Question: Please be specific as possible without using excel. A tractor for over-the-road hauling is to be purchased by AgriGrow for $90,000. It is expected to

Please be specific as possible without using excel.

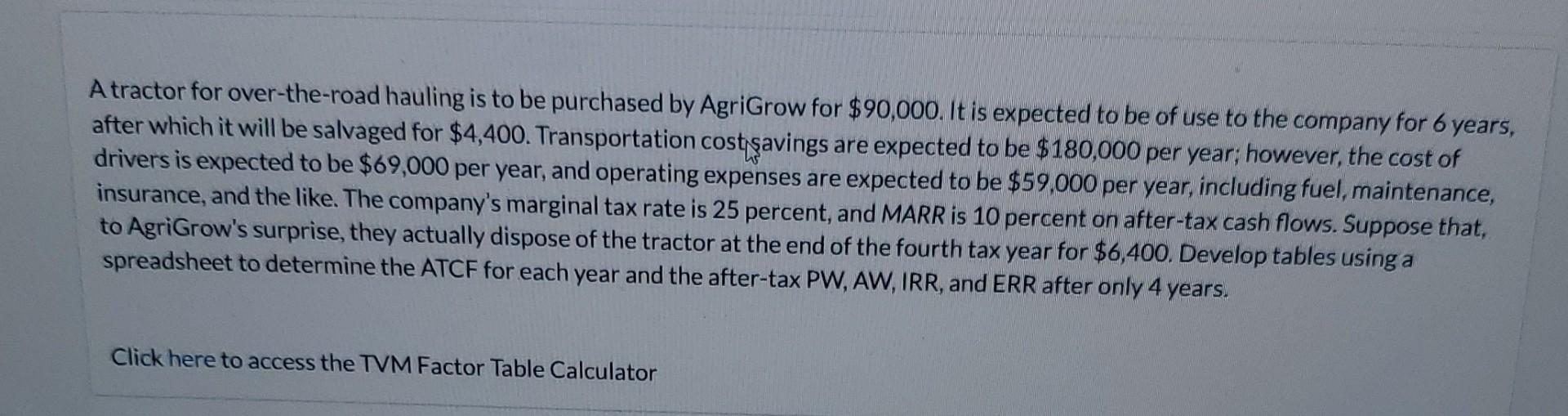

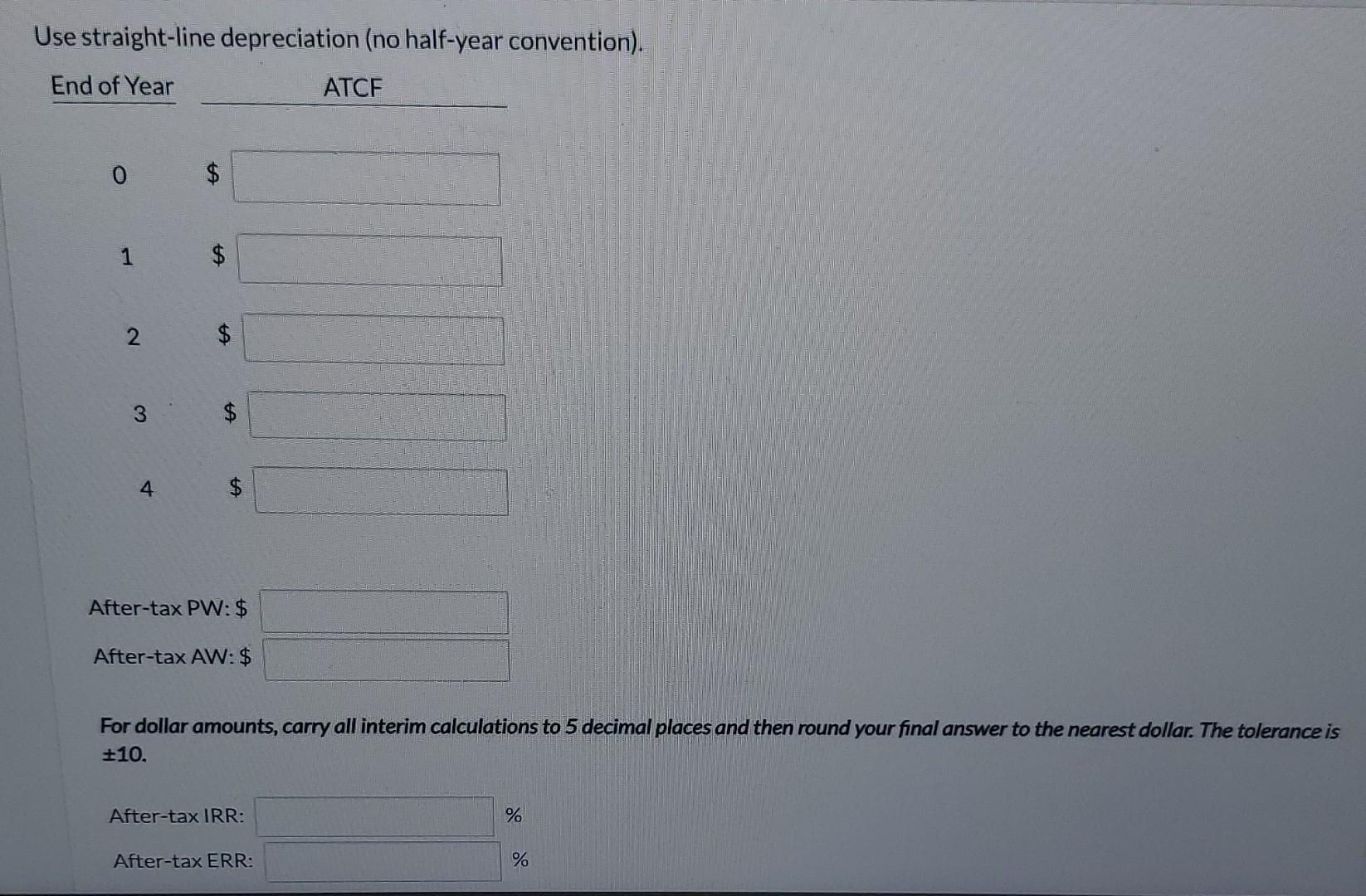

A tractor for over-the-road hauling is to be purchased by AgriGrow for $90,000. It is expected to be of use to the company for 6 years, after which it will be salvaged for $4,400. Transportation costssavings are expected to be $180,000 per year; however, the cost of drivers is expected to be $69,000 per year, and operating expenses are expected to be $59,000 per year, including fuel, maintenance, insurance, and the like. The company's marginal tax rate is 25 percent, and MARR is 10 percent on after-tax cash flows. Suppose that, to AgriGrow's surprise, they actually dispose of the tractor at the end of the fourth tax year for $6,400. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR after only 4 years. Click here to access the TVM Factor Table Calculator Use straight-line depreciation (no half-year convention). After-tax PW: \$ After-tax AW: \$ For dollar amounts, carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is \pm 10 . After-tax IRR: % After-tax ERR: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts