Question: Please assist with questions 2 & 3 Alternative Inventory Methods Frate Company was formed on December 1, 2015, and uses the periodic inventory system. The

Please assist with questions 2 & 3

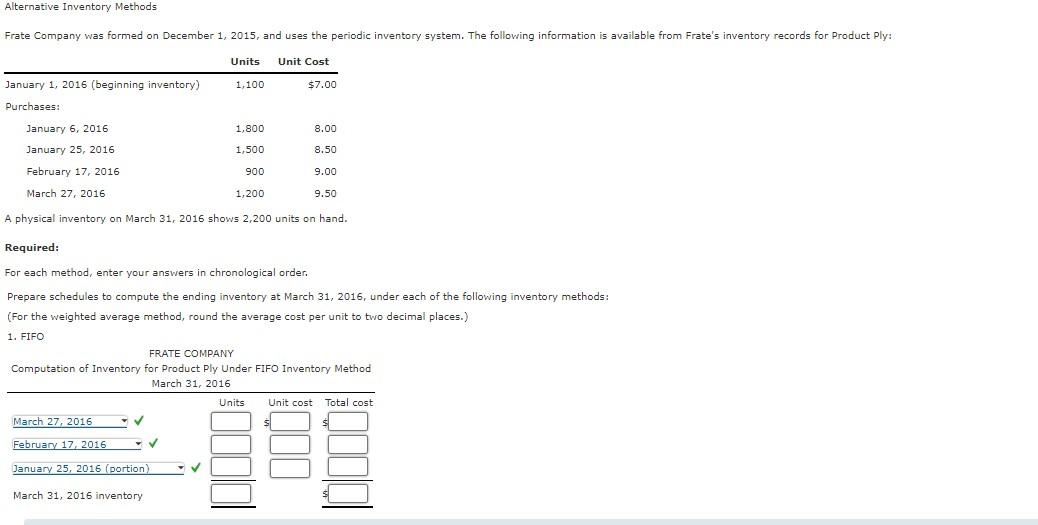

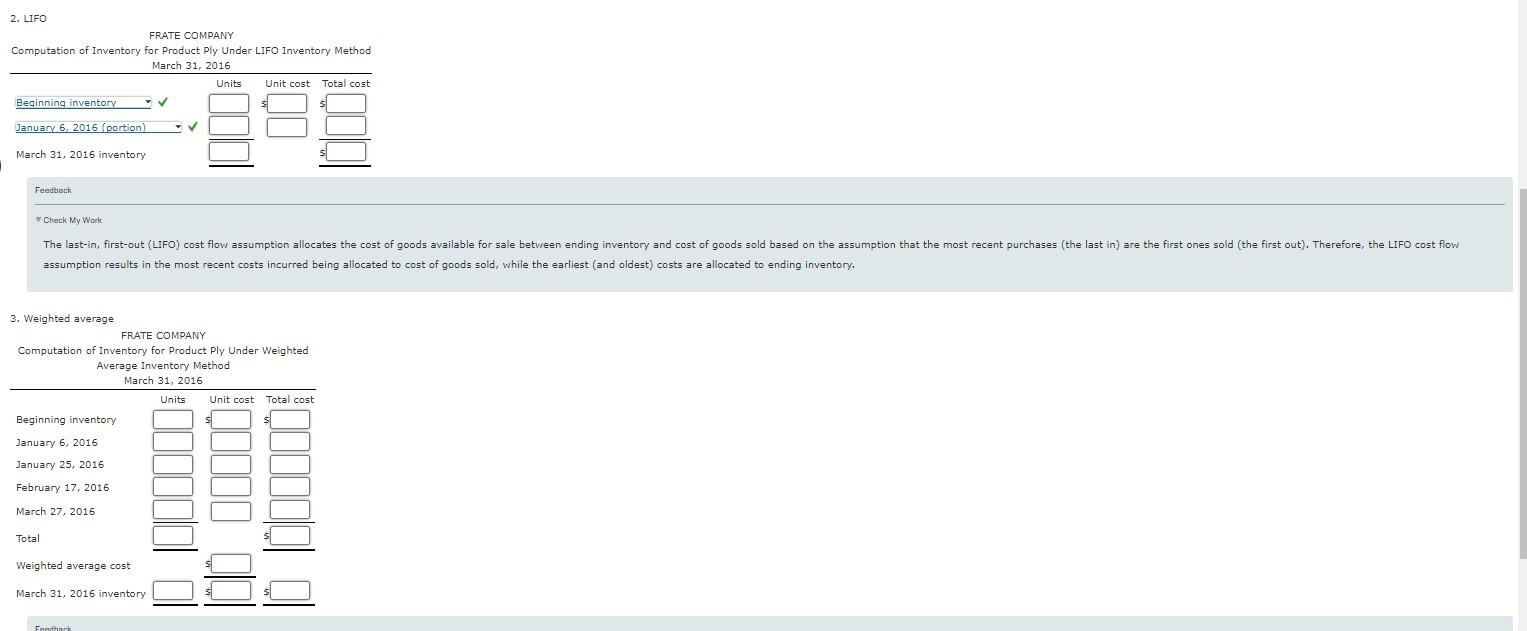

Alternative Inventory Methods Frate Company was formed on December 1, 2015, and uses the periodic inventory system. The following information is available from Frate's inventory records for Product Ply: Units Unit Cost January 1, 2016 (beginning inventory) Purchases: 1,100 January 6, 2016 January 25, 2016 February 17, 2016 9.00 March 27, 2016 9.50 A physical inventory on March 31, 2016 shows 2,200 units on hand. 1,800 1,500 900 1,200 March 27, 2016 B February 17, 2016 January 25, 2016 (portion) March 31, 2016 inventory $7.00 Required: For each method, enter your answers in chronological order. Prepare schedules to compute the ending inventory at March 31, 2016, under each of the following inventory methods: (For the weighted average method, round the average cost per unit to two decimal places.) 1. FIFO 8.00 8.50 FRATE COMPANY Computation of Inventory for Product Ply Under FIFO Inventory Method March 31, 2016 Units Unit cost Total cost 2. LIFO FRATE COMPANY Computation of Inventory for Product Ply Under LIFO Inventory Method March 31, 2016 Beginning inventory January 6, 2016 (portion) March 31, 2016 inventory Feedback Beginning inventory January 6, 2016 January 25, 2016 February 17, 2016 March 27, 2016 Total Check My Work The last-in, first-out (LIFO) cost flow assumption allocates the cost of goods available for sale between ending inventory and cost of goods sold based on the assumption that the most recent purchases (the last in) are the first ones sold (the first out). Therefore, the LIFO cost flow assumption results in the most recent costs incurred being allocated to cost of goods sold, while the earliest (and oldest) costs are allocated to ending inventory. 3. Weighted average FRATE COMPANY Computation of Inventory for Product Ply Under Weighted Average Inventory Method March 31, 2016 Units Weighted average cost March 31, 2016 inventory V Feedback Units Unit cost Total cost Unit cost. Total cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts