Question: Please be careful with roundings. The expected return on Big Time Toys is 9 percent and its standard deviation is 13 percent. The expected return

Please be careful with roundings.

Please be careful with roundings.

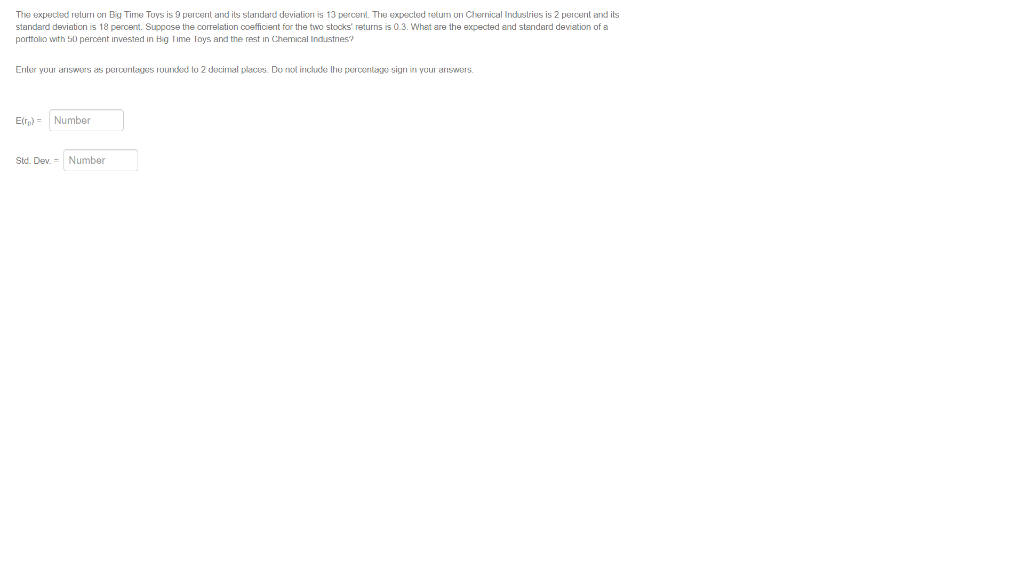

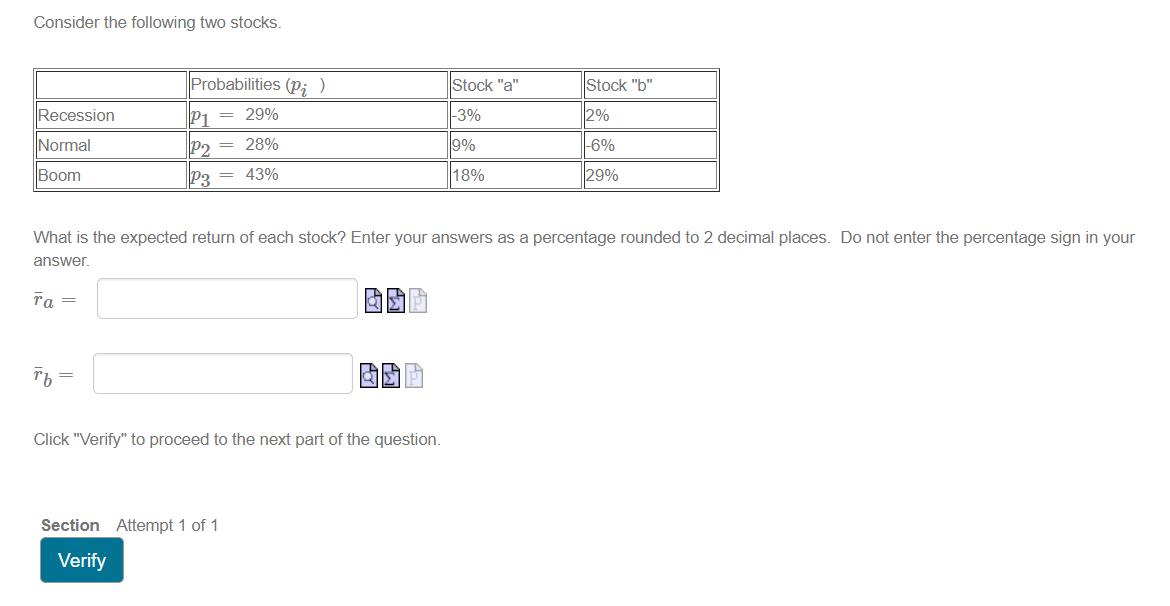

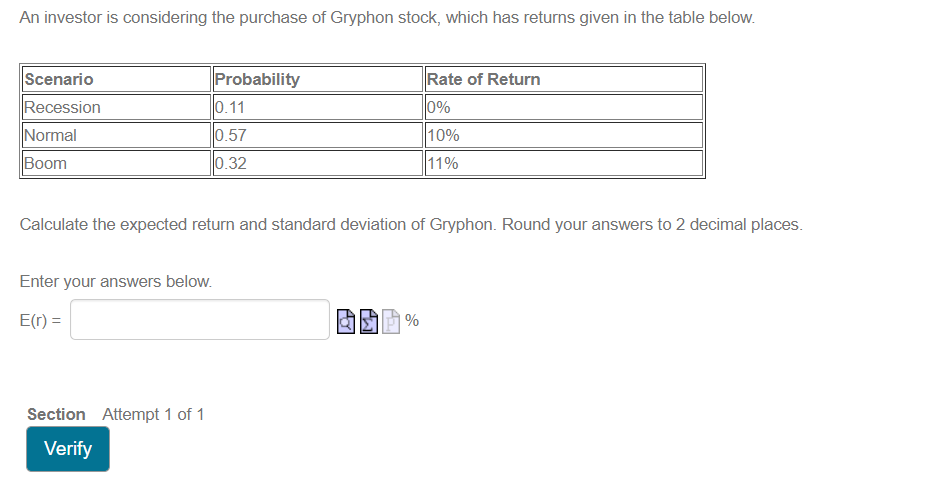

The expected return on Big Time Toys is 9 percent and its standard deviation is 13 percent. The expected return on Chemical Industries is 2 percent and ils standard deviation is 18 percent. Suppose the correlation coefficient for the two stocks' returns is 0.3. What are the expected and standard deviation of a portfolio with 50 percent invested in Big Time loys and the rest in Chemical Industnes? Enter your answers as percentages rounded to 2 decimal places. Do not include the percentage sign in your answers. E(rp) = Number Std. Dev. = Number Consider the following two stocks. Recession Normal Boom Probabilities (Pi) P1 = 29% P2 = 28% P3 = 43% Stock "a" -3% 9% 18% Stock "b" 2% -6% 29% What is the expected return of each stock? Enter your answers as a percentage rounded to 2 decimal places. Do not enter the percentage sign in your answer. Ta = fp = Click "Verify" to proceed to the next part of the question. Section Attempt 1 of 1 Verify An investor is considering the purchase of Gryphon stock, which has returns given in the table below. Scenario Recession Normal Boom Probability 10.11 10.57 Rate of Return 10% 10% 0.32 11% Calculate the expected return and standard deviation of Gryphon. Round your answers to 2 decimal places. Enter your answers below. E() = % Section Attempt 1 of 1 Verify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts