Question: please assist using TVM solver 2. An employee plans on working and contributing to his retirement account monthly for 32 years and then plans to

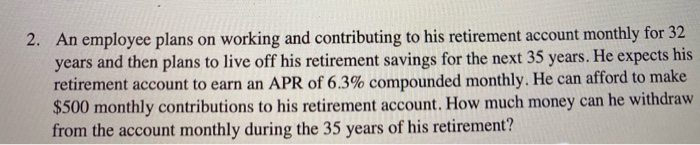

2. An employee plans on working and contributing to his retirement account monthly for 32 years and then plans to live off his retirement savings for the next 35 years. He expects his retirement account to earn an APR of 6.3% compounded monthly. He can afford to make $500 monthly contributions to his retirement account. How much money can he withdraw from the account monthly during the 35 years of his retirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts