Question: Please ASAP and show the work! Below is the most recent financial information for Auster's Books Company. If the sales are expected to increase by

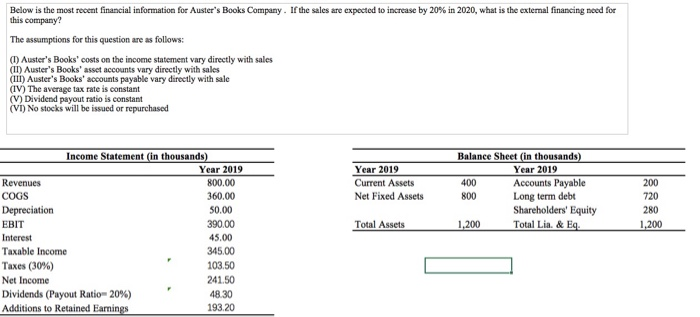

Below is the most recent financial information for Auster's Books Company. If the sales are expected to increase by 20% in 2020, what is the external financing need for this company? The assumptions for this question are as follows: (1) Auster's Books' costs on the income statement vary directly with sales (II) Auster's Books' asset accounts vary directly with sales (III) Auster's Books' accounts payable vary directly with sale (IV) The average tax rate is constant (V) Dividend payout ratio is constant (VI) No stocks will be issued or repurchased Year 2019 Current Assets Net Fixed Assets Income Statement (in thousands) Year 2019 Revenues 800.00 COGS 360.00 Depreciation 50.00 EBIT 390.00 Interest 45.00 Taxable income 345.00 Taxes (30%) 103.50 Net Income 241.50 Dividends (Payout Ratio-20%) 48.30 Additions to Retained Earnings 193.20 Balance Sheet (in thousands) Year 2019 400 Accounts Payable 800 Long term debt Shareholders' Equity 1,200 Total Lia. & Eq. 200 720 280 1,200 Total Assets Below is the most recent financial information for Auster's Books Company. If the sales are expected to increase by 20% in 2020, what is the external financing need for this company? The assumptions for this question are as follows: (1) Auster's Books' costs on the income statement vary directly with sales (II) Auster's Books' asset accounts vary directly with sales (III) Auster's Books' accounts payable vary directly with sale (IV) The average tax rate is constant (V) Dividend payout ratio is constant (VI) No stocks will be issued or repurchased Year 2019 Current Assets Net Fixed Assets Income Statement (in thousands) Year 2019 Revenues 800.00 COGS 360.00 Depreciation 50.00 EBIT 390.00 Interest 45.00 Taxable income 345.00 Taxes (30%) 103.50 Net Income 241.50 Dividends (Payout Ratio-20%) 48.30 Additions to Retained Earnings 193.20 Balance Sheet (in thousands) Year 2019 400 Accounts Payable 800 Long term debt Shareholders' Equity 1,200 Total Lia. & Eq. 200 720 280 1,200 Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts