Question: Please be as explanatory as possible! 1. - What costs in general are considered to be irrelevant in management accounting? . Explain. T 2. -

Please be as explanatory as possible!

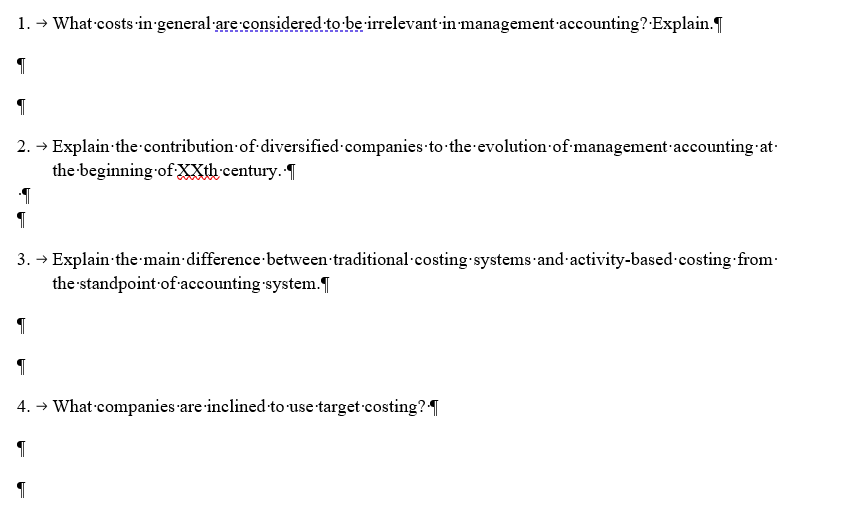

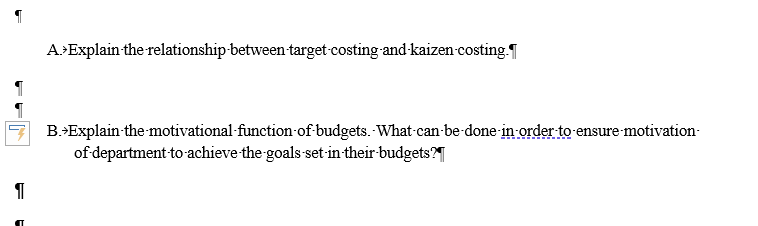

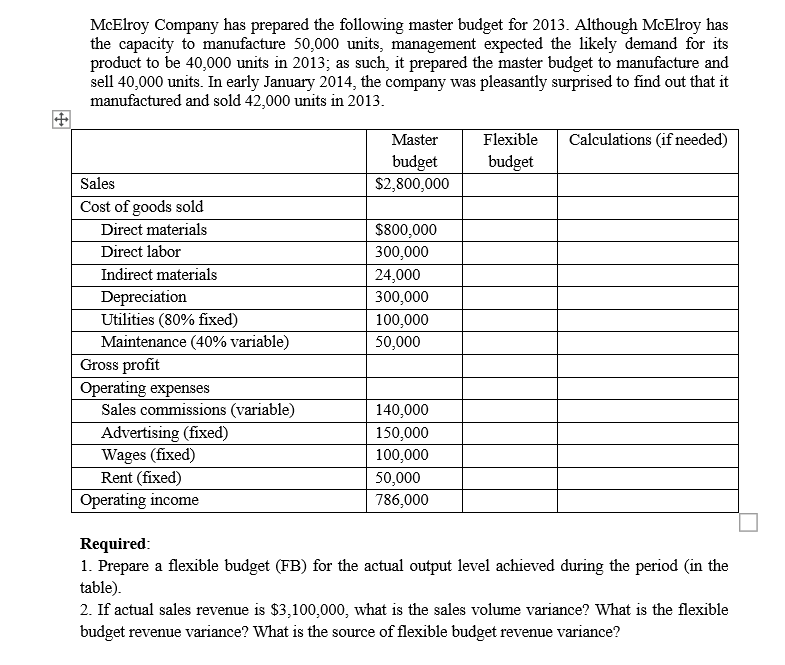

1. - What costs in general are considered to be irrelevant in management accounting? . Explain. T 2. - Explain the contribution of diversified .companies. to the evolution of management accounting. at. the beginning of XXth century. T 3. - Explain the main difference between traditional costing systems and activity-based costing from. the standpoint of accounting system. T 4. - What companies are inclined to use target costing?IA.*Explain the relationship-between-target costing and kaizen-costing.I B.+Explain the-motivational function of budgets. What can-be done in order to ensure-motivation- of department-to achieve the goals set-in their-budgets?McElroy Company has prepared the following master budget for 2013. Although McElroy has the capacity to manufacture 50,000 units, management expected the likely demand for its product to be 40,000 units in 2013; as such, it prepared the master budget to manufacture and sell 40,000 units. In early January 2014, the company was pleasantly surprised to find out that it manufactured and sold 42,000 units in 2013. Master Flexible Calculations (if needed) budget budget Sales $2,800,000 Cost of goods sold Direct materials $800,000 Direct labor 300,000 Indirect materials 24,000 Depreciation 300,000 Utilities (80% fixed) 100,000 Maintenance (40% variable) 50,000 Gross profit Operating expenses Sales commissions (variable) 140,000 Advertising (fixed) 150,000 Wages (fixed) 100.000 Rent (fixed) 50,000 Operating income 786,000 Required: 1. Prepare a flexible budget (FB) for the actual output level achieved during the period (in the table). 2. If actual sales revenue is $3,100,000, what is the sales volume variance? What is the flexible budget revenue variance? What is the source of flexible budget revenue variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts