Question: please be as clear and as simple as possible. I am trying to understand it. show me the steps, not only the answers. thank you

please be as clear and as simple as possible. I am trying to understand it. show me the steps, not only the answers. thank you in advance.

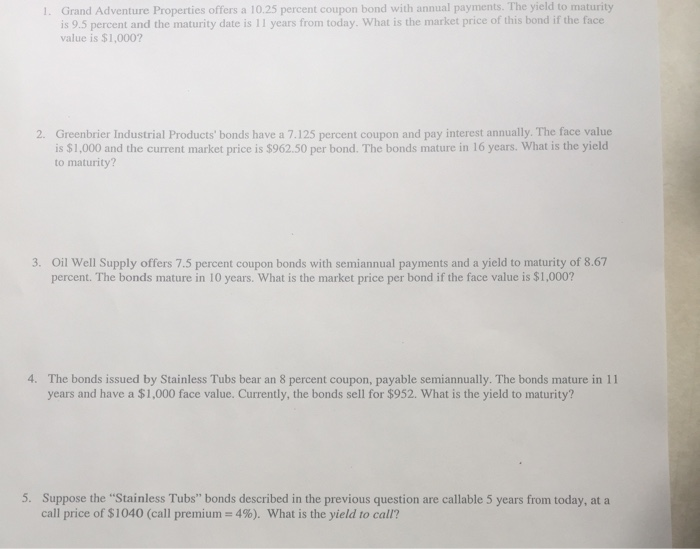

1. Grand Adventure Properties offers a 10.25 percent coupon bond with annual payments. The yield to maturity is 9.5 percent and the maturity date is 11 years from today. What is the market price of this bond if the face value is $1,000? 2. Greenbrier Industrial Products' bonds have a 7.125 percent coupon and pay interest annually. The face value is $1,000 and the current market price is $962.50 per bond. The bonds mature in 16 years. What is the yield to maturity? 3. Oil Well Supply offers 7.5 percent coupon bonds with semiannual payments and a yield to maturity of 8.67 percent. The bonds mature in 10 years. What is the market price per bond if the face value is $1,000? 4. The bonds issued by Stainless Tubs bear an 8 percent coupon, payable semiannually. The bonds mature in 11 years and have a $1,000 face value. Currently, the bonds sell for $952. What is the yield to maturity? 5. Suppose the "Stainless Tubs" bonds described in the previous question are callable 5 years from today, at a call price of $1040 (call premium = 4%). What is the yield to call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts