Question: Please attempt the question if you can solve all the questions, please do not attempt if you are going to solve only 1 part. i

Please attempt the question if you can solve all the questions, please do not attempt if you are going to solve only 1 part. i WILL DOWNVOTE AND REPORT IF 1 ANSWERED.

Calculate the NPV:

Year 0: ($10,000) Year 1: $6,500 Year 2: $1,500 Year 3: $3,500 Year 4: $4,300 Year 5: $1,000

Discount rate = 9%

Calculate the MIRR:

Year 0: ($10,000) Year 1: $6,500 Year 2: $1,500 Year 3: $3,500 Year 4: $4,300 Year 5: $1,000 Discount rate = 9%

Calculate the Profitability index:

Year 0: ($10,000) Year 1: $6,500 Year 2: $1,500 Year 3: $3,500 Year 4: $4,300 Year 5: $1,000 Discount rate = 9%

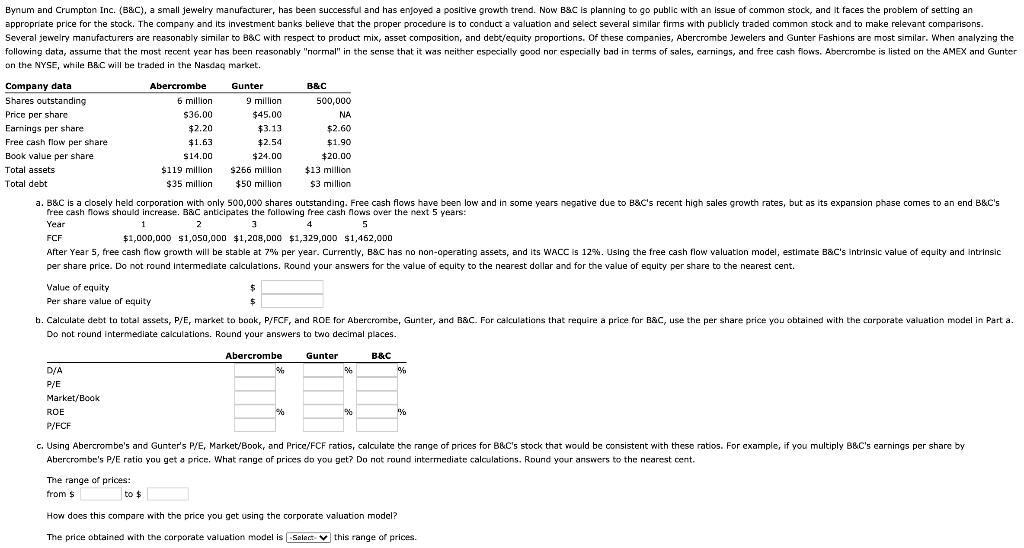

in the NYSE, while BaC will be traded in the Nasdaq market. free cash flows should increase. BQC anticipates the following free cash flows over the next 5 years: YearFCF1$1,000,0002$1,050,0003$1,208,0004$1,329,0005$1,462,000 b. Calculate debt to total assets, P/Er market to book, P/FCF, and ROE For Abercrombe, Do not round intermediate calculations. Round your answers to two decimal places. Do not round intermediate calculations. Round your answers to two decimal places. Abercrombe's P/E ratio you get a price. What range of prices do you get? Do not round intermediate calculations. Round your answers to the nearest cent. The range of prices: from \$ to $ How does this compare with the price you get using the corporate valuation model? The price obtained with the corporate valuation model is this range of prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts