Question: Please be specific in writing steps, will need some explanations, thanks! 1. Using the zero-coupon bond prices and natural gas deferred fixed-rate swap prices in

Please be specific in writing steps, will need some explanations, thanks!

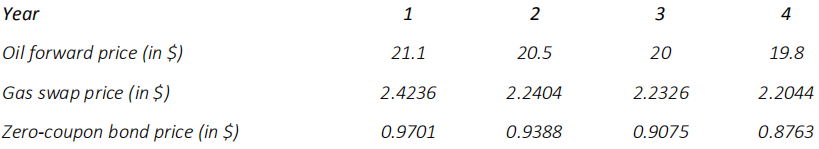

1. Using the zero-coupon bond prices and natural gas deferred fixed-rate swap prices in the above table, what are gas forward prices for each of the 4 years? (Hint: think bootstrapping)

2. Given a 4-year oil swap price of $20.43, construct the implicit loan balance for each quarter over the life of the swap. (Remember, swaps are nothing more than forward contracts coupled with borrowing and lending money)

Year 1 2 3 4 Oil forward price (in $) 21.1 20.5 20 19.8 Gas swap price (in $) 2.4236 2.2404 2.2326 2.2044 Zero-coupon bond price (in $) 0.9701 0.9388 0.9075 0.8763 Year 1 2 3 4 Oil forward price (in $) 21.1 20.5 20 19.8 Gas swap price (in $) 2.4236 2.2404 2.2326 2.2044 Zero-coupon bond price (in $) 0.9701 0.9388 0.9075 0.8763

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts