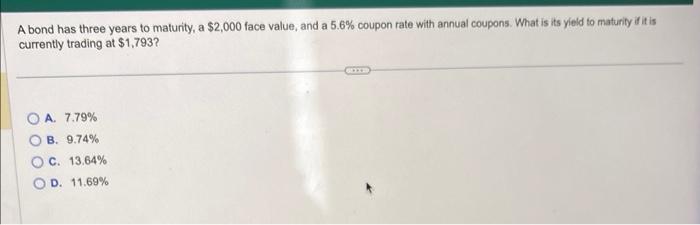

Question: PLEASE ASAP HELP WITH BOTH! I WILL RATE A bond has three years to maturity, a $2,000 face value, and a 5.6% coupon rate with

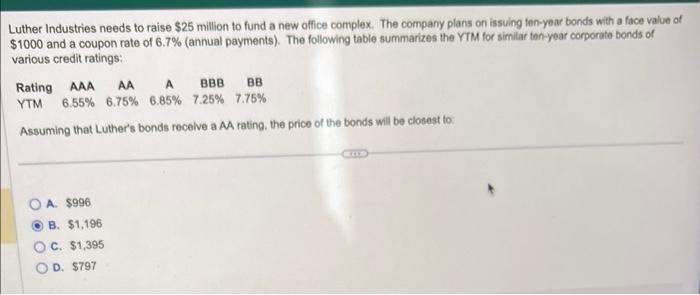

A bond has three years to maturity, a $2,000 face value, and a 5.6% coupon rate with annual coupons. What is its yield to maturity if it is currently trading at $1,793 ? A. 7.79% B. 9.74% C. 13.64% D. 11.69% Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1000 and a coupon rate of 6.7% (annual payments). The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings: Assuming that Luther's bonds recelve a AA rating, the price of the bonds will be closest to: A. $996 B. $1,196 C. $1,395 D. $797

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts