Question: Please bold final answer, thank you! In 2022 , Lisa and Fred, a married couple, had taxable income of $302,400. If they were to file

Please bold final answer, thank you!

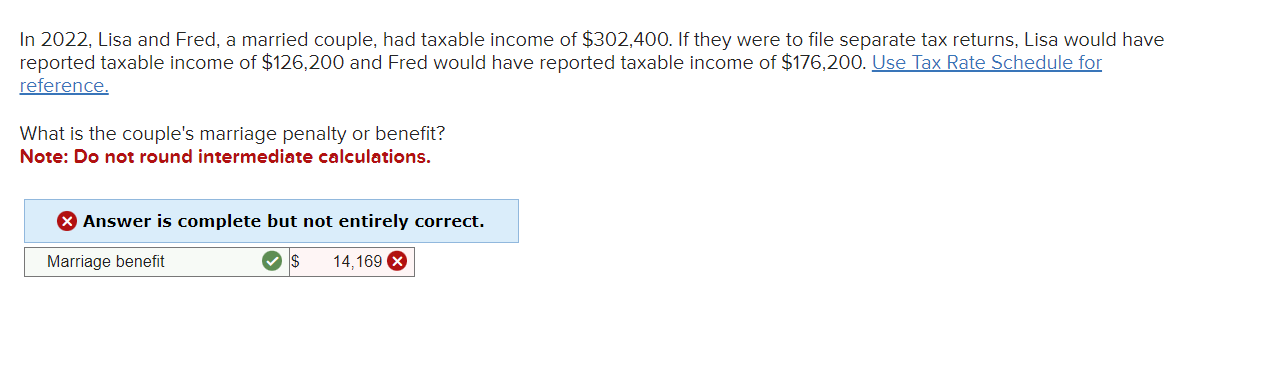

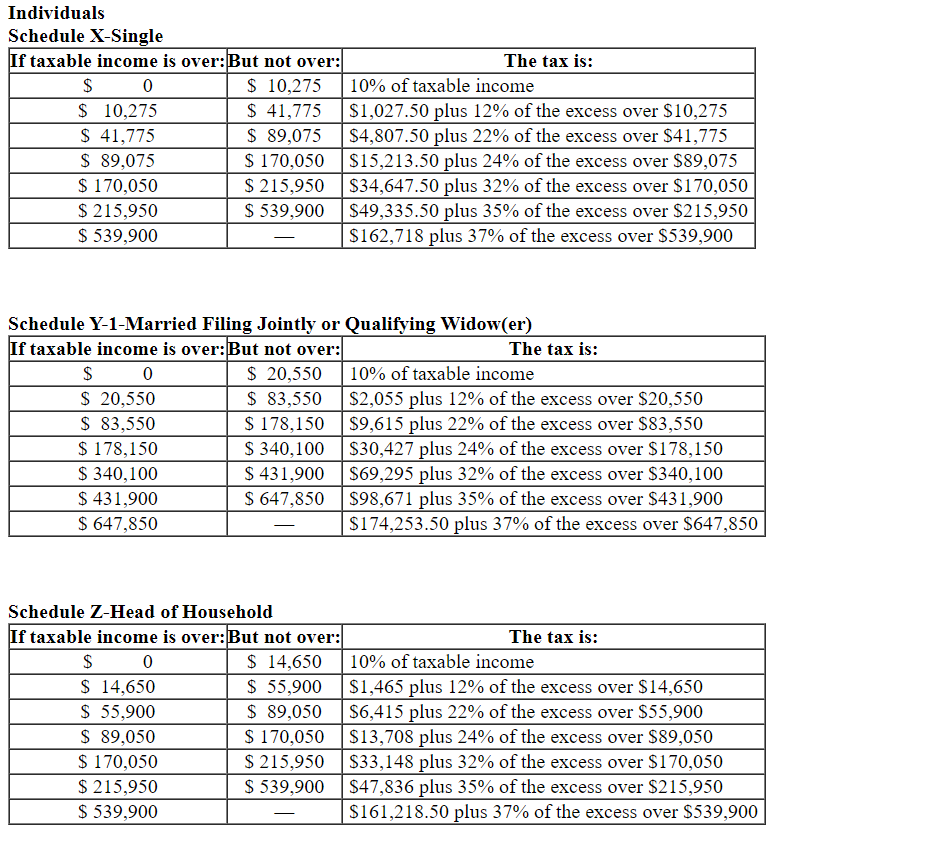

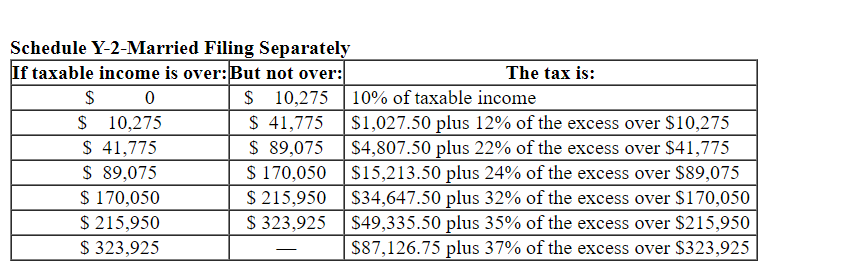

In 2022 , Lisa and Fred, a married couple, had taxable income of $302,400. If they were to file separate tax returns. Lisa would have reported taxable income of $126,200 and Fred would have reported taxable income of $176,200. reference. What is the couple's marriage penalty or benefit? Note: Do not round intermediate calculations. Individuals Gohornla X_Sinola Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & - & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts