Question: Please both 1a & 1b for 1b, ANSWER THE QUESTION REFERRING TO THE ARTICLE attached , Elaborate more at least 150+ words in both questions

Please both 1a & 1b

for 1b, ANSWER THE QUESTION REFERRING TO THE ARTICLE attached , Elaborate more at least 150+ words in both questions

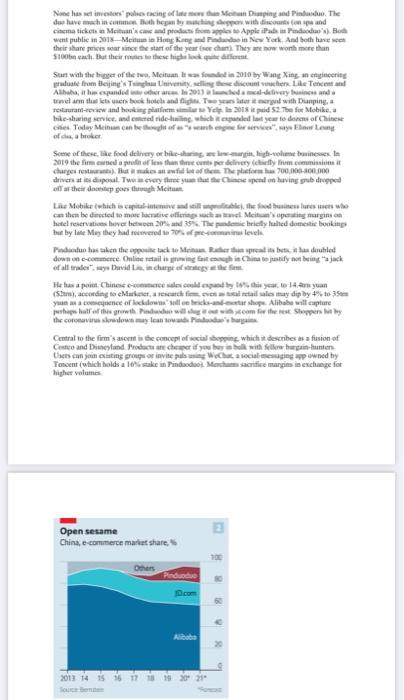

Q1 (a) Briefly explain different categories of new service development. What are the significances of new service development for an enterprise? (b) Referring to the article "Meituan-Dianping and Pinduoduo embody the excitement over digital China, what categories of new service development have Meituan- Dianping and Pinduoduo introduced respectively? Meituan-Dianping and Pinduoduo embody the excitement over digital China Investors cannot get enough of two booming internet companies Jul 9th 2020 Reuters China's bustling digital economy has spawned thousands of startups. Yet in the eyes of many it remains "bat or bust", to cite a saying among jobseekers from the country's elite universities. The bat in question refers to the original trio of Chinese internet stars: Baidu, a search engine; Alibaba, an online emporium; and Tencent, a mobile-payments and video-game titan. The acronym is overdue an update Alibaba and Tencent continue to lord it over digital China. With market capitalisations of nearly $700bn apiece, they are the world's seventh- and eighth-biggest listed companies, respectively. Having struggled to adapt as consumers moved from desktops to smartphones, Baidu languishes in 319th place its erstwhile equals can gain or lose the equivalent of its entire market value of $45bn in a day or two The bat label also belies another development. Newer arrivals have been busily remodelling the upper reaches of China's cyberscape. They include firms like jd.com, a S100bn e-merchant listed in New York, Didi Chuxing, a privately held ride-hailing giant valued at $60bn or so, and the $100bn-plus ByteDance, the world's biggest unlisted startup (which owns, among other things. TikTok, as a short-video app popular with Western teenagers). None has set pobietacing often Diping and in The delavechim Bebegi bygges with discounts and cinema ticket Meitus we and products from to Apple iPadeda). Bode went public 2018-Meitu Hong Koin New York And both their share presence the start of the reach they worth more than Socach. But their mothese light Surt with the per of the two Meinuntai 2010 by Wang Xing an engineering prutte from beijing Tanganivety, selling contente Tencent Alha, the expanded the 2013 mal-delivery and towel an sluiters book hotel and flight. Two years later ter with Dumping, Pour and booking platform. Ypad 52. The for Mobike. hesharing service, and credideling which panel year to dars of Chinese che Today Members". Ellen och a hoker Some of these le food delivery or high-volume bonnesses 2019 the famed a prioritate come per dient cely Trum.com charges rest) Huawes of the Deplom 700,000-300.000 destins disposal. Tu every time you that the Chamberlaing gubugged offarther deep goes through Meitum. Line Mobile (which is capable and will be the fidelne who can then be directed to mare locatie ingan Memperting margin hotel reservation over between 2 and 3 The chiefly Salted domestic booking u bylo Me they had moved to 70.miles Pidato Bastaken the place to rin aprelin both doubled donne commerce Online realising in China tejto bring jack of all trades. Duvid charges We has a point Chinee e-commerce code tocar to 14.yan (Stom), according to Marimet, ac fi ventalles muy dip by 4% to 350 yun acomuence of lockdownslebeckashope Alibabe will capture perhaps later the this will go with .com for the rest Shopper by the corner woman who Central to the firm's is de concept of social shopping, which it describes as a fusion of Centre and Disneyland Products are che if you with seller began-hunter eers can jointing groups or invite pals WeChat a socialaging powned by Terent which holds a stake in Pindado Macrifice margins in exchange for higher volumes Open sesame China, e-commerce market share Others Pindo Alibaba 2013 14 15 16 17 18 19 20 21 Colin Huang, Pinduoduo's founder, who once worked as an engineer at Google in America, did not invent group shopping Groupon has been doing a version of it since 2008. But he did develop the idea, for instance introducing games which reward players with credits on future purchases. Chinese shoppers love it. At the end of March 628m of them had made at least one purchase on the app in the preceding 12 months, 42% more than the year before and 60% more than shopped on jd.com; only Alibaba has more active users (726m). Their average annual spending also rose, from 1,250 yuan to over 1,800 yuan. So has Pinduoduo's share of Chinese e-commerce from 2% in 2017 to 10% last year. Bernstein, a research firm, expects it to be 18% by 2024, in line with jd.com The shopping frenzy has boosted Pinduoduo's revenues by 44% year on year in the first quarter, to 6.5bn yuan. The money comes from transaction fees and adverts bought by merchants to have their offers promoted in the app. Similarly to eBay but not many e-commerce giants, Pinduoduo does not hold inventory or operate its own logistics network, relying on merchants to ferry products to buyers. Instead, it burns a spectacular, and growing amount of cash on sales and marketing: 112% of revenues in the first quarter. Mr Liu insists these costs can casily be dialled back. Experience of other marketplaces suggests otherwise, Uber, which also matches sellers (drivers) with buyers (riders), has been perpetually loss-making. Like Uber. Pinduoduo enjoys some "network effects the more buyers use its app, the more sellers it draws, who in turn attract new buyers, and so on. But, again as in ride- hailing, buyers and sellers face few costs in switching to another app that offers a better deal. id.com and Alibaba have already launched Pinduoduo clones to their vast user base. The market is giving Pinduoduo the benefit of the doubt. The pandemic appears to have done it no harm; cooped-up Chinese consumers have turned to the firm for necessities and, sometimes, a dose of retail therapy. With negligible business outside China, it is, like Meituan, shielded from the Sino-American tech war making life difficult for TikTok, with its mostly non-Chinese users, or Huawei, China's telecoms champion. White House threats to expel Chinese firms from American exchanges have not dampened investors' enthusiasm. Nor has the sudden departure of Mr Huang, who stepped down as its chief executive on July 1st and cut his stake in the company from 43% to 29% (he remains chairman and holds 81% of voting rights). Meituan's path to riches is clearer. It ended last year in the black for the first time. Its profitable food and travel arms have been gaining market share from rivals (such as Ele.me, Alibaba's food delivery app, and Ctrip, China's biggest travel agency). That gives its loss-making divisions financial breathing room Ultimately, both firms embody the excitement over digital China's bright prospects. But tamp will only become the new but if both firms can match Tencent's and Alibaba's consistently fat profits