Question: please as soon as possible, i will upvote 17. When equipment is purchased entirely through a loan: A) The equipment is shown as an increase

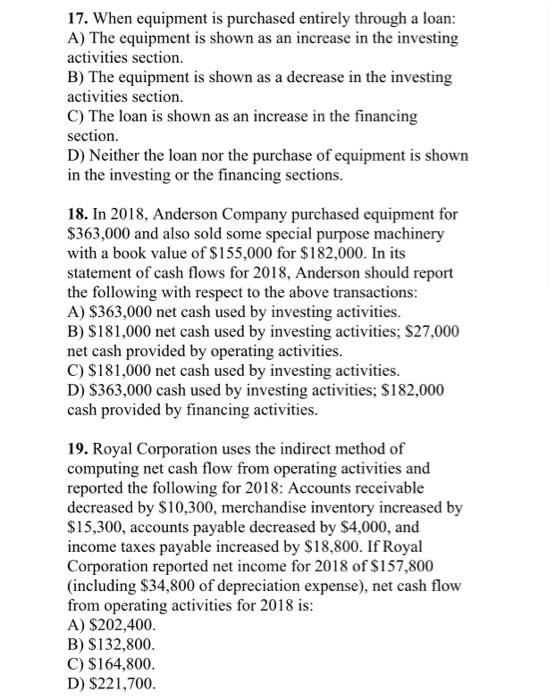

17. When equipment is purchased entirely through a loan: A) The equipment is shown as an increase in the investing activities section. B) The equipment is shown as a decrease in the investing activities section. C) The loan is shown as an increase in the financing section. D) Neither the loan nor the purchase of equipment is shown in the investing or the financing sections. 18. In 2018, Anderson Company purchased equipment for $363,000 and also sold some special purpose machinery with a book value of $155,000 for $182,000. In its statement of cash flows for 2018, Anderson should report the following with respect to the above transactions: A) $363,000 net cash used by investing activities. B) $181,000 net cash used by investing activities; $27,000 net cash provided by operating activities. C) $181,000 net cash used by investing activities. D) $363,000 cash used by investing activities, $182,000 cash provided by financing activities. 19. Royal Corporation uses the indirect method of computing net cash flow from operating activities and reported the following for 2018: Accounts receivable decreased by $10,300, merchandise inventory increased by $15,300, accounts payable decreased by $4,000, and income taxes payable increased by $18,800. If Royal Corporation reported net income for 2018 of $157,800 (including $34,800 of depreciation expense), net cash flow from operating activities for 2018 is: A) $202,400. B) $132,800. C) $164,800. D) $221,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts