Question: Please bold answer in explanation, Thank you! Marc, a single taxpayer, earns $62,800 in taxable income and $5,280 in interest from an investment in city

Please bold answer in explanation, Thank you!

Please bold answer in explanation, Thank you!

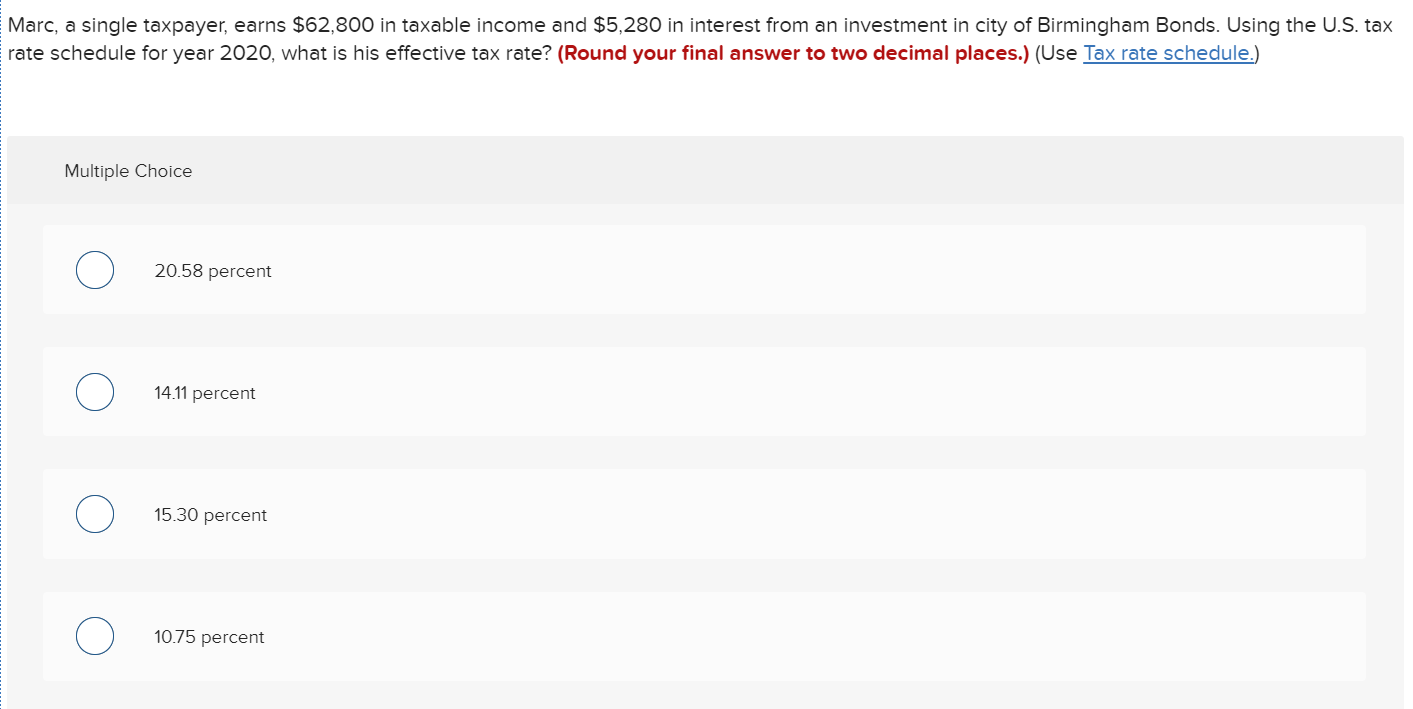

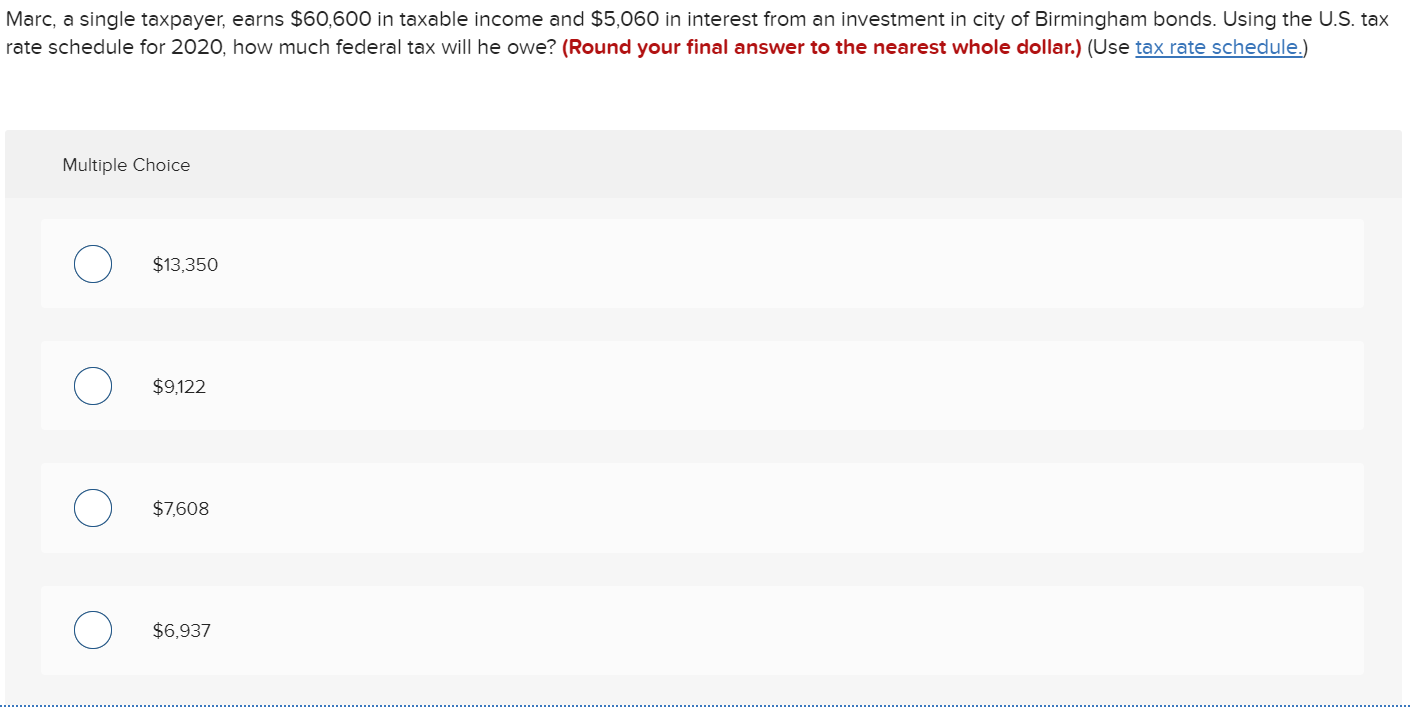

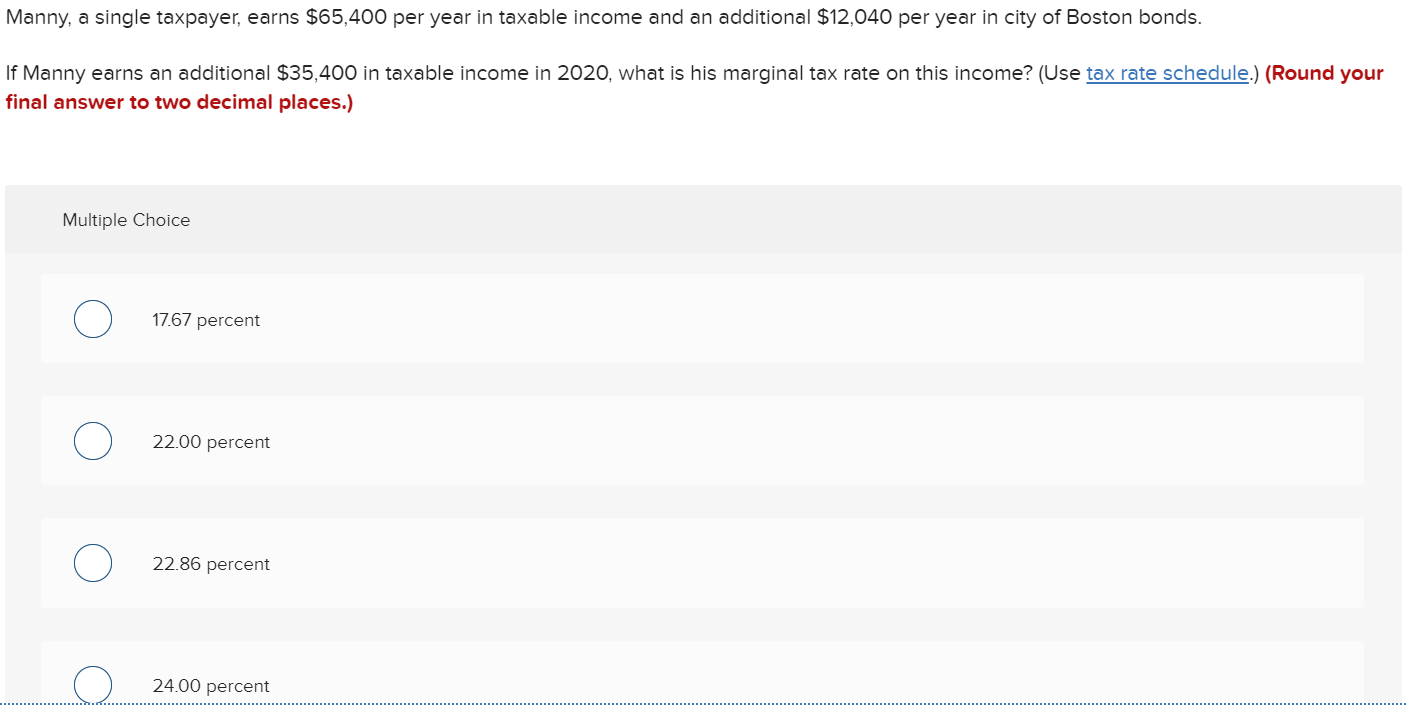

Marc, a single taxpayer, earns $62,800 in taxable income and $5,280 in interest from an investment in city of Birmingham Bonds. Using the U.S. tax rate schedule for year 2020, what is his effective tax rate? (Round your final answer to two decimal places.) (Use Tax rate schedule.) Multiple Choice 20.58 percent 14.11 percent 15.30 percent 10.75 percent Marc, a single taxpayer, earns $60,600 in taxable income and $5,060 in interest from an investment in city of Birmingham bonds. Using the U.S. tax rate schedule for 2020, how much federal tax will he owe? (Round your final answer to the nearest whole dollar.) (Use tax rate schedule.) Multiple Choice $13,350 $9,122 $7,608 $6,937 Manny, a single taxpayer, earns $65,400 per year in taxable income and an additional $12,040 per year in city of Boston bonds. If Manny earns an additional $35,400 in taxable income in 2020, what is his marginal tax rate on this income? (Use tax rate schedule.) (Round your final answer to two decimal places.) Multiple Choice 17.67 percent 22.00 percent 22.86 percent 24.00 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts