Question: please be sure to answer all parts to the question, i included multiple images showing the drop down options for each fill in the blank

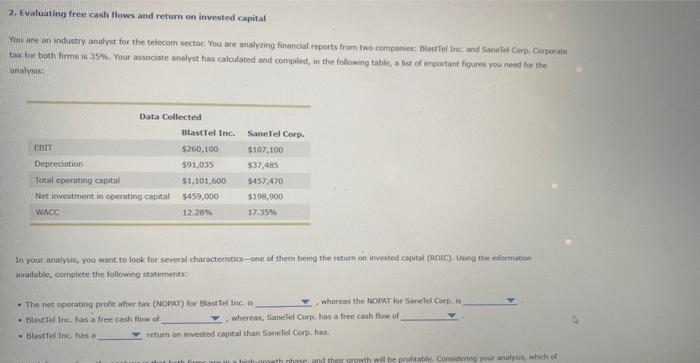

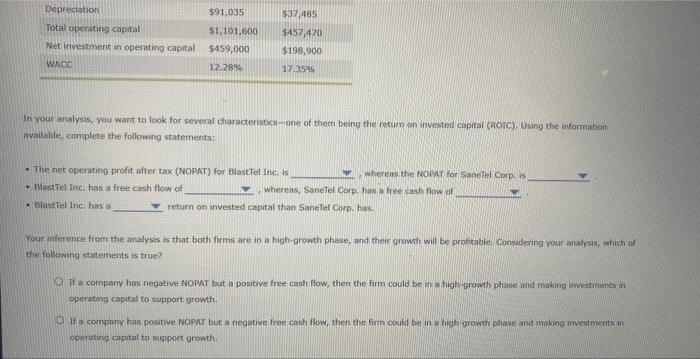

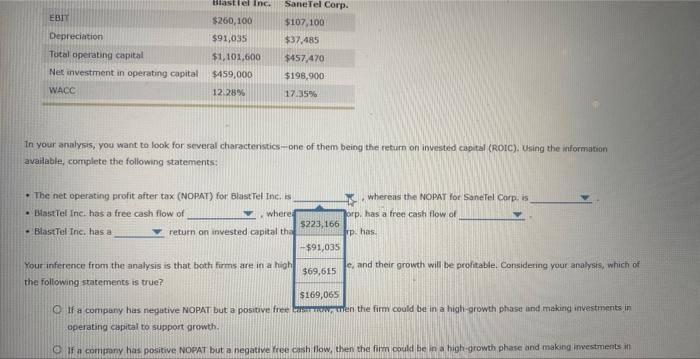

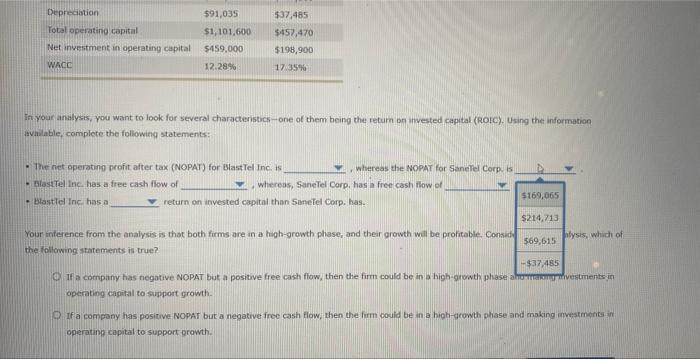

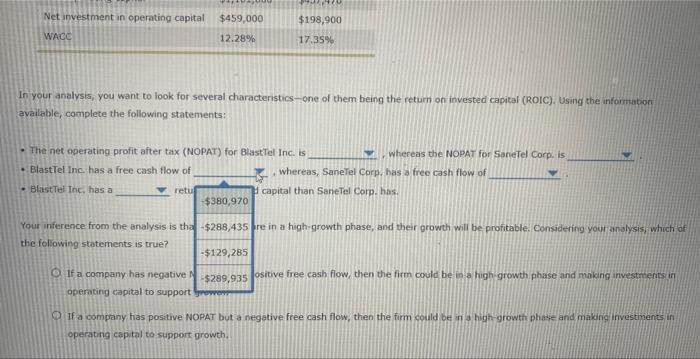

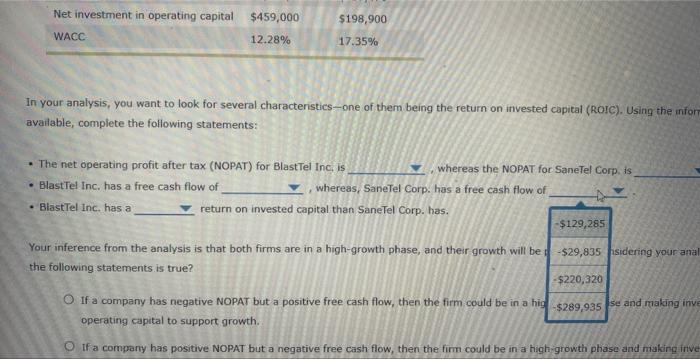

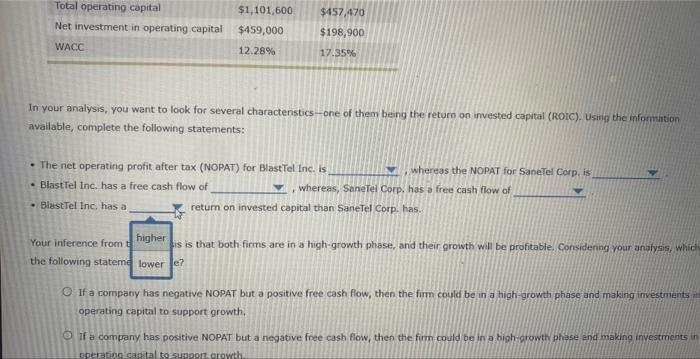

2. fvaluating free cashy flows ahil return on invissted capital Yois are on industry analyst for the telecom-sectoc: You are analycing fanancial repiorts from fwo companies; Mast Tel Inc; and Sane Iel Corp, Ceiporate tax. for both fimms is 359 . Your associate analyst has caloulated and compiled, in the following table, at list of important figures rou nend for the andishis: In yout andlysis, you want to look for several characteriatics-one of them being the ceturn on invested caputal (Rotc): (iung the irfiermation available, cotrplete the following statementst - The inet nperating profit after tas (fVOPAI) for biast Ieil Inc. is whereas the NOPNT for Saneted Carp. is - Blistrel Tne; has a free cash flow of whereas, fanelel Corm. has a free cmh flow of - Blasitail Inci has a return on invested rapital than Saneted Corp. han. Ini yout enalysis, you want to look for several characteristics - one of thern being the refum on invested copital (notC). Using the informabion available, complete the following statements: - The net operating protit after tax (NOPNT) for BlastTel inci is whereas the NoPAT for sanelel Corp. is - Bhistfer Inc, has a free cash flow of , whereas, SaneJel Corp. has a free cash flow of - Biasitel tric. has a return on invested capital than Sanerel corp. has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be protithble Consadering your analysis, which of the follawing statements is true? If a company has negative NOPAT but a positive free cash flow, then the firm could be in a high orowth phase and naking imestinents in operating eapital to support growth. If a company has positive NopAr but a negative free cash flow, then the firm could be in a highi groweh phase and making investenents. in pperoting capital to suppor arowth. In your analysis, you want to look for several charactenstics-one of them being the return on invested capital (RDIC). Using the inlormation available, complete the following statements: - The net operating profit after tax (NOPAT) for BlastTel Inc, is - Basttel Inc has a free cash flow of - Blastelel Inc. has a Your inference from the analysis is that both firms are in a high $69,615 e, and their growth will be prohitable. Considering your analysis, which of the following statemencs is true? If a compary has nepative NOPAT but a positive free cantmowrmen the firm could be in a high-growth phaset and making investmerts in operating capital to support growth. If a company has positive Nopat but ag negative free cash flow, then the firm oald be in a highigrowth phase and making imestments an Tn yout analysis, you want to look for several characteristics -one of them being the return on invested capital (Rolc). Using the information isvalable, complete the following statements: - The net operating profit after tax (NOPAT) for Blast Tel Inc. is 1. whereas the NOPAT for Ganelel Corp is - Blasetel lnc has a free cash flow of 1. whereas, Sanelel Corp, has free cash how of - Blastiel Inc has a return on invested capital than Sanetel corp. has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Consik Ysis, which of the following itatements is true? If a compiny has negative NOPAT but a positive free cash flow, then the firm could be in a high-growth phase aniourarum mivestinents in operating eapital to support growth. If a company has positive NOpAr but a negative free cash flow, then the firm couli be in a high-growth phase and making investments in operating capital to support erowth. In your analysis, you want to look for several characteristics -one of them being the return on invested capital (ROIC). Using the informator available, complete the following statements: - The net operating profit after tax (NOPAT) for BlastTel Inc. is whereas the NOPAT for Sanetel Corp. is - Blastiel lnc has a free cash flow of whereas, Sanerel Corp. has a free cash flow of - BlastTei Inc, has a retu I capital than SaneTel Corp. has. Your inerence from the analysis is the re in a high-growth phase, and their growth will be profitable. Considering your aralysis, which of the following statements is true? If a company has negative ? asitive free cash flow, then the firm could be in a hugh-growth phase and making investunerts in operating capital to support If a company hias posative NOPAT but a negative free cash flow; then the firm coculd be ni a high-growthi phase and making investments in operating coptal to support growth. In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the infor avalable, complete the following statements: - The net operating profit after tax (NOPAT) for BlastTel Inc, is whereas the NOPAT for SaneTel Corp, is - BlastTel Inc, has a free cash flow of whereas, SaneTel Corp. has a free cash flow of - BlastTel Inc. has a return on invested capital than Sanefel Corp. has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be the following statements is true? If a company has negative NOPAT but a positive free cash flow, then the firm could be in a hig operating capital to support growth. If a company has positive NOPAT but a negative free cash flow, then the firm could be in a high growth phase and muking invi In your analysis, you want to look for several charactenstics-one of them being the return on invested capital (Rolc). Using the informition available, complete the following statements: - The net operating profit after tax (NOPAT) for Blast Tel Inc. is whereas the NOPAT for SaneTel Corp, is - Blastiel inc, has a free cash flow of - whereas, Sanetel Corp. has a free cash flow of - Blastel lnc, has a return on invested capital than saneTel Corp. has. Your inference from 5 is that both.firms are in a high-growth phase, and their growth will be profitable, Considenng your analysis, whic the following statem 7? If a company has negative NOPAT but a positive free cash flow, then the firm could be in a high-growth phase and making investurents operating capital to support growth. If a company has positive NOPAT but a negative free cash flow, then the fum could be in a hightorowth phase and making investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts