Question: please attach feasible set below. thanks 2. Please answer the following 1719questions, provide your analysis. Also, please draw the feasible set when asset A and

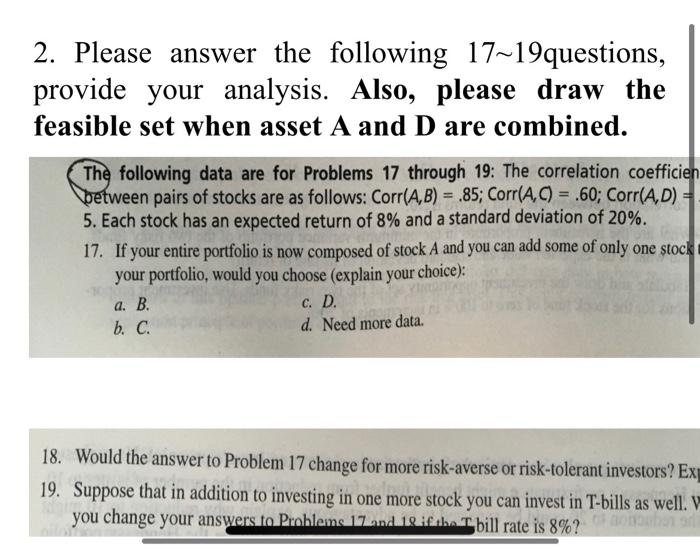

2. Please answer the following 1719questions, provide your analysis. Also, please draw the feasible set when asset A and D are combined. The following data are for Problems 17 through 19: The correlation coefficien between pairs of stocks are as follows: Corr(A,B) = .85; Corr(A,C) = .60; Corr(A,D) 5. Each stock has an expected return of 8% and a standard deviation of 20%. 17. If your entire portfolio is now composed of stock A and you can add some of only one stock your portfolio, would you choose (explain your choice): c. D. b. C. d. Need more data. a. B. 18. Would the answer to Problem 17 change for more risk-averse or risk-tolerant investors? Exy 19. Suppose that in addition to investing in one more stock you can invest in T-bills as well. V you change your answers to Problems and the bill rate is 8%? 2. Please answer the following 1719questions, provide your analysis. Also, please draw the feasible set when asset A and D are combined. The following data are for Problems 17 through 19: The correlation coefficien between pairs of stocks are as follows: Corr(A,B) = .85; Corr(A,C) = .60; Corr(A,D) 5. Each stock has an expected return of 8% and a standard deviation of 20%. 17. If your entire portfolio is now composed of stock A and you can add some of only one stock your portfolio, would you choose (explain your choice): c. D. b. C. d. Need more data. a. B. 18. Would the answer to Problem 17 change for more risk-averse or risk-tolerant investors? Exy 19. Suppose that in addition to investing in one more stock you can invest in T-bills as well. V you change your answers to Problems and the bill rate is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts