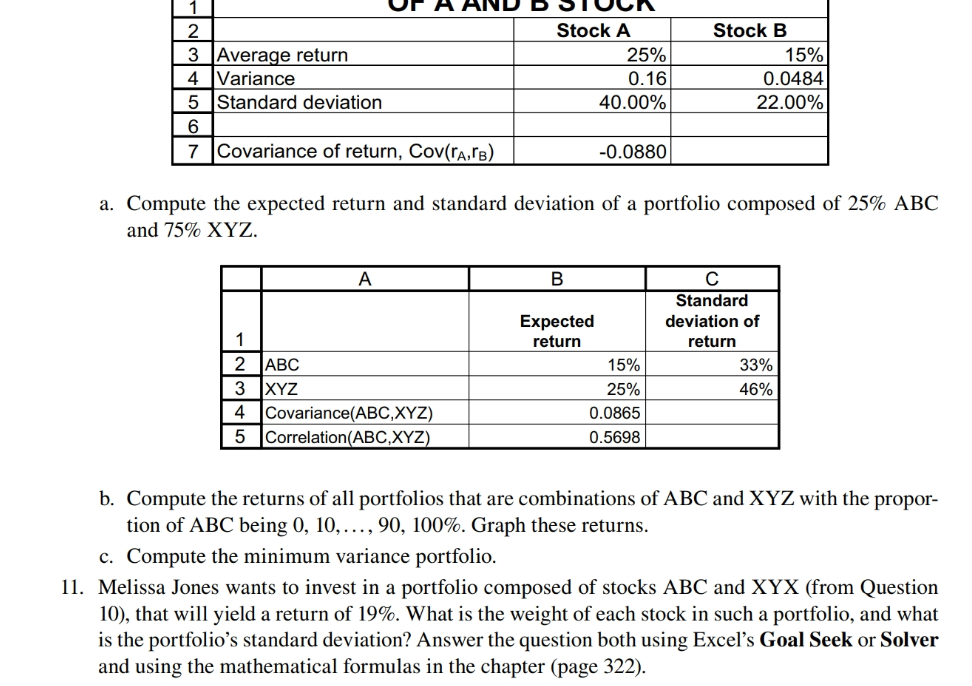

Question: Please assist. Please see screen shot for data points 2 3 4 5 6 7 Avera e return Variance Standard deviation Covariance of return, Stock

Please assist. Please see screen shot for data points

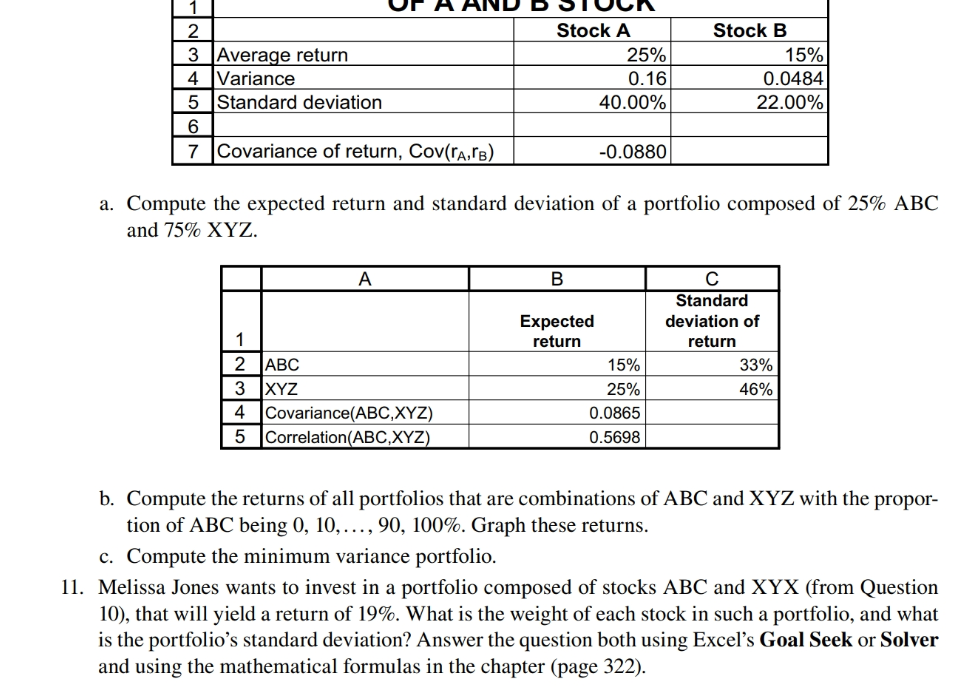

2 3 4 5 6 7 Avera e return Variance Standard deviation Covariance of return, Stock A 25% 0.16 40.00% -0.0880 Stock B 15% 0.0484 22.00% a. b. c. Compute the expected return and standard deviation of a portfolio composed of 25% ABC and XYZ. 2 3 4 5 ABC xyz Covariance(ABC,XYZ) Correlation ABC,XYZ Expected return 15% 25% 0.0865 0.5698 Standard deviation of return 33% Compute the returns of all portfolios that are combinations of ABC and XYZ with the propor- tion of ABC being O, 10, , 90, 100%. Graph these returns. Compute the minimum variance portfolio. II. Melissa Jones wants to invest in a portfolio composed of stocks ABC and XYX (from Question 10), that will yield a return of 19%. What is the weight of each stock in such a portfolio, and what is the portfolio's standard deviation? Answer the question both using Excel's Goal Seek or Solver and using the mathematical formulas in the chapter (page 322).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts