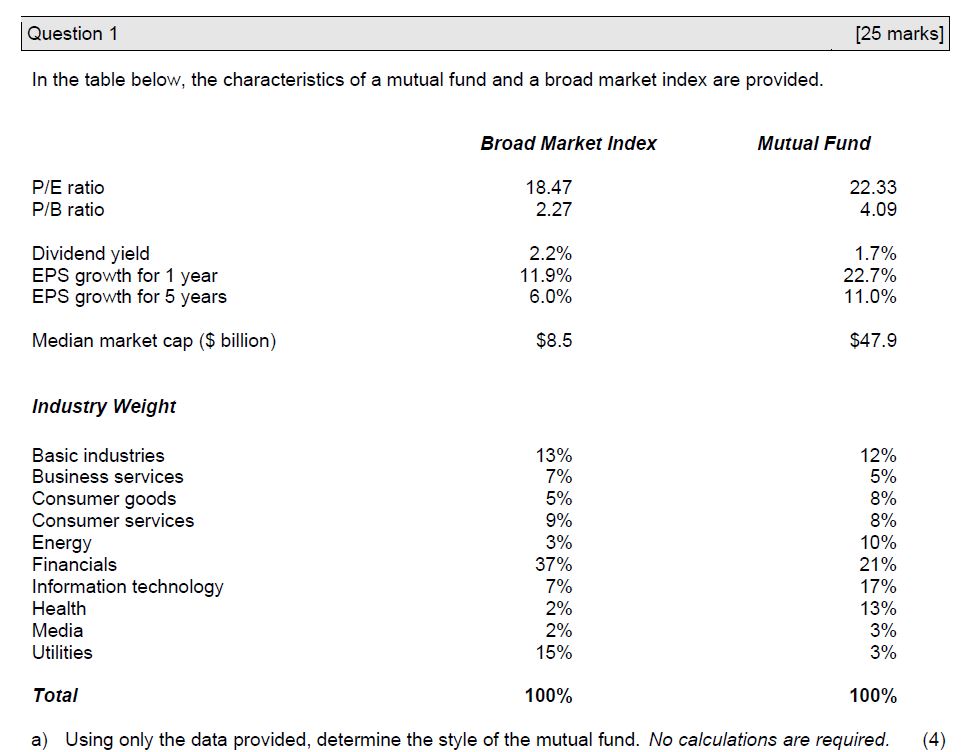

Question: Please assist Question 1 ln the table below, the characteristics of a mutual fund and a broad market index are provided. Broad Market In dex

Please assist

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock