Question: Please assist me in determining what is wrong with this. I only received Partial Credit. A company must decide between scrapping or reworking units that

Please assist me in determining what is wrong with this. I only received Partial Credit.

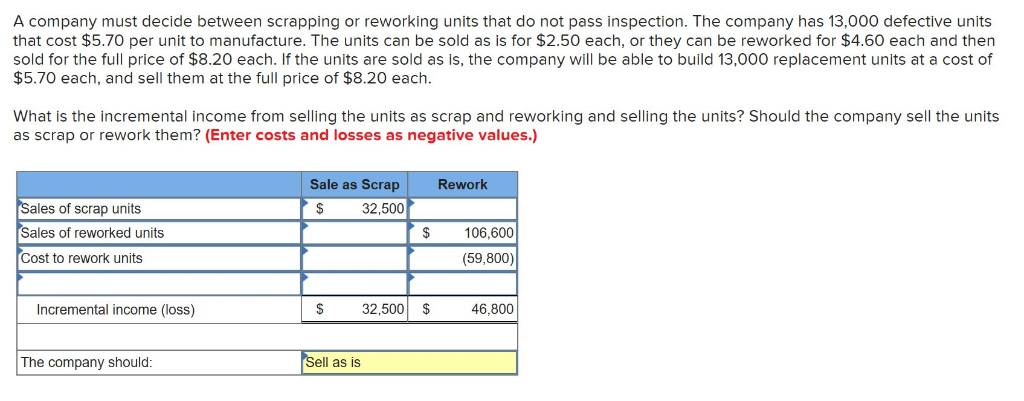

A company must decide between scrapping or reworking units that do not pass inspection. The company has 13,000 defective units that cost $5.70 per unit to manufacture. The units can be sold as is for $2.50 each, or they can be reworked for $4.60 each and then sold for the full price of $8.20 each. If the units are sold as is, the company will be able to build 13,000 replacement units at a cost of $5.70 each, and sell them at the full price of $8.20 each. What is the incremental income from selling the units as scrap and reworking and selling the units? Should the company sell the units as scrap or rework them? (Enter costs and losses as negative values.) Rework Sale as Scrap 32,500 ales of scrap units Sales of reworked units Cost to rework units $ 106,600 (59,800) 32,500 $ 46,800 Incremental income (loss) The company should ell as is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts