Question: please asnwer this question This is the complete question You only have to solve the first question 1. The beginning inventory of screws on Jan

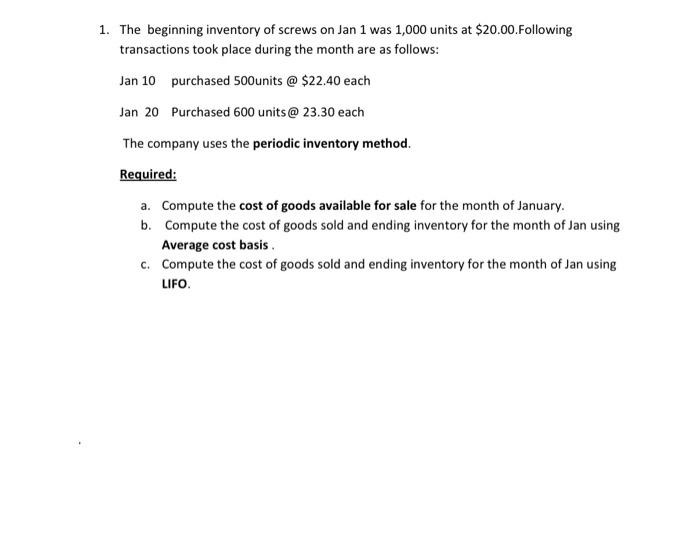

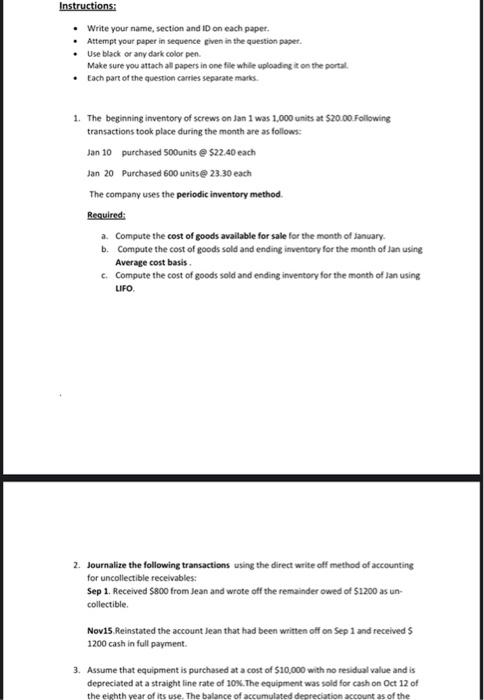

1. The beginning inventory of screws on Jan 1 was 1,000 units at $20.00.Following transactions took place during the month are as follows: Jan 10 purchased 500 units @ $22.40 each Jan 20 Purchased 600 units @ 23.30 each The company uses the periodic inventory method. Required: a. Compute the cost of goods available for sale for the month of January. b. Compute the cost of goods sold and ending inventory for the month of Jan using Average cost basis C. Compute the cost of goods sold and ending inventory for the month of Jan using LIFO. Instructions: Write your name, section and ID on each papet. Attempt your paper in sequence given in the question paper. Use black or any dark color pen Make sure you attach all papers in one file while uploading it on the portal Each part of the question carries separate marks 1. The beginning inventory of screws on Jan 1 was 1,000 units at $20.00. Following transactions took place during the month are as follows: Jan 10 purchased 500units @ $22.40 each Jan 20 Purchased 600 units 23.30 each The company uses the periodic inventory method. Required a compute the cost of goods available for sale for the month of January b. Compute the cost of goods sold and ending inventory for the month of Jan using Average cost basis Compute the cost of goods sold and ending inventory for the month of Jan using LIFO 2. Journalize the following transactions using the direct write off method of accounting for uncollectible receivables: Sep 1. Received $800 from Jean and wrote off the remainder owed of $1200 as un collectible Novis Reinstated the account Jean that had been written off on Sep 1 and received 1200 cash in full payment 3. Assume that equipment is purchased at a cost of $10,000 with no residual value and is depreciated at a straight fine rate of 10%. The equipment was sold for cash on Oct 12 of the eighth year of its use. The balance of accumulated depreciation account as of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts