Question: please B and C only ASAP Mini-Case D: (2 marks) Ellie is 30 years old and just started working for Microsoft. She is paid on

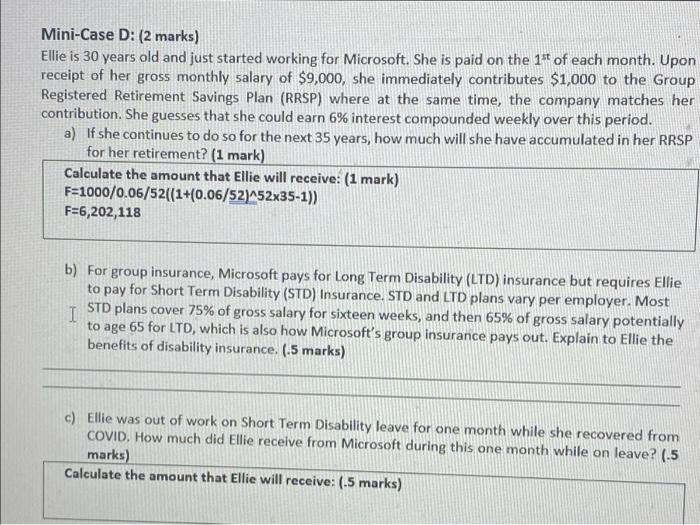

Mini-Case D: (2 marks) Ellie is 30 years old and just started working for Microsoft. She is paid on the 1st of each month. Upon receipt of her gross monthly salary of $9,000, she immediately contributes $1,000 to the Group Registered Retirement Savings Plan (RRSP) where at the same time, the company matches her contribution. She guesses that she could earn 6% interest compounded weekly over this period. a) If she continues to do so for the next 35 years, how much will she have accumulated in her RRSP for her retirement? (1 mark) Calculate the amount that Ellie will receive: (1 mark) F=1000/0.06/52((1+(0.06/52)^52x35-1)) F=6,202,118 b) For group insurance, Microsoft pays for Long Term Disability (LTD) insurance but requires Ellie to pay for Short Term Disability (STD) Insurance STD and LTD plans vary per employer. Most I STD plans cover 75% of gross salary for sixteen weeks, and then 65% of gross salary potentially to age 65 for LTD, which is also how Microsoft's group insurance pays out. Explain to Ellie the benefits of disability insurance. (.5 marks) c) Ellie was out of work on Short Term Disability leave for one month while she recovered from COVID. How much did Ellie receive from Microsoft during this one month while on leave? (.5 marks) Calculate the amount that Ellie will receive: (.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts