible QUESTION 2 You work as an underwriter for Park Investments, a leading provider of derivative products, where

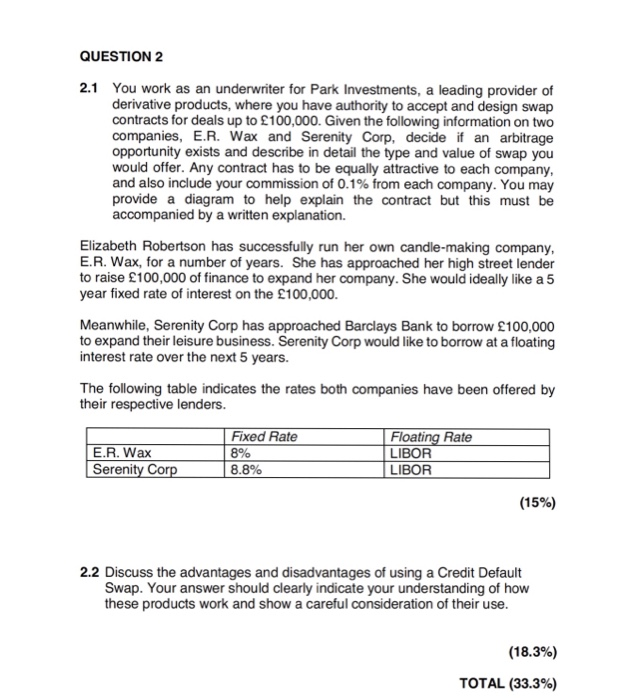

QUESTION 2 You work as an underwriter for Park Investments, a leading provider of derivative products, where you have authority to accept and design swap contracts for deals up to 100,000. Given the following information on two companies, E.R. Wax and Serenity Corp, decide if an arbitrage opportunity exists and describe in detail the type and value of swap you would offer. Any contract has to be equally attractive to each company and also include your commission of 0.1% from each company. You may provide a diagram to help explain the contract but this must be 2.1 accompanied by a written explanation. Elizabeth Robertson has successfully run her own candle-making company E.R. Wax, for a number of years. She has approached her high street lender to raise 100,000 of finance to expand her company. She would ideally like a5 year fixed rate of interest on the 100,000 Meanwhile, Serenity Corp has approached Barclays Bank to borrow 100,000 to expand their leisure business. Serenity Corp would like to borrow at a floating interest rate over the next 5 years. The following table indicates the rates both companies have been offered by their respective lenders. Fixed Rate 8% 8.8% Floating Rate LIBOR E.R. Wax Serenit LIBOR (15%) 2.2 Discuss the advantages and disadvantages of using a Credit Default Swap. Your answer should clearly indicate your understanding of how these products work and show a careful consideration of their use (18.3%) TOTAL (33.3%) QUESTION 2 You work as an underwriter for Park Investments, a leading provider of derivative products, where you have authority to accept and design swap contracts for deals up to 100,000. Given the following information on two companies, E.R. Wax and Serenity Corp, decide if an arbitrage opportunity exists and describe in detail the type and value of swap you would offer. Any contract has to be equally attractive to each company and also include your commission of 0.1% from each company. You may provide a diagram to help explain the contract but this must be 2.1 accompanied by a written explanation. Elizabeth Robertson has successfully run her own candle-making company E.R. Wax, for a number of years. She has approached her high street lender to raise 100,000 of finance to expand her company. She would ideally like a5 year fixed rate of interest on the 100,000 Meanwhile, Serenity Corp has approached Barclays Bank to borrow 100,000 to expand their leisure business. Serenity Corp would like to borrow at a floating interest rate over the next 5 years. The following table indicates the rates both companies have been offered by their respective lenders. Fixed Rate 8% 8.8% Floating Rate LIBOR E.R. Wax Serenit LIBOR (15%) 2.2 Discuss the advantages and disadvantages of using a Credit Default Swap. Your answer should clearly indicate your understanding of how these products work and show a careful consideration of their use (18.3%) TOTAL (33.3%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts