Question: please both question if you dont mind D covariance with the market index 10. Two investment advisors are comparing performance. Advisor A averaged a 15%

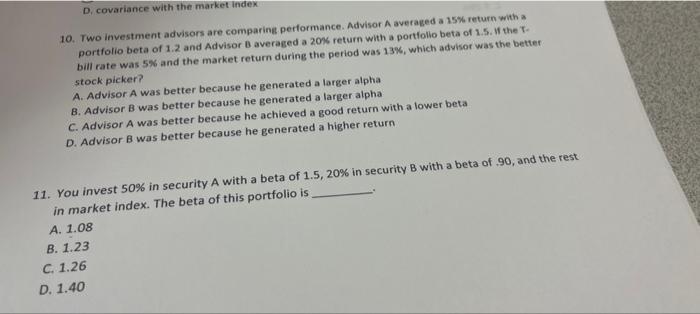

D covariance with the market index 10. Two investment advisors are comparing performance. Advisor A averaged a 15% return with a portfolio beta of 1.2 and Advisor B averaged a 20% return with a portfolio beta of 1.5. the T- bill rate was 5% and the market return during the period was 13%, which advisor was the better stock picker? A. Advisor A was better because he generated a larger alpha 8. Advisor B was better because he generated a larger alpha C. Advisor A was better because he achieved a good return with a lower beta D. Advisor B was better because he generated a higher return 11. You invest 50% in security A with a beta of 1.5, 20% in security with a beta of.90, and the rest in market index. The beta of this portfolio is A. 1.08 B. 1.23 C. 1.26 D. 1.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts