Question: please As soon as possible nswer this question Topic 6: Consolidations and Intragroup transactions 6.5 answer following question: 1. Gotham Ltd purchased 100% of the

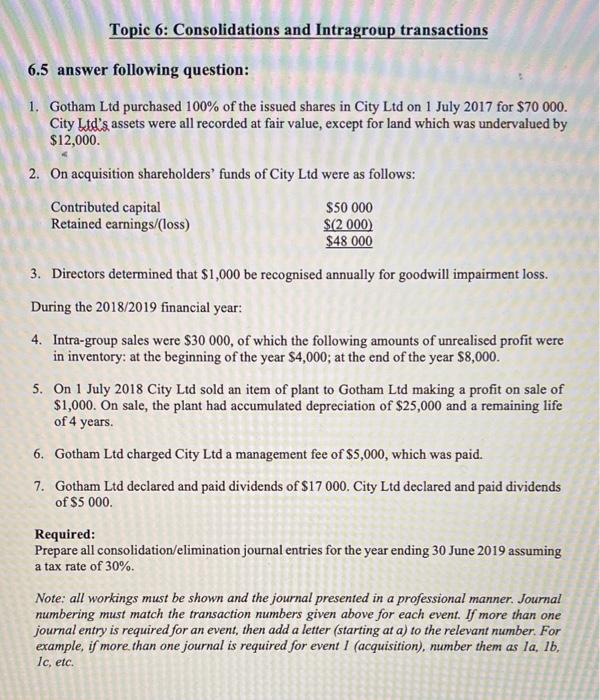

Topic 6: Consolidations and Intragroup transactions 6.5 answer following question: 1. Gotham Ltd purchased 100% of the issued shares in City Ltd on 1 July 2017 for $70 000. City Ltd's assets were all recorded at fair value, except for land which was undervalued by $12,000 2. On acquisition shareholders' funds of City Ltd were as follows: Contributed capital $50 000 Retained earnings/(loss) $(2 000) $48 000 3. Directors determined that $1,000 be recognised annually for goodwill impairment loss. During the 2018/2019 financial year: 4. Intra-group sales were $30 000, of which the following amounts of unrealised profit were in inventory: at the beginning of the year $4,000; at the end of the year $8,000. 5. On 1 July 2018 City Ltd sold an item of plant to Gotham Ltd making a profit on sale of $1,000. On sale, the plant had accumulated depreciation of $25,000 and a remaining life of 4 years. 6. Gotham Ltd charged City Ltd a management fee of $5,000, which was paid. 7. Gotham Ltd declared and paid dividends of $17 000. City Ltd declared and paid dividends of $5 000. Required: Prepare all consolidation/elimination journal entries for the year ending 30 June 2019 assuming a tax rate of 30%. Note: all workings must be shown and the journal presented in a professional manner. Journal numbering must match the transaction numbers given above for each event. If more than one journal entry is required for an event, then add a letter (starting at a) to the relevant number. For example, if more than one journal is required for event 1 (acquisition), number them as la, lb, Ic, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts