Question: Please assist with question !g Please 4G. ... *018% D 00:19 The machinery was shipped tree-on-board on 31 January 2021, and delivered to the factory

Please assist with question !g

Please

Please

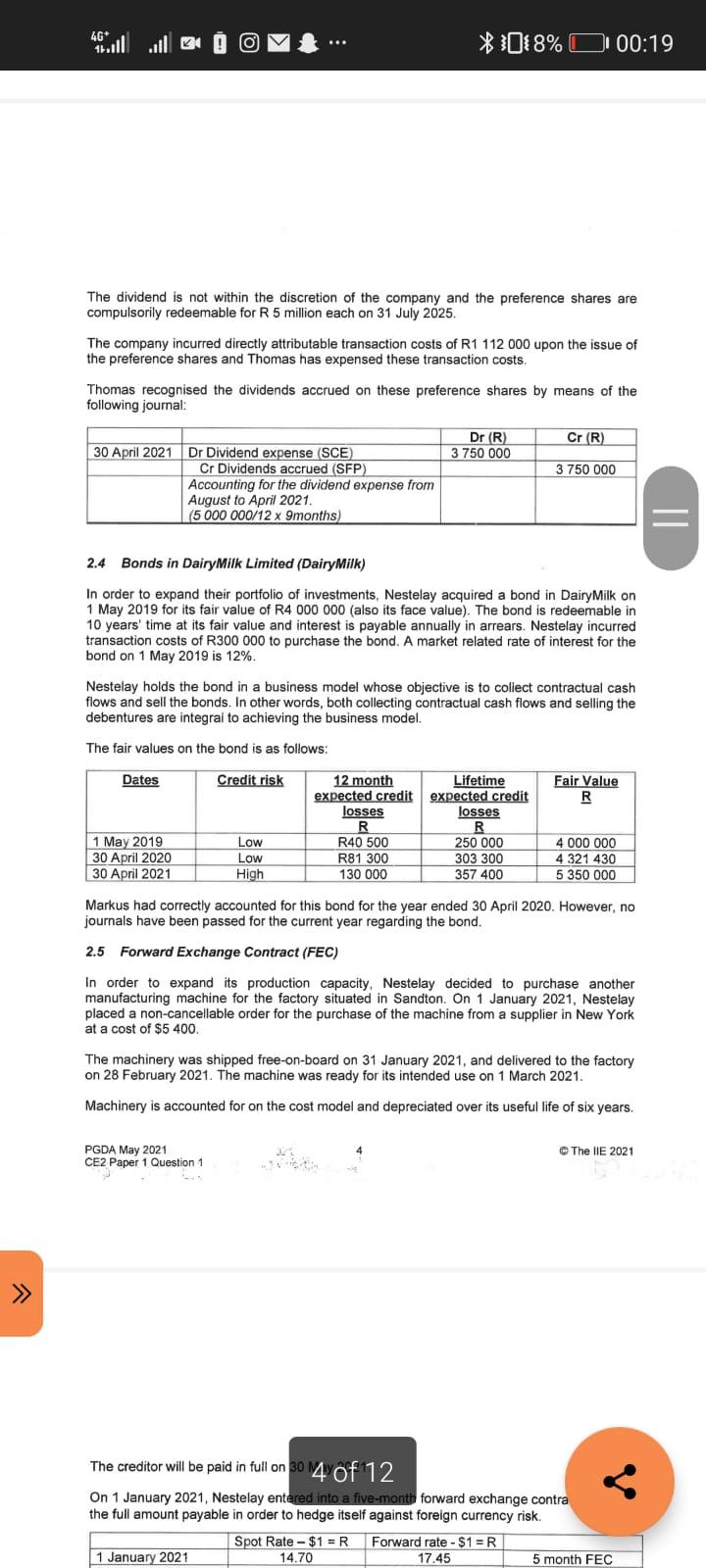

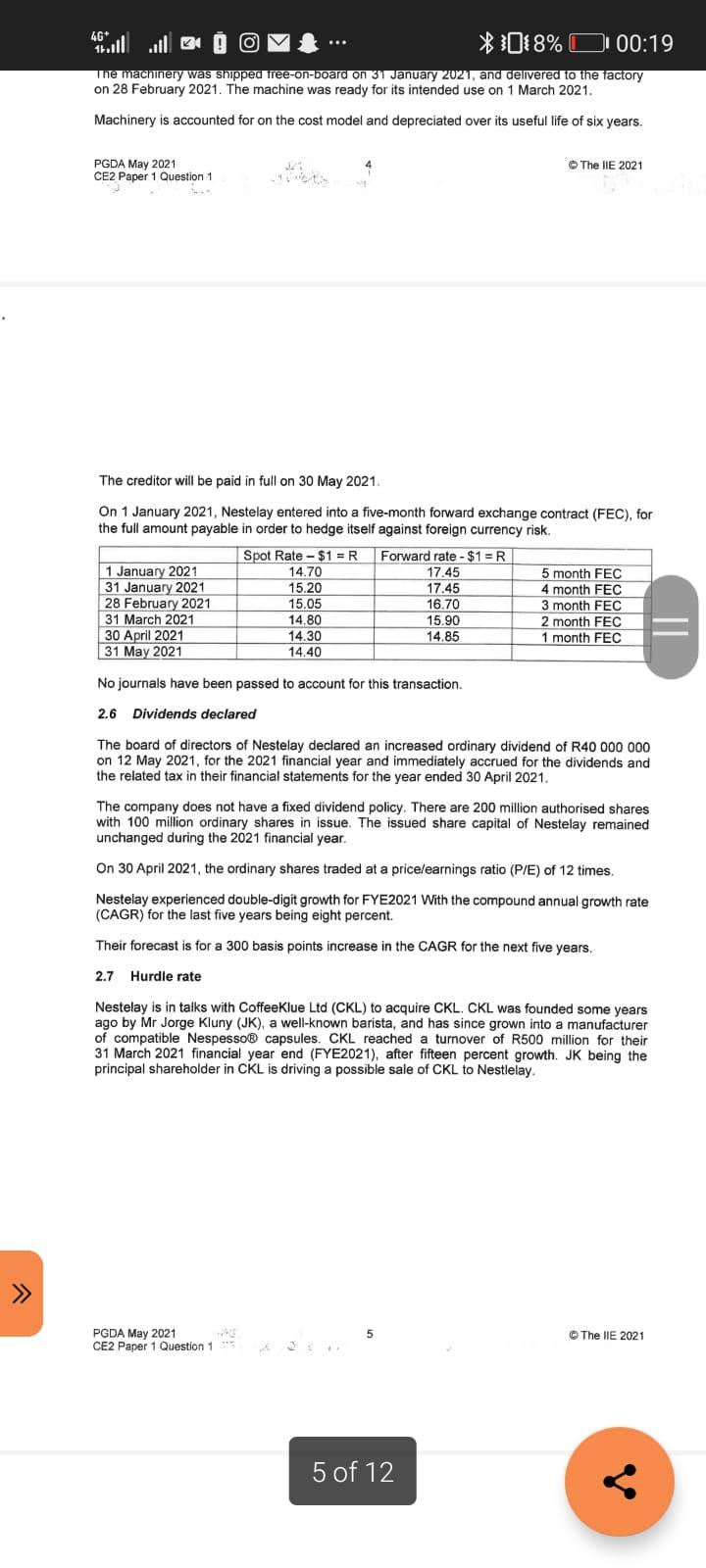

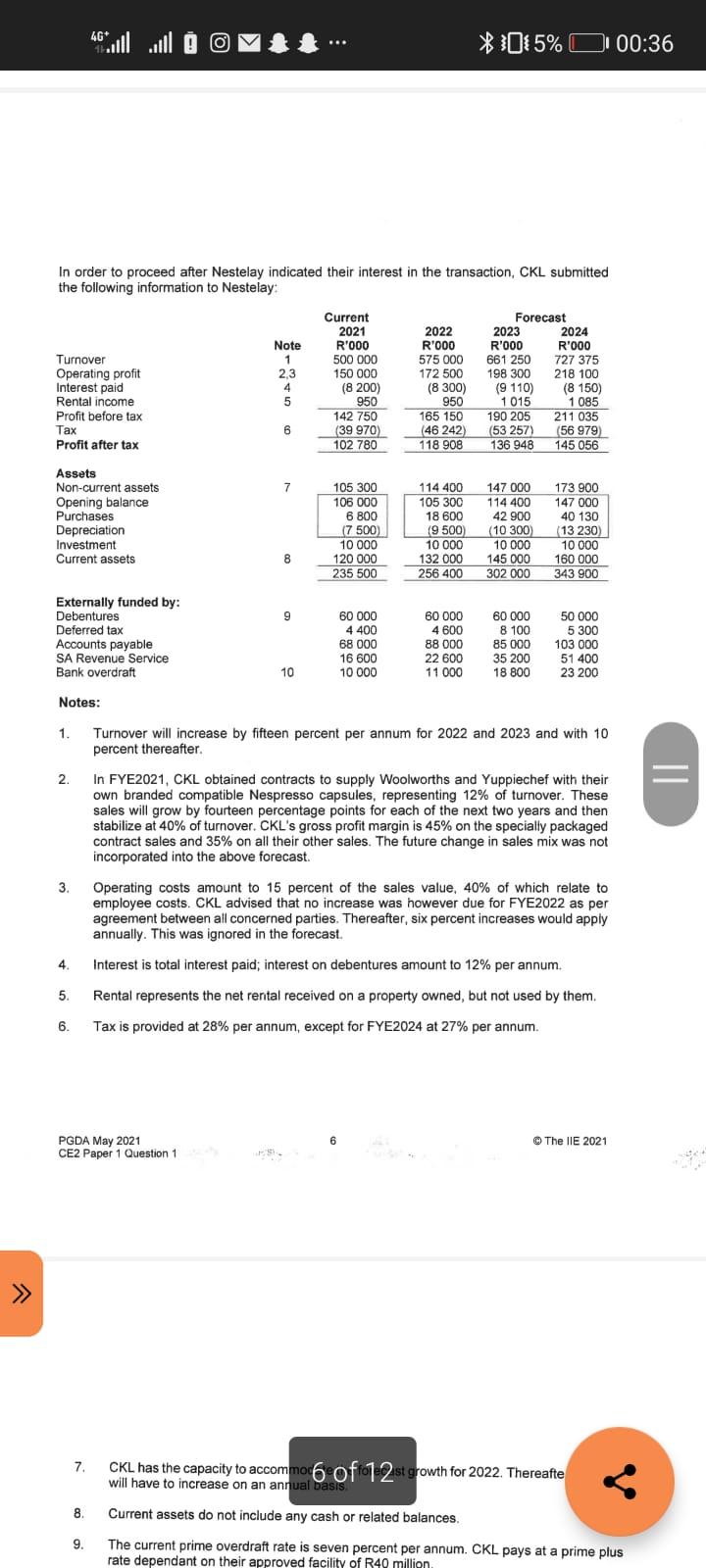

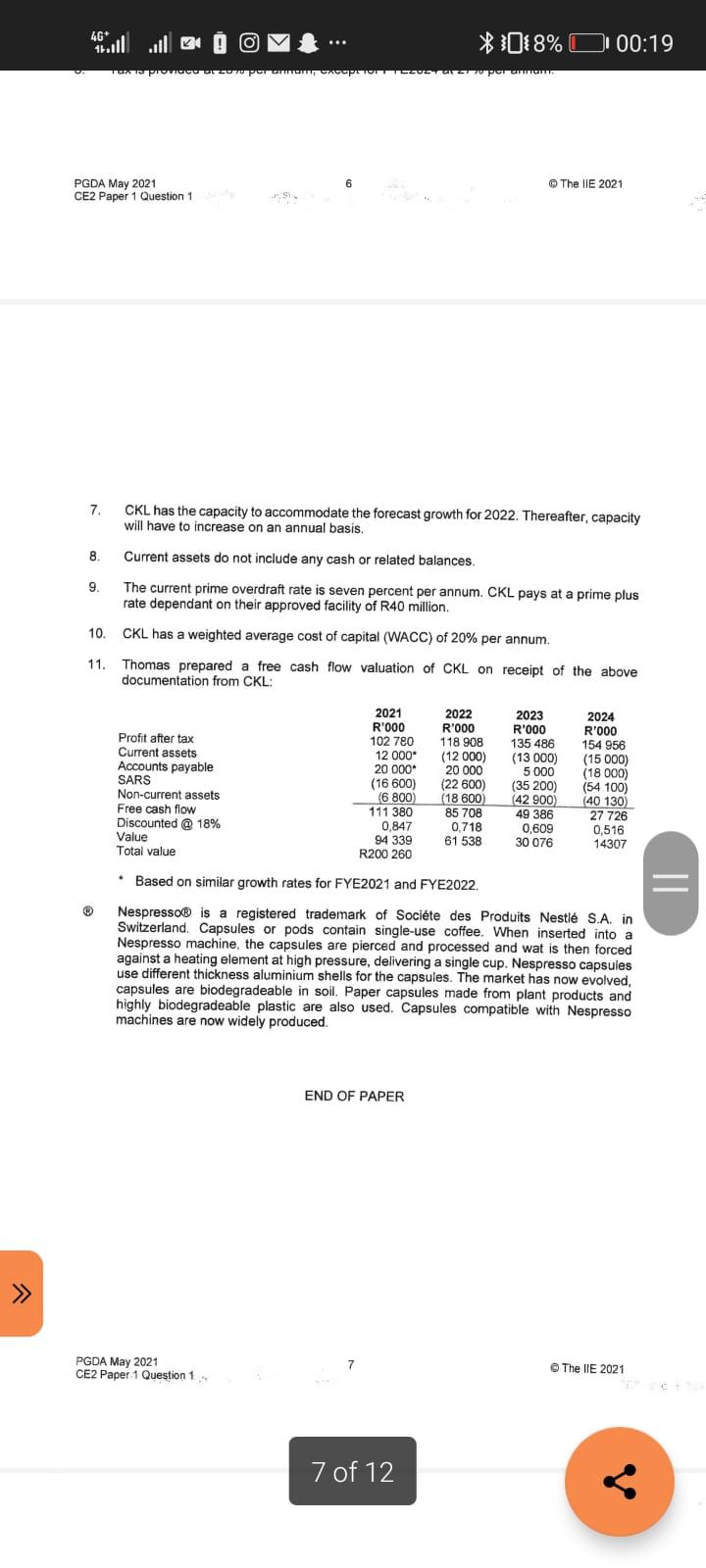

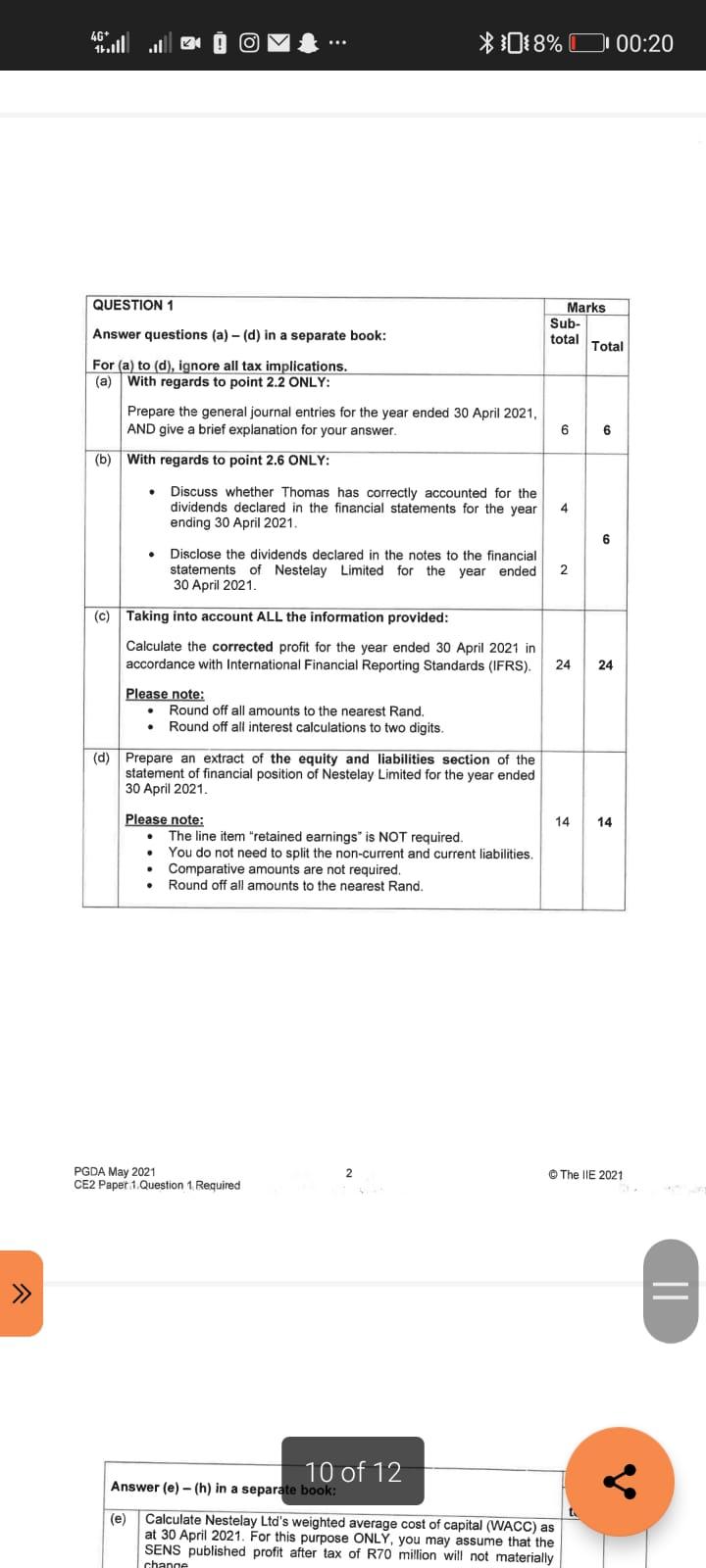

4G. ... *018% D 00:19 The machinery was shipped tree-on-board on 31 January 2021, and delivered to the factory on 28 February 2021. The machine was ready for its intended use on 1 March 2021. Machinery is accounted for on the cost model and depreciated over its useful life of six years. PGDA May 2021 CE2 Paper 1 Question 1 The lIE 2021 The creditor will be paid in full on 30 May 2021. On 1 January 2021, Nestelay entered into a five-month forward exchange contract (FEC), for the full amount payable in order to hedge itself against foreign currency risk. Spot Rate - $1 = R Forward rate - $1 =R 1 January 2021 14.70 17.45 5 month FEC 31 January 2021 15.20 17.45 4 month FEC 28 February 2021 15.05 16.70 3 month FEC 31 March 2021 14.80 15.90 2 month FEC 30 April 2021 14.30 14.85 1 month FEC 31 May 2021 14.40 No journals have been passed to account for this transaction. 2.6 Dividends declared The board of directors of Nestelay declared an increased ordinary dividend of R40 000 000 on 12 May 2021, for the 2021 financial year and immediately accrued for the dividends and the related tax in their financial statements for the year ended 30 April 2021. The company does not have a fixed dividend policy. There are 200 million authorised shares with 100 million ordinary shares in issue. The issued share capital of Nestelay remained unchanged during the 2021 financial year. On 30 April 2021, the ordinary shares traded at a pricelearnings ratio (P/E) of 12 times. Nestelay experienced double-digit growth for FYE2021 With the compound annual growth rate (CAGR) for the last five years being eight percent. Their forecast is for a 300 basis points increase in the CAGR for the next five years. . 2.7 Hurdle rate Nestelay is in talks with CoffeeKlue Ltd (CKL) to acquire CKL. CKL was founded some years ago by Mr Jorge Kluny (JK), a well-known barista, and has since grown into a manufacturer of compatible Nespesso capsules. CKL reached a turnover of R500 million for their 31 March 2021 financial year end (FYE2021), after fifteen percent growth. JK being the principal shareholder in CRL is driving a possible sale of CKL to Nestlelay. PGDA May 2021 CE2 Paper 1 Question 1 : 5 The IIE 2021 5 of 12 @ ... *5% O 00:36 05 In order to proceed after Nestelay indicated their interest in the transaction, CKL submitted the following information to Nestelay: R'000 Turnover Operating profit Interest paid Rental income Profit before tax Tax Profit after tax Note 1 1 2,3 4 5 Current 2021 R'000 500 000 150 000 (8200) 950 142 750 (39 970) 102 780 2022 R'000 575 000 172 500 (8 300) 950 165 150 (46 242) 118 908 Forecast 2023 2024 R'000 661 250 727 375 198 300 218 100 (9 110) (8 150) 1 015 1 085 190 205 211 035 (53 257) 56 979) 136 948 145 056 6 7 Assets Non-current assets Opening balance Purchases Depreciation Investment Current assets 105 300 106 000 6 800 17 500 10 000 120 000 235 500 114 400 105 300 18 600 (9 500) 10 000 132 000 256 400 147 000 173 900 114 400 147 000 42 900 40 130 (10 300 (13230) 10 000 10 000 145 000 160 000 302 000 343 900 8 8 9 Externally funded by: Debentures Deferred tax Accounts payable SA Revenue Service Bank overdraft 60 000 4 400 68 000 16 600 10 000 60 000 4 600 88 000 22 600 11 000 60 000 8 100 85 000 35 200 18 800 50 000 5 300 103 000 51 400 23 200 10 Notes: 1. Turnover will increase by fifteen percent per annum for 2022 and 2023 and with 10 percent thereafter. 2. II In FYE2021, CKL obtained contracts to supply Woolworths and Yuppiechef with their own branded compatible Nespresso capsules, representing 12% of turnover. These sales will grow by fourteen percentage points for each of the next two years and then stabilize at 40% of turnover. CKL's gross profit margin is 45% on the specially packaged contract sales and 35% on all their other sates. The future change in sales mix was not incorporated into the above forecast. Operating costs amount to 15 percent of the sales value, 40% of which relate to employee costs. CKL advised that no increase was however due for FYE2022 as per agreement between all concerned parties. Thereafter, six percent increases would apply annually. This was ignored in the forecast 3. 4 4. Interest is total interest paid; interest on debentures amount to 12% per annum. 5. Rental represents the net rental received on a property owned, but not used by them. 6. Tax is provided at 28% per annum, except for FYE2024 at 27% per annum. 6 The IIE 2021 PGDA May 2021 CE2 Paper 1 Question 1 >> 7. CKL has the capacity to accommo6 of 12 st growth for 2022. Thereafte will have to increase on an annual basis 8. Current assets do not include any cash or related balances. The current prime overdraft rate is seven percent per annum. CKL pays at a prime plus rate dependant on their approved facility of R40 million 9. s@ ( 4G ... *018% O 00:19 - 6 The IE 2021 PGDA May 2021 CE2 Paper 1 Question 1 -5 7. CKL has the capacity to accommodate the forecast growth for 2022. Thereafter, capacity will have to increase on an annual basis. 8. 8. Current assets do not include any cash or related balances 9. 9 The current prime overdraft rate is seven percent per annum. CKL pays at a prime plus rate dependant on their approved facility of R40 million. 10. CKL has a weighted average cost of capital (WACC) of 20% per annum 11. Thomas prepared a free cash flow valuation of CKL on receipt of the above documentation from CKL: : Profit after tax Current assets Accounts payable SARS Non-current assets Free cash flow Discounted @ 18% Value Total value 2021 R'000 102 7e0 12 000 20 000 (16 600) 6 800 111 380 0,847 94 339 R200 260 2022 R'000 118 908 (12 000) 20 000 (22 600) (18 600 85 708 0.718 61 538 2023 R'000 135 486 (13 000) 5 000 (35 200) (42 900) 49 386 0,609 30 076 2024 R'000 154 956 (15 000) (18 000) (54 100) 40 130) 27 726 0,516 14307 Based on similar growth rates for FYE2021 and FYE2022. Nespresso is a registered trademark of Socite des Produits Nestl S.A. in Switzerland. Capsules or pods contain single-use coffee. When inserted into a Nespresso machine, the capsules are pierced and processed and wat is then forced against a heating element at high pressure, delivering a single cup. Nespresso capsules use different thickness aluminium shells for the capsules. The market has now evolved, capsules are biodegradeable in soil. Paper capsules made from plant products and highly biodegradeable plastic are also used. Capsules compatible with Nespresso machines are now widely produced. END OF PAPER PGDA May 2021 CE2 Paper 1 Question 1 7 The IIE 2021 7 of 12 @ ... *018% O 00:20 QUESTION 1 Answer questions (a)-(d) in a separate book: Marks Sub- total Total For (a) to (d), ignore all tax implications. (a) With regards to point 2.2 ONLY: Prepare the general journal entries for the year ended 30 April 2021, AND give a brief explanation for your answer. (b) With regards to point 2.6 ONLY: 66 . Discuss whether Thomas has correctly accounted for the dividends declared in the financial statements for the year ending 30 April 2021. 4 6 6 Disclose the dividends declared in the notes to the financial statements of Nestelay Limited for the year ended 30 April 2021. 2 24 24 (c) Taking into account ALL the information provided: Calculate the corrected profit for the year ended 30 April 2021 in accordance with International Financial Reporting Standards (IFRS). Please note: Round off all amounts to the nearest Rand, Round off all interest calculations to two digits . (d) Prepare an extract of the equity and liabilities section of the statement of financial position of Nestelay Limited for the year ended 30 April 2021. 14 14 Please note: The line item "retained earnings is NOT required. You do not need to split the non-current and current liabilities. Comparative amounts are not required. Round off all amounts to the nearest Rand. . PGDA May 2021 CE2 Paper 1 Question 1 Required 2 The IIE 2021 >> = 10 of 12 Answer (e)-(h) in a separate book: (e) Calculate Nestelay Ltd's weighted average cost of capital (WACC) as at 30 April 2021. For this purpose ONLY, you may assume that the SENS published profit after tax of R70 million will not materially chance 4G. ... *018% D 00:19 The machinery was shipped tree-on-board on 31 January 2021, and delivered to the factory on 28 February 2021. The machine was ready for its intended use on 1 March 2021. Machinery is accounted for on the cost model and depreciated over its useful life of six years. PGDA May 2021 CE2 Paper 1 Question 1 The lIE 2021 The creditor will be paid in full on 30 May 2021. On 1 January 2021, Nestelay entered into a five-month forward exchange contract (FEC), for the full amount payable in order to hedge itself against foreign currency risk. Spot Rate - $1 = R Forward rate - $1 =R 1 January 2021 14.70 17.45 5 month FEC 31 January 2021 15.20 17.45 4 month FEC 28 February 2021 15.05 16.70 3 month FEC 31 March 2021 14.80 15.90 2 month FEC 30 April 2021 14.30 14.85 1 month FEC 31 May 2021 14.40 No journals have been passed to account for this transaction. 2.6 Dividends declared The board of directors of Nestelay declared an increased ordinary dividend of R40 000 000 on 12 May 2021, for the 2021 financial year and immediately accrued for the dividends and the related tax in their financial statements for the year ended 30 April 2021. The company does not have a fixed dividend policy. There are 200 million authorised shares with 100 million ordinary shares in issue. The issued share capital of Nestelay remained unchanged during the 2021 financial year. On 30 April 2021, the ordinary shares traded at a pricelearnings ratio (P/E) of 12 times. Nestelay experienced double-digit growth for FYE2021 With the compound annual growth rate (CAGR) for the last five years being eight percent. Their forecast is for a 300 basis points increase in the CAGR for the next five years. . 2.7 Hurdle rate Nestelay is in talks with CoffeeKlue Ltd (CKL) to acquire CKL. CKL was founded some years ago by Mr Jorge Kluny (JK), a well-known barista, and has since grown into a manufacturer of compatible Nespesso capsules. CKL reached a turnover of R500 million for their 31 March 2021 financial year end (FYE2021), after fifteen percent growth. JK being the principal shareholder in CRL is driving a possible sale of CKL to Nestlelay. PGDA May 2021 CE2 Paper 1 Question 1 : 5 The IIE 2021 5 of 12 @ ... *5% O 00:36 05 In order to proceed after Nestelay indicated their interest in the transaction, CKL submitted the following information to Nestelay: R'000 Turnover Operating profit Interest paid Rental income Profit before tax Tax Profit after tax Note 1 1 2,3 4 5 Current 2021 R'000 500 000 150 000 (8200) 950 142 750 (39 970) 102 780 2022 R'000 575 000 172 500 (8 300) 950 165 150 (46 242) 118 908 Forecast 2023 2024 R'000 661 250 727 375 198 300 218 100 (9 110) (8 150) 1 015 1 085 190 205 211 035 (53 257) 56 979) 136 948 145 056 6 7 Assets Non-current assets Opening balance Purchases Depreciation Investment Current assets 105 300 106 000 6 800 17 500 10 000 120 000 235 500 114 400 105 300 18 600 (9 500) 10 000 132 000 256 400 147 000 173 900 114 400 147 000 42 900 40 130 (10 300 (13230) 10 000 10 000 145 000 160 000 302 000 343 900 8 8 9 Externally funded by: Debentures Deferred tax Accounts payable SA Revenue Service Bank overdraft 60 000 4 400 68 000 16 600 10 000 60 000 4 600 88 000 22 600 11 000 60 000 8 100 85 000 35 200 18 800 50 000 5 300 103 000 51 400 23 200 10 Notes: 1. Turnover will increase by fifteen percent per annum for 2022 and 2023 and with 10 percent thereafter. 2. II In FYE2021, CKL obtained contracts to supply Woolworths and Yuppiechef with their own branded compatible Nespresso capsules, representing 12% of turnover. These sales will grow by fourteen percentage points for each of the next two years and then stabilize at 40% of turnover. CKL's gross profit margin is 45% on the specially packaged contract sales and 35% on all their other sates. The future change in sales mix was not incorporated into the above forecast. Operating costs amount to 15 percent of the sales value, 40% of which relate to employee costs. CKL advised that no increase was however due for FYE2022 as per agreement between all concerned parties. Thereafter, six percent increases would apply annually. This was ignored in the forecast 3. 4 4. Interest is total interest paid; interest on debentures amount to 12% per annum. 5. Rental represents the net rental received on a property owned, but not used by them. 6. Tax is provided at 28% per annum, except for FYE2024 at 27% per annum. 6 The IIE 2021 PGDA May 2021 CE2 Paper 1 Question 1 >> 7. CKL has the capacity to accommo6 of 12 st growth for 2022. Thereafte will have to increase on an annual basis 8. Current assets do not include any cash or related balances. The current prime overdraft rate is seven percent per annum. CKL pays at a prime plus rate dependant on their approved facility of R40 million 9. s@ ( 4G ... *018% O 00:19 - 6 The IE 2021 PGDA May 2021 CE2 Paper 1 Question 1 -5 7. CKL has the capacity to accommodate the forecast growth for 2022. Thereafter, capacity will have to increase on an annual basis. 8. 8. Current assets do not include any cash or related balances 9. 9 The current prime overdraft rate is seven percent per annum. CKL pays at a prime plus rate dependant on their approved facility of R40 million. 10. CKL has a weighted average cost of capital (WACC) of 20% per annum 11. Thomas prepared a free cash flow valuation of CKL on receipt of the above documentation from CKL: : Profit after tax Current assets Accounts payable SARS Non-current assets Free cash flow Discounted @ 18% Value Total value 2021 R'000 102 7e0 12 000 20 000 (16 600) 6 800 111 380 0,847 94 339 R200 260 2022 R'000 118 908 (12 000) 20 000 (22 600) (18 600 85 708 0.718 61 538 2023 R'000 135 486 (13 000) 5 000 (35 200) (42 900) 49 386 0,609 30 076 2024 R'000 154 956 (15 000) (18 000) (54 100) 40 130) 27 726 0,516 14307 Based on similar growth rates for FYE2021 and FYE2022. Nespresso is a registered trademark of Socite des Produits Nestl S.A. in Switzerland. Capsules or pods contain single-use coffee. When inserted into a Nespresso machine, the capsules are pierced and processed and wat is then forced against a heating element at high pressure, delivering a single cup. Nespresso capsules use different thickness aluminium shells for the capsules. The market has now evolved, capsules are biodegradeable in soil. Paper capsules made from plant products and highly biodegradeable plastic are also used. Capsules compatible with Nespresso machines are now widely produced. END OF PAPER PGDA May 2021 CE2 Paper 1 Question 1 7 The IIE 2021 7 of 12 @ ... *018% O 00:20 QUESTION 1 Answer questions (a)-(d) in a separate book: Marks Sub- total Total For (a) to (d), ignore all tax implications. (a) With regards to point 2.2 ONLY: Prepare the general journal entries for the year ended 30 April 2021, AND give a brief explanation for your answer. (b) With regards to point 2.6 ONLY: 66 . Discuss whether Thomas has correctly accounted for the dividends declared in the financial statements for the year ending 30 April 2021. 4 6 6 Disclose the dividends declared in the notes to the financial statements of Nestelay Limited for the year ended 30 April 2021. 2 24 24 (c) Taking into account ALL the information provided: Calculate the corrected profit for the year ended 30 April 2021 in accordance with International Financial Reporting Standards (IFRS). Please note: Round off all amounts to the nearest Rand, Round off all interest calculations to two digits . (d) Prepare an extract of the equity and liabilities section of the statement of financial position of Nestelay Limited for the year ended 30 April 2021. 14 14 Please note: The line item "retained earnings is NOT required. You do not need to split the non-current and current liabilities. Comparative amounts are not required. Round off all amounts to the nearest Rand. . PGDA May 2021 CE2 Paper 1 Question 1 Required 2 The IIE 2021 >> = 10 of 12 Answer (e)-(h) in a separate book: (e) Calculate Nestelay Ltd's weighted average cost of capital (WACC) as at 30 April 2021. For this purpose ONLY, you may assume that the SENS published profit after tax of R70 million will not materially chance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts