Question: Please assist TUTORIAL LETTER 1 (ASSIGNMENT 1) - 2020 FIRST SEMAT101 FINANCIAL MANAGEMENT Question 4 (24) 4.1. The total risk of an asset is said

Please assist

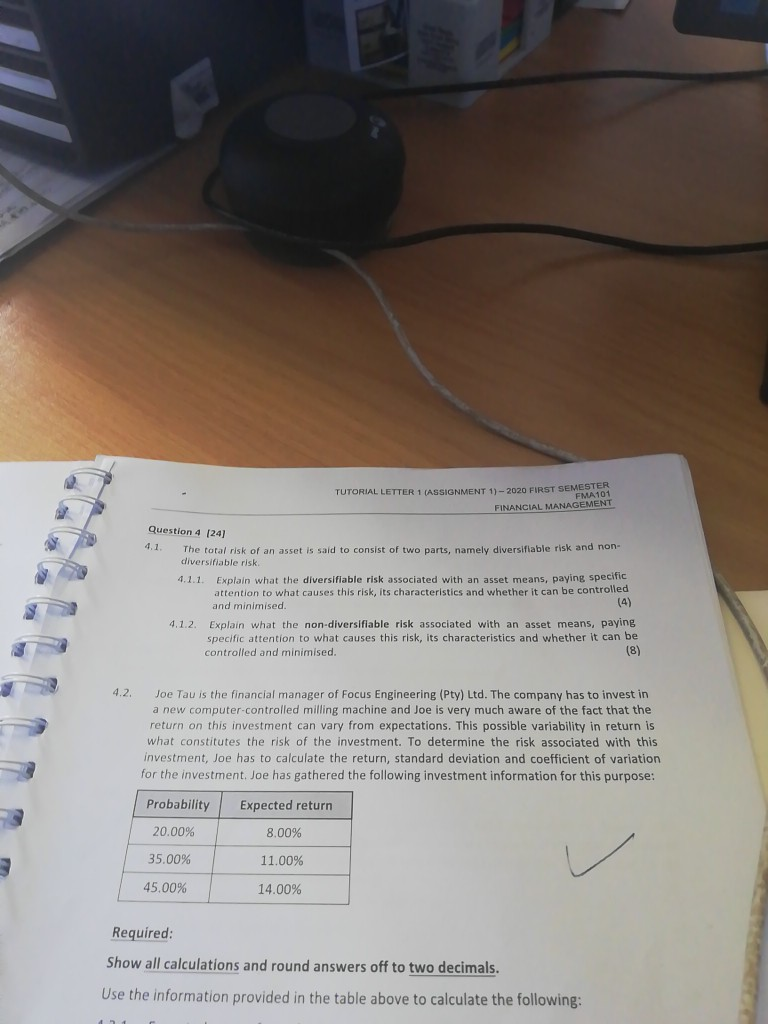

TUTORIAL LETTER 1 (ASSIGNMENT 1) - 2020 FIRST SEMAT101 FINANCIAL MANAGEMENT Question 4 (24) 4.1. The total risk of an asset is said to consist of two parts, namely diversifiable risk and non The total diversifiable risk 4.1.1. Explain what the diversifiable risk associated with an asset means, paying specific attention to what causes this risk, its characteristics and whether it can be controlled and minimised (4) 4.1.2. Explain what the non diversifiable risk associated with an asset means, paying Specific attention to what causes this risk, its characteristics and whether it can be controlled and minimised. (8) Joe Tau is the financial manager of Focus Engineering (Pty) Ltd. The company has to invest in a new computer-controlled milling machine and Joe is very much aware of the fact that the return on this investment can vary from expectations. This possible variability in return is what constitutes the risk of the investment. To determine the risk associated with this investment, Joe has to calculate the return, standard deviation and coefficient of variation for the investment, Joe has gathered the following investment information for this purpose: Probability Expected return 20.00% 8.00% 35.00% 11.00% 45.00% 14.00% Required: Show all calculations and round answers off to two decimals. Use the information provided in the table above to calculate the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts