Question: please be specific with answer Suppose that the international parity conditions all hold and a country has a lower nominal interest rate than the United

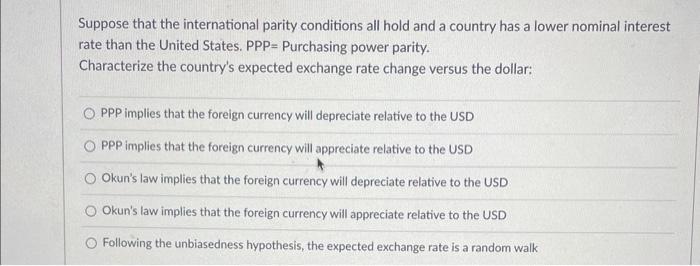

Suppose that the international parity conditions all hold and a country has a lower nominal interest rate than the United States. PPP= Purchasing power parity. Characterize the country's expected exchange rate change versus the dollar: PPP implies that the foreign currency will depreciate relative to the USD PPP implies that the foreign currency will appreciate relative to the USD Okun's law implies that the foreign currency will depreciate relative to the USD Okun's law implies that the foreign currency will appreciate relative to the USD Following the unbiasedness hypothesis, the expected exchange rate is a random walk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts