Question: Please assis on this? QUESTION 4 ( 1 0 MARKS ) Note to student: Do not round off values too early in the calculations. Maintain

Please assis on this?

QUESTION

MARKS

Note to student:

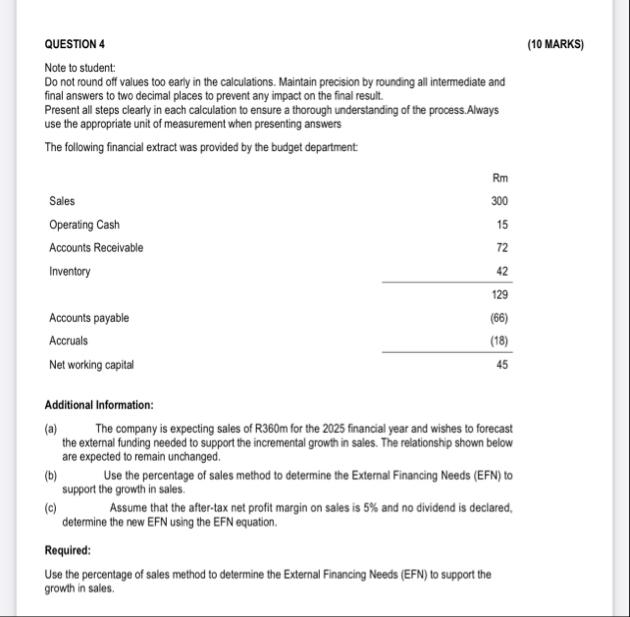

Do not round off values too early in the calculations. Maintain precision by rounding all intermediate and final answers to two decimal places to prevent any impact on the final result.

Present all steps clearly in each calculation to ensure a thorough understanding of the process.Always use the appropriate unit of measurement when presenting answers

The following financial extract was provided by the budget department:

tableRmSalesOperating Cash,Accounts Receivable,InventoryAccounts payable,AccrualsNet working capital,

Additional Information:

a The company is expecting sales of Rm for the financial year and wishes to forecast the external funding needed to support the incremental growth in sales. The relationship shown below are expected to remain unchanged.

b Use the percentage of sales method to determine the External Financing Needs EFN to support the growth in sales.

c Assume that the aftertax net profit margin on sales is and no dividend is declared, determine the new EFN using the EFN equation.

Required:

Use the percentage of sales method to determine the External Financing Needs EFN to support the growth in sales.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock