Question: please break down each item line when creating the income statement , retained earning statemend and classified balance statement SRS Consulting Services Unadjusted Trial Balance

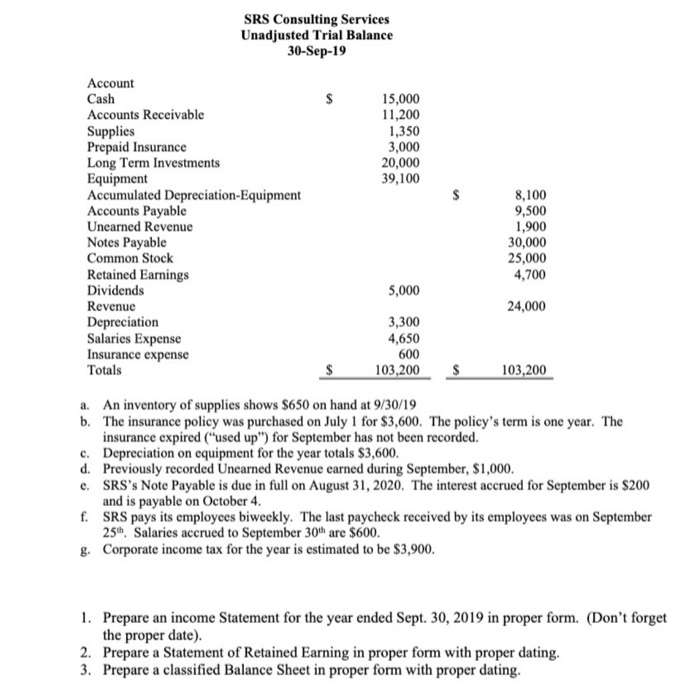

SRS Consulting Services Unadjusted Trial Balance 30-Sep-19 $ Account Cash 15,000 Accounts Receivable 11,200 Supplies 1,350 Prepaid Insurance 3,000 Long Term Investments 20,000 Equipment 39,100 Accumulated Depreciation-Equipment 8,100 Accounts Payable 9,500 Uncarned Revenue 1,900 Notes Payable 30,000 Common Stock 25,000 Retained Earnings 4,700 Dividends 5,000 Revenue 24,000 Depreciation 3,300 Salaries Expense 4,650 Insurance expense 600 Totals $ 103,200 $ 103,200 a. An inventory of supplies shows $650 on hand at 9/30/19 b. The insurance policy was purchased on July 1 for $3,600. The policy's term is one year. The insurance expired ("used up") for September has not been recorded. c. Depreciation on equipment for the year totals $3,600. d. Previously recorded Unearned Revenue earned during September, $1,000. e. SRS's Note Payable is due in full on August 31, 2020. The interest accrued for September is $200 and is payable on October 4. f. SRS pays its employees biweekly. The last paycheck received by its employees was on September 25th Salaries accrued to September 30th are $600. g. Corporate income tax for the year is estimated to be $3,900. 1. Prepare an income Statement for the year ended Sept. 30, 2019 in proper form. (Don't forget the proper date). 2. Prepare a Statement of Retained Earning in proper form with proper dating. 3. Prepare a classified Balance Sheet in proper form with proper dating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts