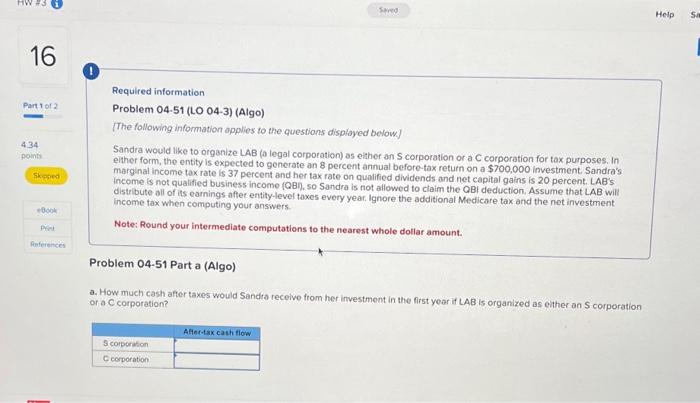

Question: please assist with tax 2 homework Problem 04.51 (LO 04-3) (Algo) [The following information applies to the questions displayed below] Sandra would like to organize

![following information applies to the questions displayed below] Sandra would like to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670106743e377_43567010673d509b.jpg)

Problem 04.51 (LO 04-3) (Algo) [The following information applies to the questions displayed below] Sandra would like to organize LAB (o legal corporation) as either an S corporation or a C corporation for tax purposes. In either form, the entity is expected to generate an 8 percent annual before-tax retum on a $700,000 investment. Sandra's marginal income tax rate is 37 percent and her tax rate on qualified dividends and net capital gains is 20 percent. LAB's income is not qualified business income (QB), so Sandra is not allowed to claim the QBI deduction, Assume that LAB will distribute all of its earnings after entity-level taxes every year. Ignore the additional Medicare tax and the net investment income tax when computing your answers. Note: Round your intermediate computations to the nearest whole dollar amount. Problem 04-51 Part a (Algo) a. How much cash after taxes would Sandra receive from her investment in the first year if LAB is organized as either an S corporation or a C corporation? Required information Problem 04-51 (LO 04-3) (Algo) The following information applies to the questions displayed below] Sandra would like to organize LAB (a legal corporation) as either an 5 corporation or a C corporation for tax purposes. In either form, the entity is expected to generate an 8 percent annual before-tax return on a $700,000 investment. Sandra's marginal income tax rate is 37 percent and her tax rate on qualified dividends and net capitol gains is 20 percent. LAB's income is not qualfied business income (CBP, so Sandra is not allowod to claim the QBi deduction. Assume that LAB will distribute all of its earnings after entity-level taxes every yeac, Ignore the additional Medicare tax and the net investment income tax when computing your answers. Note: Round your intermediate computations to the nearest whole dollar amount. Problem 04-51 Part b (Algo) b. What is the overall tax rate on LAB's income in the first year if LAB is organized as an $ corporation or as 3 C corporation? Note: Round your final answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts