Question: please be as clear and as simple as possible. I am trying to understand it. show me the steps, not only the answers. thank you

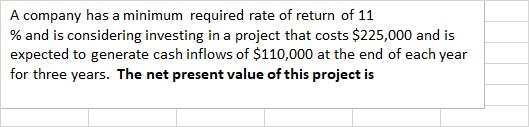

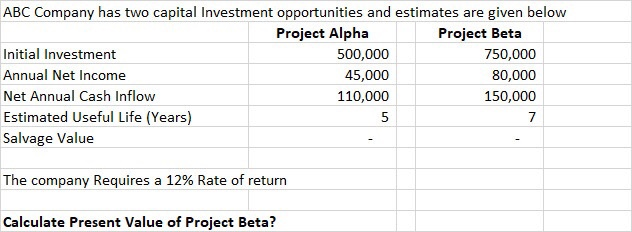

A company has a minimum required rate of return of 11 % and is considering investing in a project that costs $225,000 and is expected to generate cash inflows of $110,000 at the end of each year for three years. The net present value of this project is ABC Company has two capital Investment opportunities and estimates are given below Project Alpha Project Beta Initial Investment 500,000 750,000 Annual Net Income 45,000 80,000 Net Annual Cash Inflow 110,000 150,000 Estimated Useful Life (Years) Salvage Value The company Requires a 12% Rate of return Calculate Present Value of Project Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts