Question: please attach excel formula Challenge problem) The last 5 years' results for Niccair Corp. are given value the company's stock based on a model of

please attach excel formula

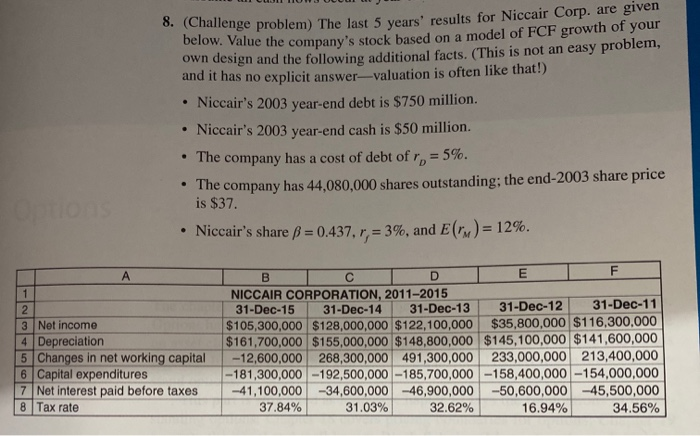

Challenge problem) The last 5 years' results for Niccair Corp. are given value the company's stock based on a model of FCF growth of your own design and the following additional facts. (This is not an easy problem, and it has no explicit answer-valuation is often like that!) Niccair's 2003 year-end debt is $750 million. Niccair's 2003 year-end cash is $50 million. The company has a cost of debt of r = 5%. The company has 44,080,000 shares outstanding: the end-2003 share price is $37. Niccair's share = 0.437. r;= 3%, and E(M)= 12%. 3 Net income 4 Depreciation 5 Changes in net working capital 6 Capital expenditures Z Net interest paid before taxes 8 Tax rate - B C D E F NICCAIR CORPORATION, 2011-2015 31-Dec-15 31-Dec-14 31-Dec-13 31-Dec-12 31-Dec-11 $105,300,000 $128,000,000 $122,100,000 $35,800,000 $116,300,000 $161,700,000 $155,000,000 $148,800,000 $145,100,000 $141,600,000 -12,600,000 268,300,000 491,300,000 233,000,000 213,400,000 -181,300,000 -192,500,000 -185,700,000 -158,400,000 -154,000,000 -41,100,000 -34,600,000 -46,900,000 -50,600,000 -45,500,000 37.84% 31.03% 32.62% 16.94% 34.56% Challenge problem) The last 5 years' results for Niccair Corp. are given value the company's stock based on a model of FCF growth of your own design and the following additional facts. (This is not an easy problem, and it has no explicit answer-valuation is often like that!) Niccair's 2003 year-end debt is $750 million. Niccair's 2003 year-end cash is $50 million. The company has a cost of debt of r = 5%. The company has 44,080,000 shares outstanding: the end-2003 share price is $37. Niccair's share = 0.437. r;= 3%, and E(M)= 12%. 3 Net income 4 Depreciation 5 Changes in net working capital 6 Capital expenditures Z Net interest paid before taxes 8 Tax rate - B C D E F NICCAIR CORPORATION, 2011-2015 31-Dec-15 31-Dec-14 31-Dec-13 31-Dec-12 31-Dec-11 $105,300,000 $128,000,000 $122,100,000 $35,800,000 $116,300,000 $161,700,000 $155,000,000 $148,800,000 $145,100,000 $141,600,000 -12,600,000 268,300,000 491,300,000 233,000,000 213,400,000 -181,300,000 -192,500,000 -185,700,000 -158,400,000 -154,000,000 -41,100,000 -34,600,000 -46,900,000 -50,600,000 -45,500,000 37.84% 31.03% 32.62% 16.94% 34.56%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts