Question: Please anwer this question Calibu 11 copy A AWE Format Painter BTU 23 Wrap Text Merge a Center - Accounting $ %*38-99 Conditional Formu Formatting

Please anwer this question

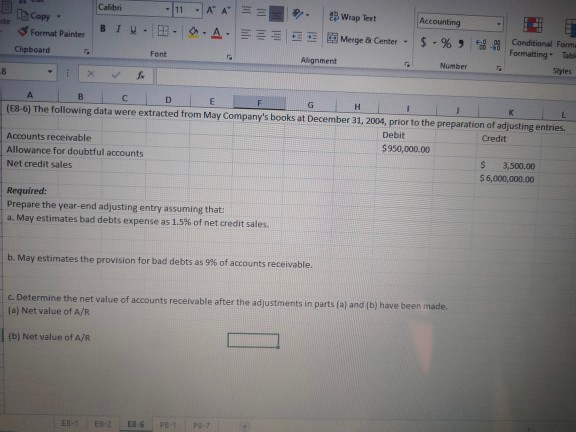

Calibu 11 copy A AWE Format Painter BTU 23 Wrap Text Merge a Center - Accounting $ %*38-99 Conditional Formu Formatting - tabi Styles Clipboard Font Alignment Number 8 2 A D E H L (E8-6) The following data were extracted from May Company's books at December 31, 2004, prior to the preparation of adjusting entries. Debit Credit Accounts receivable $950,000.00 Allowance for doubtful accounts $ 3,500.00 Net credit sales $ 6,000,000.00 Required: Prepare the year-end adjusting entry assuming that: a. May estimates bad debts expense as 1.5% of net credit sales. b. May estimates the provision for bad debts as 9% of accounts receivable. c. Determine the net value of accounts receivable after the adjustments in parts (a) and (b) have been made. (a) Net value of A/R (b) Net value of A/R EL EB 6 PB PS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts