Question: please be hand written or clarify the formulas doing in excel Example 3: Harry's Health club just paid a $2.20 annual dividend. The company pays

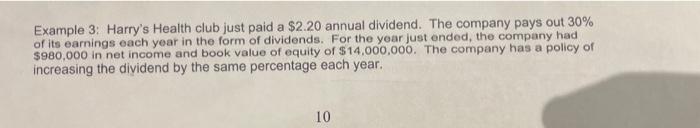

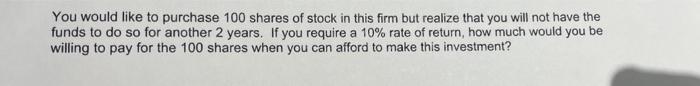

Example 3: Harry's Health club just paid a \$2.20 annual dividend. The company pays out 30% of its earnings each year in the form of dividends. For the year just ended, the company had $980,000 in net income and book value of equity of $14,000,000. The company has a policy of increasing the dividend by the same percentage each year. You would like to purchase 100 shares of stock in this firm but realize that you will not have the funds to do so for another 2 years. If you require a 10% rate of return, how much would you be willing to pay for the 100 shares when you can afford to make this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts