Question: Please be detailed in your explanation and or excel work. Metallic Peripherals, Inc. has received a production contract for a new product. The contract lasts

Please be detailed in your explanation and or excel work.

Please be detailed in your explanation and or excel work.

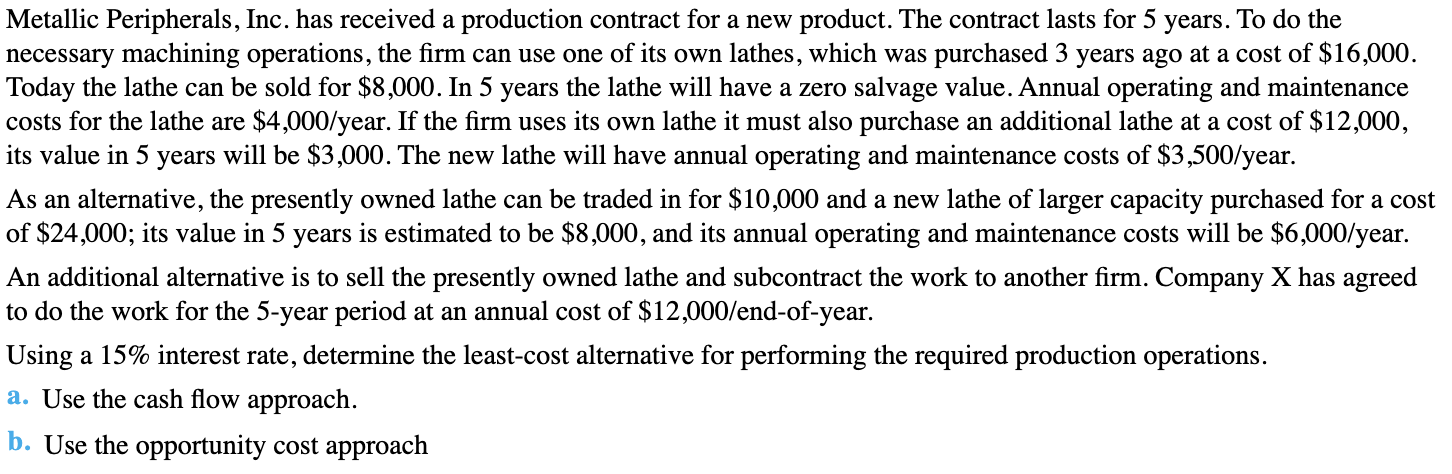

Metallic Peripherals, Inc. has received a production contract for a new product. The contract lasts for 5 years. To do the necessary machining operations, the firm can use one of its own lathes, which was purchased 3 years ago at a cost of $16,000. Today the lathe can be sold for $8,000. In 5 years the lathe will have a zero salvage value. Annual operating and maintenance costs for the lathe are $4,000/year. If the firm uses its own lathe it must also purchase an additional lathe at a cost of $12,000, its value in 5 years will be $3,000. The new lathe will have annual operating and maintenance costs of $3,500/year. As an alternative, the presently owned lathe can be traded in for $10,000 and a new lathe of larger capacity purchased for a cost of $24,000; its value in 5 years is estimated to be $8,000, and its annual operating and maintenance costs will be $6,000/year. An additional alternative is to sell the presently owned lathe and subcontract the work to another firm. Company X has agreed to do the work for the 5-year period at an annual cost of $12,000/end-of-year. Using a 15% interest rate, determine the least-cost alternative for performing the required production operations. a. Use the cash flow approach. b. Use the opportunity cost approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts