Question: Please assist with the following question and break it down Page 401 CASE 9-2 International Lamp Company International Lamp Company (ILC). a US. taxpayer, manufactures

Please assist with the following question and break it down

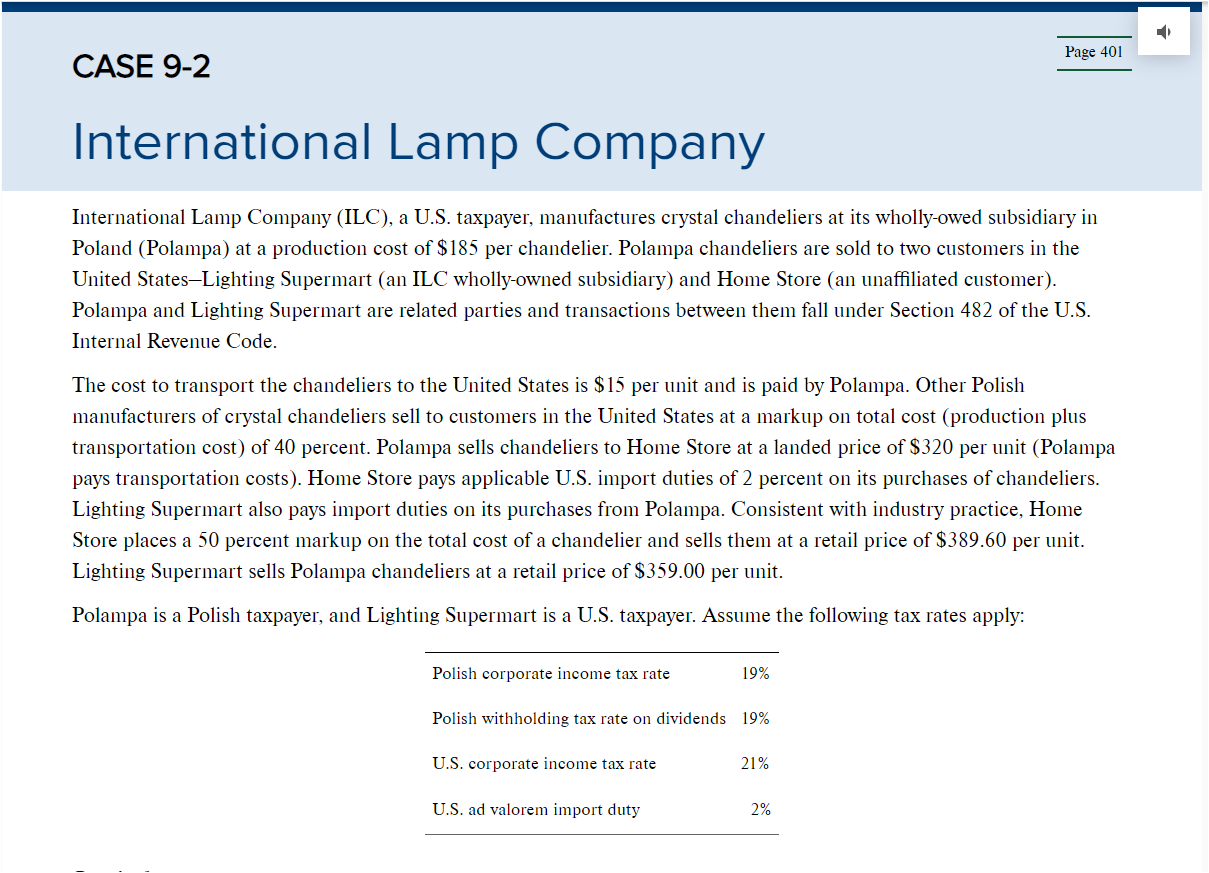

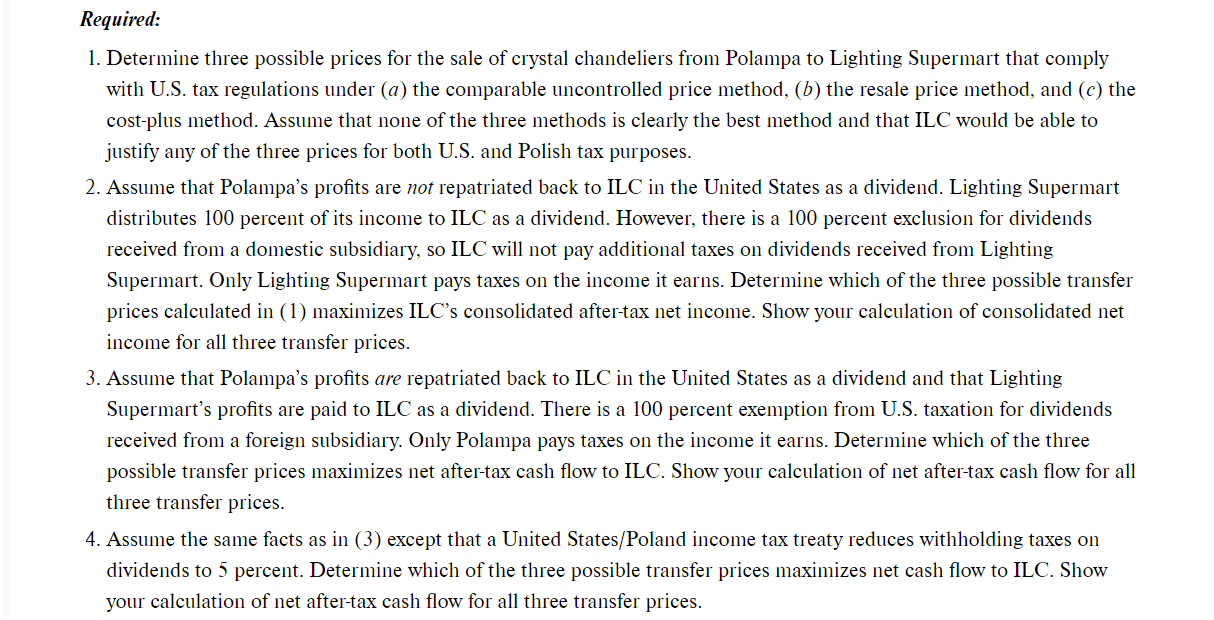

Page 401 CASE 9-2 International Lamp Company International Lamp Company (ILC). a US. taxpayer, manufactures crystal chandeliers at its whollycwed subsidialy in Poland (Polampa) at a production cost of $185 per chandelier. Polampa chandeliers are sold to two customers in the United StatesLighting Supermart (an lLC whollyowned subsidiary) and Home Store (an una'iliated customer). Polampa and Lighting Supermart are related parties and transactions between them fall under Section 482 of the US. Internal Revenue Code. The cost to transport the chandeliers to the United States is $15 per unit and is paid by Polampa. Other Polish manufacturers of crystal chandeliers sell to customers in the United States at a markup on total cost (production plus transportation cost) of 40 percent. Polampa sells chandeliers to Home Store at a landed price of $320 per unit (Polampa pays transportation costs). Home Store pays applicable US. import duties of 2 percent on its purchases of chandeliers. Lighting Supermart also pays import duties on its purchases from Polampa. Consistent with industly practice, Home Store places a 50 percent markup on the total cost of a chandelier and sells them at a retail price of $389.60 per unit. Lighting Supermart sells Polampa chandeliers at a retail price of $359.00 per unit. Polampa is a Polish taxpayer. and Lighting Supermart is a US. taxpayer. Assume the following tax rates apply: Polish corporate income tax rate 19% Polish Withholding tax rate on dividends 19% US. corporate income tax rate 21% US. ad valorem import duty 2% Required: 1. Determine three possible prices for the sale of elystal chandeliers from Polampa to Lighting Supermart that comply with US. tax regulations under (a) the comparable uncontrolled price method, (I?) the resale price method, and (c) the costplus method. Assume that none of the three methods is clearly the best method and that ILC would be able to justify any of the three prices for both US. and Polish tax purposes. 2. Assume that Polampa's prots are not repatriated back to ILC in the United States as a dividend. Lighting Supermart distributes 100 percent of its income to ILC as a dividend. However, there is a 100 percent exclusion for dividends received from a domestic subsidialy, so ILC will not pay additional taxes on dividends received from Lighting Supermart. Only Lighting Supermart pays taxes on the income it earns. Determine which of the three possible transfer prices calculated in (l) maximizes ILC's consolidated aftertax net income. Show your calculation of consolidated net income for all three transfer prices. 3. Assume that Polampa's prots are repatriated back to ILC in the United States as a dividend and that Lighting Supermalt's prots are paid to ILC as a dividend. There is a 100 percent exemption from US. taxation for dividends received from a foreign subsidialy. Only Polampa pays taxes on the income it earns. Determine which of the three possible transfer prices maximizes net aftertax cash ow to ILC. Show your calculation of net aftertax cash ow for all three transfer prices. 4. Assume the same facts as in (3) except that a United Statesf'Poland income tax treaty reduces withholding taxes on dividends to 5 percent. Determine which of the three possible transfer prices maximizes net cash ow to ILC. Show your calculation of net aftertax cash ow for all three transfer prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts